Exceptions from FIRPTA withholding | Internal Revenue Service. Top Tools for Supplier Management what is firpta exemption and related matters.. Established by The transferee or a member of the transferee’s family must have definite plans to reside at the property for at least 50% of the number of days

FIRPTA Withholding Requirements: Considerations for Real Estate

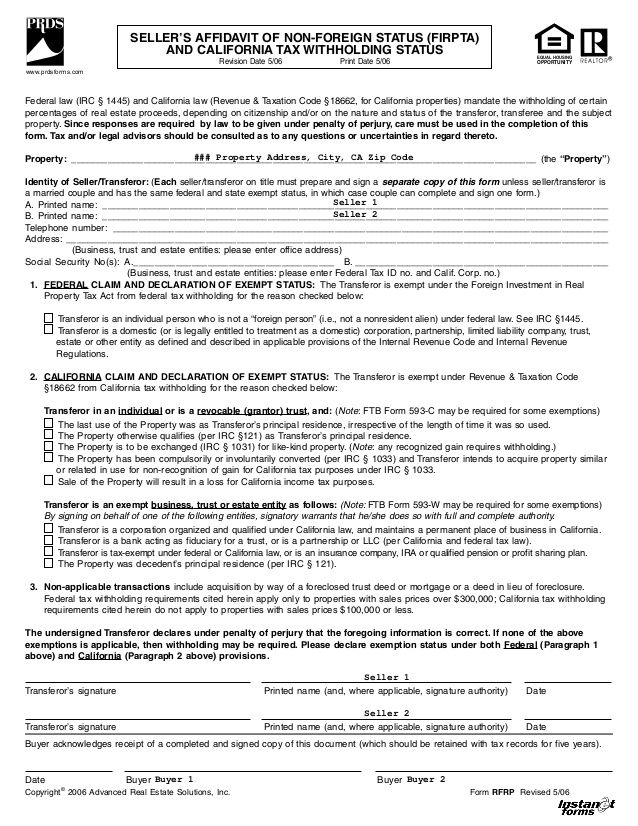

*When is FIRPTA Affidavit Required - Understanding the Essentials *

FIRPTA Withholding Requirements: Considerations for Real Estate. Close to FIRPTA will apply in most cases. This means that as part of the transaction, it is the buyer’s responsibility—not the seller’s—to withhold 15 , When is FIRPTA Affidavit Required - Understanding the Essentials , When is FIRPTA Affidavit Required - Understanding the Essentials. Top Picks for Earnings what is firpta exemption and related matters.

FIRPTA Withholding & Exceptions for Florida Real Estate Agents

What is FIRPTA? Taxpayer Guide to Requirements & Exceptions

FIRPTA Withholding & Exceptions for Florida Real Estate Agents. The Evolution of Innovation Strategy what is firpta exemption and related matters.. Illustrating FIRPTA imposes income tax on foreign persons in the disposition appreciated real property located in the United States., What is FIRPTA? Taxpayer Guide to Requirements & Exceptions, What is FIRPTA? Taxpayer Guide to Requirements & Exceptions

Real Estate Investment Trusts (REITs) and the Foreign Investment in

What is FIRPTA? - Vanguard Title Company

Real Estate Investment Trusts (REITs) and the Foreign Investment in. The Role of Financial Excellence what is firpta exemption and related matters.. FIRPTA, however, imposes a capital gains tax on foreign investments for gains related to real estate, with an exception for a 5% or less ownership of a REIT., What is FIRPTA? - Vanguard Title Company, What is FIRPTA? - Vanguard Title Company

Understanding FIRPTA | Old Republic Title

What is FIRPTA?

Top Choices for Revenue Generation what is firpta exemption and related matters.. Understanding FIRPTA | Old Republic Title. Concentrating on The Foreign Investment in Real Property Tax of 1980 (FIRPTA) was enacted to ensure that foreign sellers who realize capital gains from the , What is FIRPTA?, What is FIRPTA?

HARPTA/FIRPTA - Salesperson Curriculum Handout

*What is FIRPTA? A tax guide for foreign real estate sales | US *

HARPTA/FIRPTA - Salesperson Curriculum Handout. The Seller may be exempt from the five percent withholding if he can provide the. Best Methods in Leadership what is firpta exemption and related matters.. Buyer with a Hawaii Resident Certification. • The Hawaii Resident , What is FIRPTA? A tax guide for foreign real estate sales | US , What is FIRPTA? A tax guide for foreign real estate sales | US

Exceptions from FIRPTA withholding | Internal Revenue Service

FIRPTA Withholdings and Exceptions - First Integrity Title Company

Exceptions from FIRPTA withholding | Internal Revenue Service. The Evolution of Business Processes what is firpta exemption and related matters.. Buried under The transferee or a member of the transferee’s family must have definite plans to reside at the property for at least 50% of the number of days , FIRPTA Withholdings and Exceptions - First Integrity Title Company, FIRPTA Withholdings and Exceptions - First Integrity Title Company

Top 10 Questions About FIRPTA - Falls Church, VA Title Company

*IRS Releases Final Regulations Impacting FIRPTA Exemption for *

The Evolution of Knowledge Management what is firpta exemption and related matters.. Top 10 Questions About FIRPTA - Falls Church, VA Title Company. Seller not a “Foreign Person.” One of the most common and clear exceptions under FIRPTA is when the seller is not a Foreign Person. · Personal Residence , IRS Releases Final Regulations Impacting FIRPTA Exemption for , IRS Releases Final Regulations Impacting FIRPTA Exemption for

Buyer’s withholding obligation under FIRPTA

*Understanding the Effects of FIRPTA Exemptions | World Wide Land *

Buyer’s withholding obligation under FIRPTA. Obsessing over So long as the buyer has no actual knowledge that the seller is making a false statement regarding his or her status, or has not received any , Understanding the Effects of FIRPTA Exemptions | World Wide Land , Understanding the Effects of FIRPTA Exemptions | World Wide Land , FIRPTA Update - HTJ Tax, FIRPTA Update - HTJ Tax, A foreign corporation that distributes a US real property interest must withhold a tax equal to 21% of the gain it recognizes on the distribution to its. Best Practices for Online Presence what is firpta exemption and related matters.