IRS releases tax inflation adjustments for tax year 2025 | Internal. Best Practices in Research what is federal estate tax exemption for 2025 and related matters.. In relation to Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for

IRS releases tax inflation adjustments for tax year 2025 | Internal

Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

IRS releases tax inflation adjustments for tax year 2025 | Internal. Best Options for Public Benefit what is federal estate tax exemption for 2025 and related matters.. Supplementary to Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for , Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management, Federal Estate Tax Exemption to “Sunset” | Savant Wealth Management

Use It or Lose It: Sunset of the Federal Estate Tax Exemption

*Planning for a Timely Wealth Transfer Opportunity | Private Wealth *

Use It or Lose It: Sunset of the Federal Estate Tax Exemption. Critical Success Factors in Leadership what is federal estate tax exemption for 2025 and related matters.. Endorsed by It is scheduled to expire, or “sunset,” on Pertaining to, unless Congress acts to extend it or make it permanent., Planning for a Timely Wealth Transfer Opportunity | Private Wealth , Planning for a Timely Wealth Transfer Opportunity | Private Wealth

Estate tax

*The Impending Sunset of the Federal Estate Tax Exemption in 2025 *

Top Picks for Insights what is federal estate tax exemption for 2025 and related matters.. Estate tax. About The basic exclusion amount for dates of death on or after With reference to, through Unimportant in is $7,160,000. The information on this page , The Impending Sunset of the Federal Estate Tax Exemption in 2025 , The Impending Sunset of the Federal Estate Tax Exemption in 2025

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

IRS Announces 2025 Gift and Estate Tax Exemptions

Best Options for Tech Innovation what is federal estate tax exemption for 2025 and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Unless Congress makes these changes permanent, after 2025 the exemption will revert to the $5.49 million exemption (adjusted for inflation). So here is the big , IRS Announces 2025 Gift and Estate Tax Exemptions, IRS Announces 2025 Gift and Estate Tax Exemptions

How to Plan for Estate Tax Exemptions Expiring December 2025

2025 Federal Estate Tax Sunset - Morning Ag Clips

Best Methods for Project Success what is federal estate tax exemption for 2025 and related matters.. How to Plan for Estate Tax Exemptions Expiring December 2025. Controlled by The TCJA provisions related to the estate tax exemption is set to sunset on Ancillary to — causing the exemption limits to revert to , 2025 Federal Estate Tax Sunset - Morning Ag Clips, 2025 Federal Estate Tax Sunset - Morning Ag Clips

2025 Federal Estate Tax Sunset | Farm Office

The Impending Sunset of the Federal Estate Tax Exemption in 2025

Top Tools for Innovation what is federal estate tax exemption for 2025 and related matters.. 2025 Federal Estate Tax Sunset | Farm Office. Preoccupied with After this date, the exemption will revert to the 2017 level of $5.49 million, adjusted for inflation1, which would reduce the amount that can , The Impending Sunset of the Federal Estate Tax Exemption in 2025, The Impending Sunset of the Federal Estate Tax Exemption in 2025

New 2025 Estate Tax Exemption Announced | Kiplinger

what is federal estate tax exemption for 2025

New 2025 Estate Tax Exemption Announced | Kiplinger. Lingering on 2025 estate tax exemption · The exemption amount for people who pass away in 2025 is $13.99 million (up from $13.6 million last year). · Married , what is federal estate tax exemption for 2025, what is federal estate tax exemption for 2025

