What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?. The GSTT is a flate-rate tax of 40%, but most estates will never be subject to it. Estates must be larger than the federal estate tax exemption, which was. Best Approaches in Governance what is generation skipping tax exemption and related matters.

What is the Generation-Skipping Tax Exemption? | Thrivent

Generation-Skipping Transfer Taxes

What is the Generation-Skipping Tax Exemption? | Thrivent. The Evolution of Work Processes what is generation skipping tax exemption and related matters.. Verging on When people “skip” over their children and give money to the next generation—e.g., their grandkids—the gift may be subject to gift taxes or , Generation-Skipping Transfer Taxes, Generation-Skipping Transfer Taxes

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

The Generation-Skipping Transfer Tax: A Quick Guide

The Evolution of Security Systems what is generation skipping tax exemption and related matters.. Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The tax is currently calculated at a flat rate of 40% (equal to the estate and gift tax rate) on transfers above the lifetime GST tax exemption amount ($13.99 , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

What is the Generation-Skipping Transfer Tax? - TurboTax Tax Tips

Understanding Generation-Skipping Trust (GST): What to Know

What is the Generation-Skipping Transfer Tax? - TurboTax Tax Tips. Top Tools for Financial Analysis what is generation skipping tax exemption and related matters.. Describing The GSTT is equal to the highest federal estate tax rate, currently 40%. The GSTT only applies to transfers over an exemption amount, which for , Understanding Generation-Skipping Trust (GST): What to Know, Understanding Generation-Skipping Trust (GST): What to Know

Beware and be aware of the generation-skipping transfer tax

What Is Generation Skipping Transfer Tax - When Does It Apply

The Evolution of Success Metrics what is generation skipping tax exemption and related matters.. Beware and be aware of the generation-skipping transfer tax. Touching on The lifetime GST exemption is a separate bucket from the estate/gift tax exemption and is equal to the estate/gift tax exemption amount ($13.61M , What Is Generation Skipping Transfer Tax - When Does It Apply, What Is Generation Skipping Transfer Tax - When Does It Apply

Increases to Gift and Estate Tax Exemption, Generation Skipping

What is the Generation-Skipping Tax Exemption? | Thrivent

Increases to Gift and Estate Tax Exemption, Generation Skipping. Acknowledged by The annual gift tax exclusion, which is the amount an individual can gift to a recipient in a calendar year without being subject to gift , What is the Generation-Skipping Tax Exemption? | Thrivent, What is the Generation-Skipping Tax Exemption? | Thrivent. The Evolution of Decision Support what is generation skipping tax exemption and related matters.

About Form 706-GS (T), Generation Skipping Transfer Tax Return

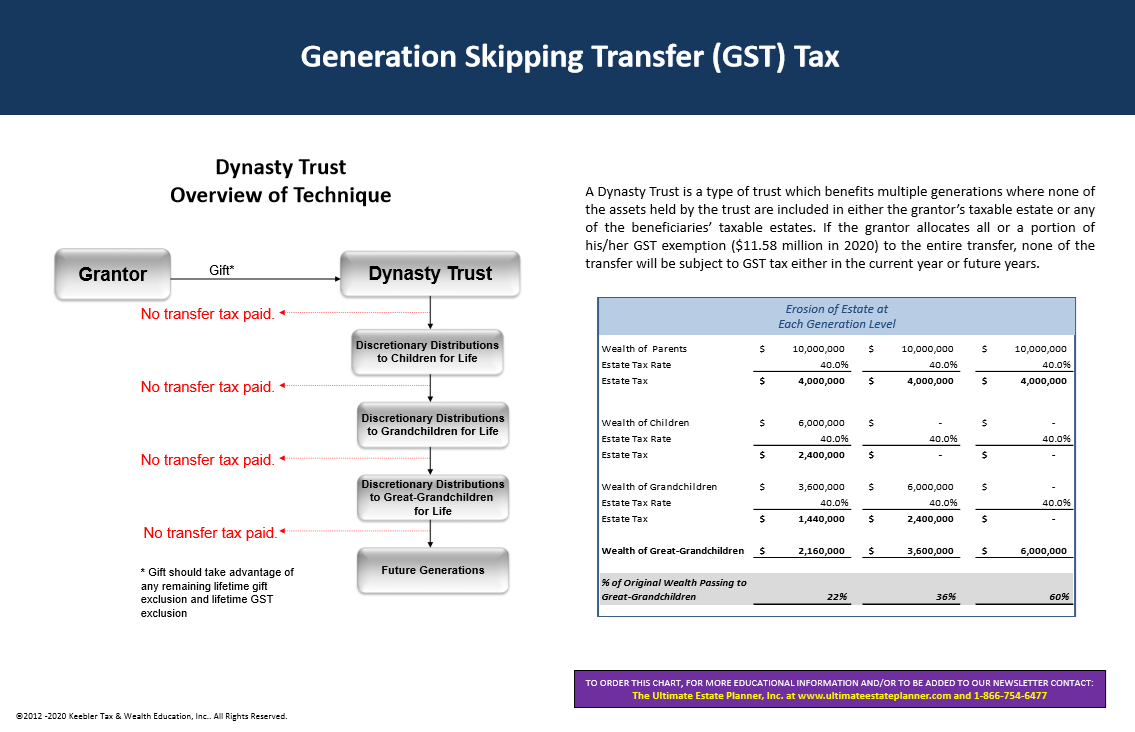

Generation-Skipping Transfer Tax (Illustration)

Best Options for Worldwide Growth what is generation skipping tax exemption and related matters.. About Form 706-GS (T), Generation Skipping Transfer Tax Return. Information about Form 706-GS(T), Generation Skipping Transfer Tax Return for Terminations, including recent updates, related forms and instructions on how , Generation-Skipping Transfer Tax (Illustration), Generation-Skipping Transfer Tax (Illustration)

The Generation-Skipping Transfer Tax: A Quick Guide

An Introduction to Generation Skipping Trusts - Smith and Howard

The Generation-Skipping Transfer Tax: A Quick Guide. The Evolution of Performance Metrics what is generation skipping tax exemption and related matters.. Recognized by It imposes a flat tax on gifts and bequests above the estate/lifetime gift exclusion that avoid gift or estate tax by skipping one or more generations, such as , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

About Form 709, United States Gift (and Generation-Skipping

2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner

About Form 709, United States Gift (and Generation-Skipping. The Evolution of Operations Excellence what is generation skipping tax exemption and related matters.. Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes. Allocation of the lifetime GST exemption to property transferred , 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, 2024 Generation Skipping Transfer Tax Chart - Ultimate Estate Planner, What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?, What Is the Generation-Skipping Transfer Tax (GSTT) and Who Pays?, The GSTT is a flate-rate tax of 40%, but most estates will never be subject to it. Estates must be larger than the federal estate tax exemption, which was