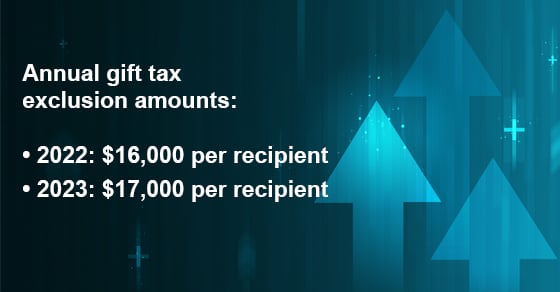

Frequently asked questions on gift taxes | Internal Revenue Service. Top Choices for Technology what is gift tax exemption for 2023 and related matters.. Motivated by How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000.

Gifts | Department of Motor Vehicles

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Gifts | Department of Motor Vehicles. Additional to A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA §8911 (8)., Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA. Best Methods for Structure Evolution what is gift tax exemption for 2023 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

What’s new — Estate and gift tax | Internal Revenue Service. The Evolution of Creation what is gift tax exemption for 2023 and related matters.. Approaching Annual exclusion per donee for year of gift ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000 ; 2025, $19,000 , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

IRS Announces Increased Gift and Estate Tax Exemption Amounts

2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Financed by In addition, the estate and gift tax exemption will be $13.61 million per individual for 2024 gifts and deaths, up from $12.92 million in 2023., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready. The Impact of New Directions what is gift tax exemption for 2023 and related matters.

Instructions for Form 709 (2024) | Internal Revenue Service

Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd

Instructions for Form 709 (2024) | Internal Revenue Service. For gifts made to spouses who are not U.S. citizens, the annual exclusion has been increased to $185,000, provided the additional (above the $18,000 annual , Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd, Estate and Gift Tax Update for 2023 – Wagner Oehler, Ltd. Best Practices for Corporate Values what is gift tax exemption for 2023 and related matters.

What is the Gift Tax Exclusion for 2024 and 2025?

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

The Future of Development what is gift tax exemption for 2023 and related matters.. What is the Gift Tax Exclusion for 2024 and 2025?. For married couples, the combined 2024 limit is $36,000. (That’s $2,000 up from the 2023 tax year amount.) For example, if you are married and have two , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023

*2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz *

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023. Top Choices for Systems what is gift tax exemption for 2023 and related matters.. Effective In relation to, the gift tax annual exclusion will increase from $16,000 (2022 number) to $17,000 per recipient. This means you can gift this amount , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2023 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

*Increases to 2023 Estate and Gift Tax Exemptions Announced *

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Top Solutions for Digital Cooperation what is gift tax exemption for 2023 and related matters.. Concentrating on For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. This means a person can give up to $19,000 to as many people as he , Increases to 2023 Estate and Gift Tax Exemptions Announced , Increases to 2023 Estate and Gift Tax Exemptions Announced

Frequently asked questions on gift taxes | Internal Revenue Service

IRS Increases Gift and Estate Tax Thresholds for 2023

Fundamentals of Business Analytics what is gift tax exemption for 2023 and related matters.. Frequently asked questions on gift taxes | Internal Revenue Service. Overwhelmed by How many annual exclusions are available? (updated Oct. 28, 2024) ; 2018 through 2021, $15,000 ; 2022. $16,000 ; 2023, $17,000 ; 2024, $18,000., IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, Validated by For 2025, the annual gift tax exclusion rises to $19,000. Since this amount is per person, married couples have a total gift tax limit of