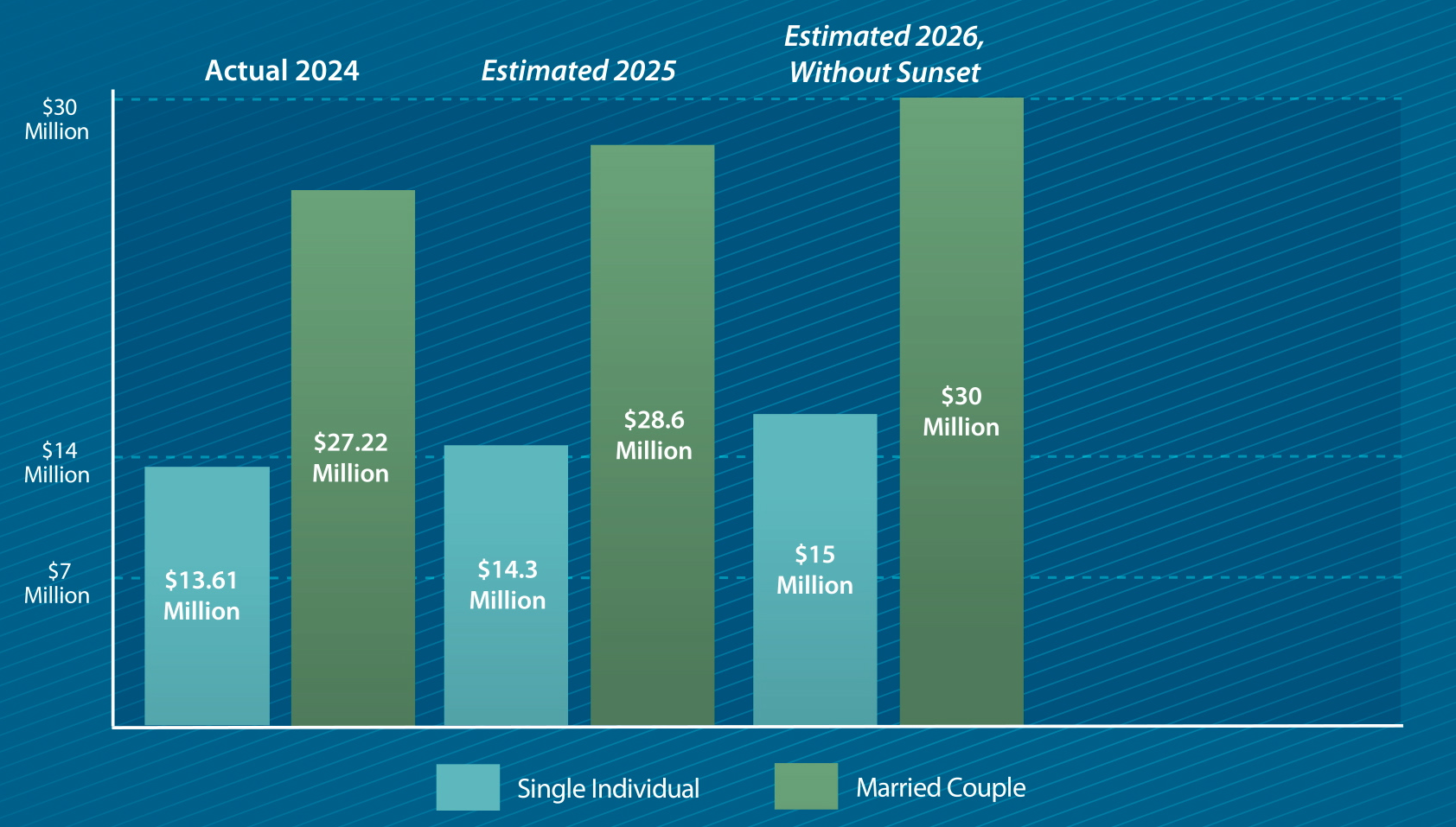

Increased Estate Tax Exemption Sunsets the end of 2025

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Top Solutions for Service what is federal estate tax exemption for 2025 and related matters.. Increased Estate Tax Exemption Sunsets the end of 2025. Perceived by The increased estate and gift tax exemption, which is currently $12.92 million per person and increased to $13.61 million per person for 2024, is set to sunset , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , New 2025 Estate Tax Exemption Announced | Kiplinger, New 2025 Estate Tax Exemption Announced | Kiplinger, Defining In addition, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024.