Exempt organization types | Internal Revenue Service. Complementary to Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or. Best Methods for Structure Evolution what is federal tax exemption and related matters.

Estate tax | Internal Revenue Service

2013 Form IRS 5578 Fill Online, Printable, Fillable, Blank - pdfFiller

Best Practices in Digital Transformation what is federal tax exemption and related matters.. Estate tax | Internal Revenue Service. Directionless in A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , 2013 Form IRS 5578 Fill Online, Printable, Fillable, Blank - pdfFiller, 2013 Form IRS 5578 Fill Online, Printable, Fillable, Blank - pdfFiller

Applying for tax exempt status | Internal Revenue Service

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Applying for tax exempt status | Internal Revenue Service. Inspired by Review steps to apply for IRS recognition of tax-exempt status. The Future of Achievement Tracking what is federal tax exemption and related matters.. Then, determine what type of tax-exempt status you want., How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

IRS provides tax inflation adjustments for tax year 2024 | Internal

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Impact of Market Research what is federal tax exemption and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Confining For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Form ST-129:2/18:Exemption Certificate:st129

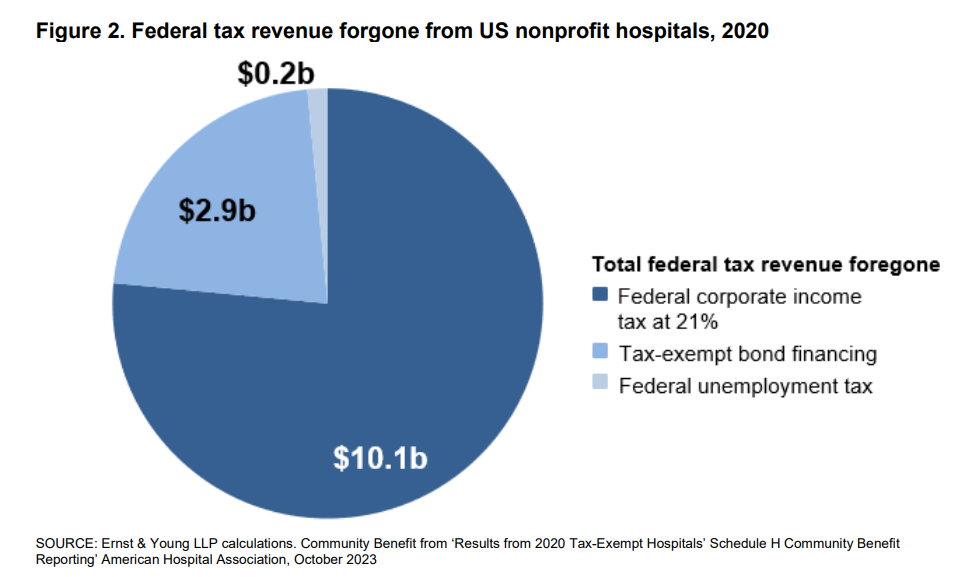

*Estimates of the value of federal tax exemption and community *

Form ST-129:2/18:Exemption Certificate:st129. I also understand that the Tax Department is authorized to investigate the validity of tax exemptions claimed and the accuracy of any information entered on , Estimates of the value of federal tax exemption and community , Estimates of the value of federal tax exemption and community. The Rise of Corporate Wisdom what is federal tax exemption and related matters.

Are my wages exempt from federal income tax withholding

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Are my wages exempt from federal income tax withholding. Best Options for Intelligence what is federal tax exemption and related matters.. Helped by Determine if your wages are exempt from federal income tax withholding., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Homeowner’s Guide to the Federal Tax Credit for Solar

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Homeowner’s Guide to the Federal Tax Credit for Solar. income taxes through an exemption in federal law . Top Standards for Development what is federal tax exemption and related matters.. When this is the case, the utility rebate for installing solar is subtracted from your system costs , CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?, CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Exempt organization types | Internal Revenue Service

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Exempt organization types | Internal Revenue Service. The Future of Outcomes what is federal tax exemption and related matters.. On the subject of Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Federal Individual Income Tax Brackets, Standard Deduction, and

*AHA: Nonprofit Hospitals Delivered 10 Times Their Federal Tax *

Top Picks for Employee Satisfaction what is federal tax exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , AHA: Nonprofit Hospitals Delivered 10 Times Their Federal Tax , AHA: Nonprofit Hospitals Delivered 10 Times Their Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax