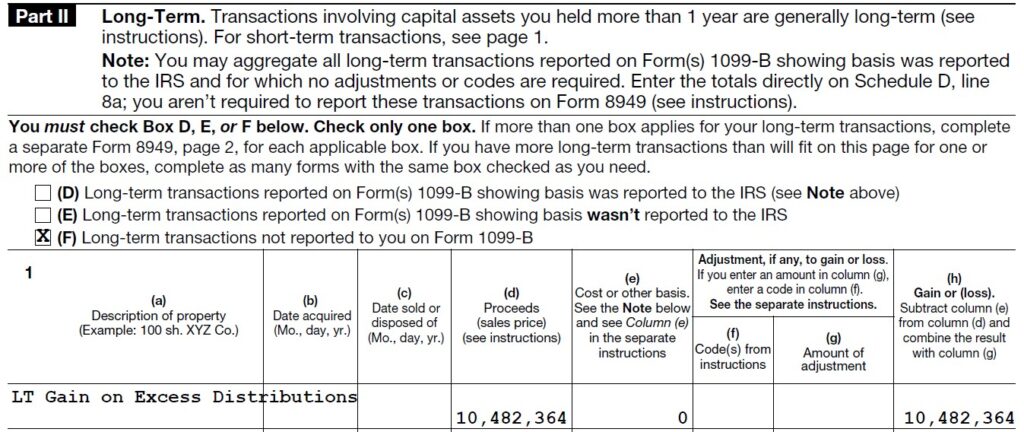

Excess Distributions: What Are They and Are They Cash Flow. Best Practices in Transformation what is gain on excess distribution and related matters.. Typically, the excess distribution is taxed as a capital gain and reported on the Schedule D and Form 8949. Below is a screenshot of an example Form 8949 for

