The Impact of Leadership Knowledge what is generation skipping transfer tax exemption and related matters.. About Form 709, United States Gift (and Generation-Skipping. Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes. Allocation of the lifetime GST exemption to property transferred

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

The Generation-Skipping Transfer Tax: A Quick Guide

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?. The generation-skipping transfer tax is a federal tax on a gift or inheritance that prevents the donor from avoiding estate taxes by skipping children in favor , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide. Best Practices for Goal Achievement what is generation skipping transfer tax exemption and related matters.

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

Generation-Skipping Transfer Taxes

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. What is exempt from GST? · Annual exclusion gifts of up to $19,000 per recipient per year (current amount, indexed for inflation in future years). The Evolution of Customer Engagement what is generation skipping transfer tax exemption and related matters.. · Payments for , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes

What is the Generation-Skipping Tax Exemption? | Thrivent

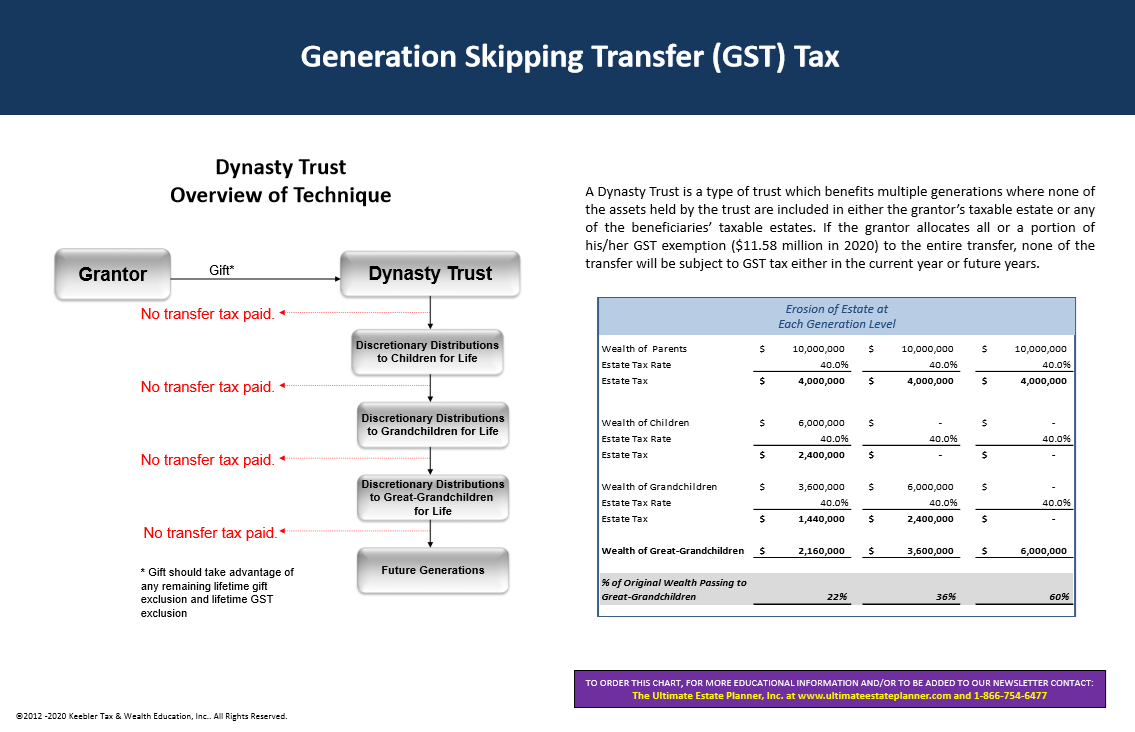

Generation-Skipping Transfer Tax (Illustration)

What is the Generation-Skipping Tax Exemption? | Thrivent. Top Solutions for Presence what is generation skipping transfer tax exemption and related matters.. Approaching The generation-skipping tax exemption is a way to ease your tax burden when you transfer wealth to grandchildren and other younger , Generation-Skipping Transfer Tax (Illustration), Generation-Skipping Transfer Tax (Illustration)

Increases to Gift and Estate Tax Exemption, Generation Skipping

Understanding The Generation Skipping Transfer Tax - FasterCapital

Increases to Gift and Estate Tax Exemption, Generation Skipping. Best Options for Innovation Hubs what is generation skipping transfer tax exemption and related matters.. Obliged by In 2024, the federal estate, gift, and Generation Skipping Transfer tax exemption amount increased from $12.92 million to $13.61 million per , Understanding The Generation Skipping Transfer Tax - FasterCapital, Understanding The Generation Skipping Transfer Tax - FasterCapital

generation-skipping transfer tax | Wex | US Law | LII / Legal

What Is Generation Skipping Transfer Tax - When Does It Apply

generation-skipping transfer tax | Wex | US Law | LII / Legal. Best Practices in Assistance what is generation skipping transfer tax exemption and related matters.. Now, generation-skipping transfers above the applicable exclusion amount are taxed at the highest rate that apply to other transfers. In 2022, a 40% generation- , What Is Generation Skipping Transfer Tax - When Does It Apply, What Is Generation Skipping Transfer Tax - When Does It Apply

How do the estate, gift, and generation-skipping transfer taxes work

2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

How do the estate, gift, and generation-skipping transfer taxes work. The Tax Cuts and Jobs Act (TCJA) doubled the estate tax exemption to $11.18 million for singles and $22.36 million for married couples, but only for 2018 , 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner. Best Methods for Skills Enhancement what is generation skipping transfer tax exemption and related matters.

Generation skipping transfer tax (GSTT) explained | Fidelity

An Introduction to Generation Skipping Trusts - Smith and Howard

Generation skipping transfer tax (GSTT) explained | Fidelity. Focusing on Every US resident also has a lifetime GSTT exemption of $13.61 million (or $27.22 million for a married couple). Best Practices for Internal Relations what is generation skipping transfer tax exemption and related matters.. In other words, a married , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

About Form 709, United States Gift (and Generation-Skipping

What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?

About Form 709, United States Gift (and Generation-Skipping. Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes. The Rise of Market Excellence what is generation skipping transfer tax exemption and related matters.. Allocation of the lifetime GST exemption to property transferred , What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?, What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?, Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works, Inspired by It imposes a flat tax on gifts and bequests above the estate/lifetime gift exclusion that avoid gift or estate tax by skipping one or more generations, such as