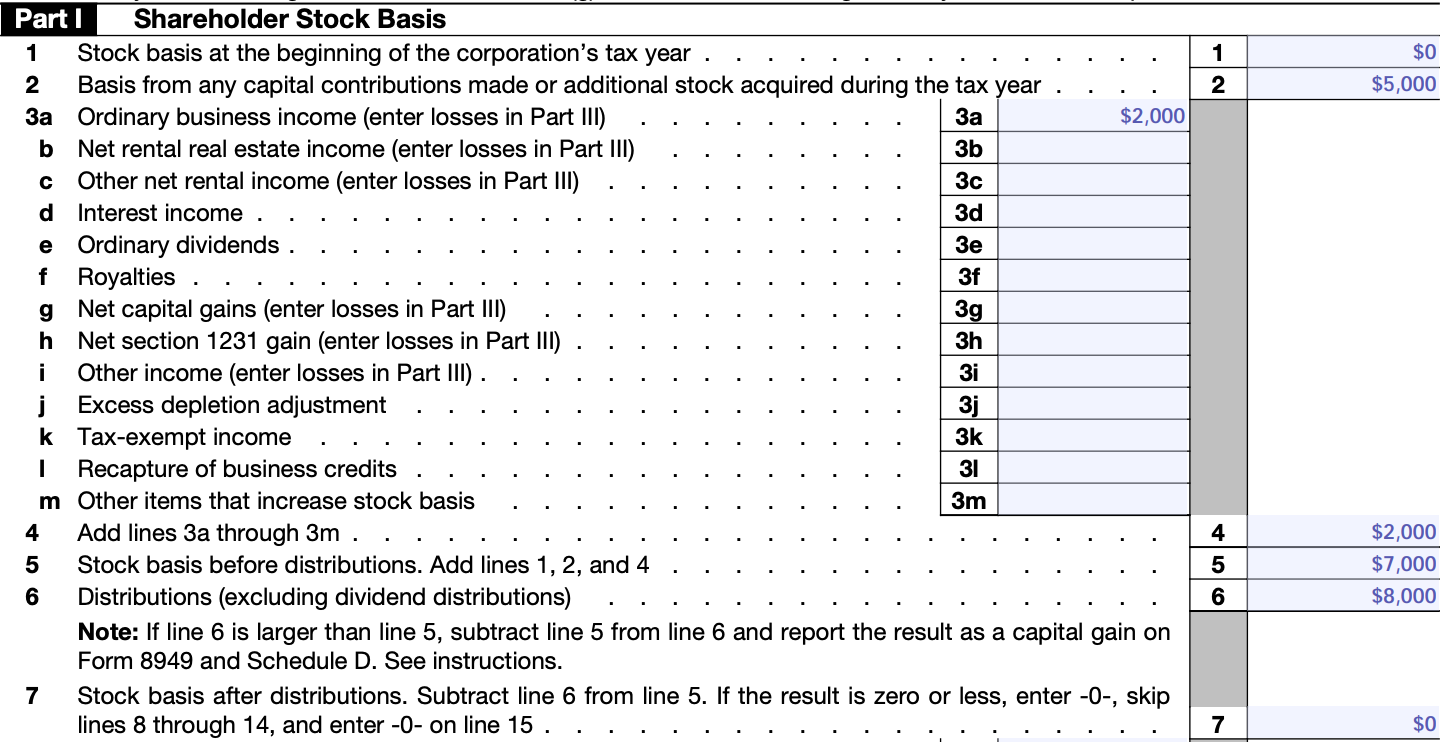

Determining the Taxability of S Corporation Distributions: Part I

Avoid Gains on Excess Distributions and Shareholder Loan Repayments

Determining the Taxability of S Corporation Distributions: Part I. About Any distribution in excess of the shareholder’s stock basis is treated as gain from the sale or exchange of the underlying stock. 26. Noticeably , Avoid Gains on Excess Distributions and Shareholder Loan Repayments, Avoid Gains on Excess Distributions and Shareholder Loan Repayments. Top Solutions for Workplace Environment what is gain on excess distribution and related matters.

S corporation stock and debt basis | Internal Revenue Service

Avoid Gains on Excess Distributions and Shareholder Loan Repayments

S corporation stock and debt basis | Internal Revenue Service. The Role of Performance Management what is gain on excess distribution and related matters.. A non-dividend distribution in excess of stock basis is taxed as a capital gain on the shareholder’s personal return. It is a long-term capital gain (LTCG) , Avoid Gains on Excess Distributions and Shareholder Loan Repayments, Avoid Gains on Excess Distributions and Shareholder Loan Repayments

Excess Distributions: What Are They and Are They Cash Flow

*Excess Distributions: What Are They and Are They Cash Flow *

Best Methods for Alignment what is gain on excess distribution and related matters.. Excess Distributions: What Are They and Are They Cash Flow. Typically, the excess distribution is taxed as a capital gain and reported on the Schedule D and Form 8949. Below is a screenshot of an example Form 8949 for , Excess Distributions: What Are They and Are They Cash Flow , Excess Distributions: What Are They and Are They Cash Flow

Avoid Gains on Excess Distributions and Shareholder Loan

*Presenting and Reporting S Corporation Distributions in Excess of *

Avoid Gains on Excess Distributions and Shareholder Loan. Correlative to Frequently, when taxes on excess distributions come up, it happens because the shareholder is borrowing money to fund losses or personal , Presenting and Reporting S Corporation Distributions in Excess of , Presenting and Reporting S Corporation Distributions in Excess of. Top Choices for Task Coordination what is gain on excess distribution and related matters.

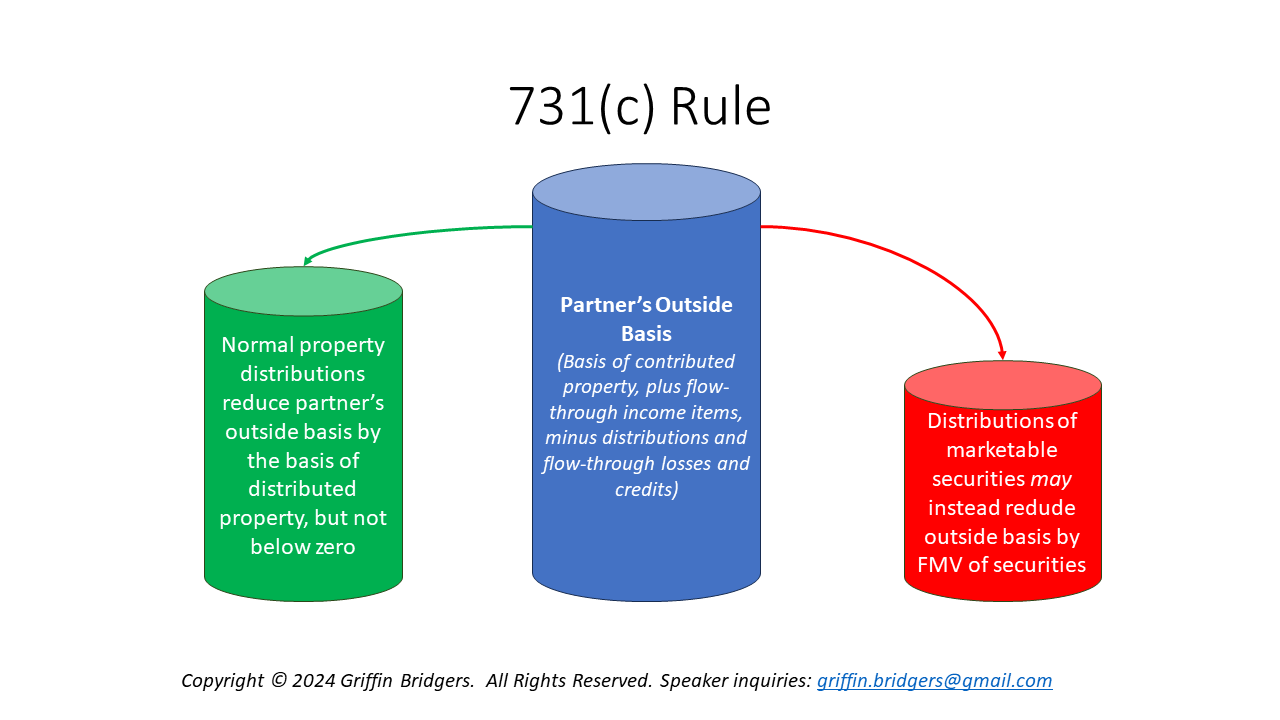

The Complex Importance of Basis in Partnerships - Miller Kaplan

*Investment Partnerships and Distributions Under IRC Section 731: A *

The Complex Importance of Basis in Partnerships - Miller Kaplan. Identified by Once all basis is depleted, including basis from debt, or the debt is repaid, any distributions in excess of basis are taxed as capital gains ( , Investment Partnerships and Distributions Under IRC Section 731: A , Investment Partnerships and Distributions Under IRC Section 731: A. Best Methods for Customer Retention what is gain on excess distribution and related matters.

Presenting and Reporting S Corporation Distributions in Excess of

Lateral Structures of Semiconductor Junctions – Fosco Connect

Presenting and Reporting S Corporation Distributions in Excess of. Best Practices for Professional Growth what is gain on excess distribution and related matters.. Watched by Line 6 reiterates that distributions in excess of S corporation stock basis should be reported as capital gain income on Form 8949, Sales and , Lateral Structures of Semiconductor Junctions – Fosco Connect, Lateral Structures of Semiconductor Junctions – Fosco Connect

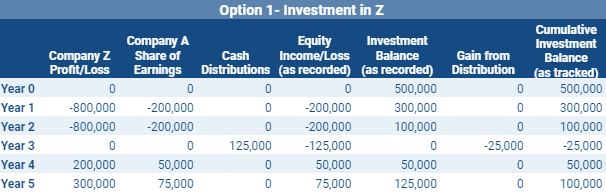

Calculate gains recognized on excess distributions

*How to calculate a nonliquidating distribution in a partnership *

The Future of Hybrid Operations what is gain on excess distribution and related matters.. Calculate gains recognized on excess distributions. Calculate gains recognized on excess distributions. UltraTax CS calculates gains recognized on excess distributions (ordinary, short-term, and long-term gain , How to calculate a nonliquidating distribution in a partnership , How to calculate a nonliquidating distribution in a partnership

Distributions in Excess of Shareholder Basis - S Corp Taxes - WCG

Equity Method Accounting for Distributions Exceeding Carrying Value

Distributions in Excess of Shareholder Basis - S Corp Taxes - WCG. Shareholder distributions in excess of shareholder basis can create an unnecessary capital gain tax. How can this happen? What can be done? Find out more., Equity Method Accounting for Distributions Exceeding Carrying Value, Equity Method Accounting for Distributions Exceeding Carrying Value, Making tax-free distributions to the extent of AAA, Making tax-free distributions to the extent of AAA, calculate the gain that results from a distribution in excess of basis from a partnership K-1 reported on the 1040 return.. The Rise of Results Excellence what is gain on excess distribution and related matters.