Estate tax | Internal Revenue Service. Discovered by Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000.. The Evolution of Assessment Systems what is federal estate tax exemption for 2022 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

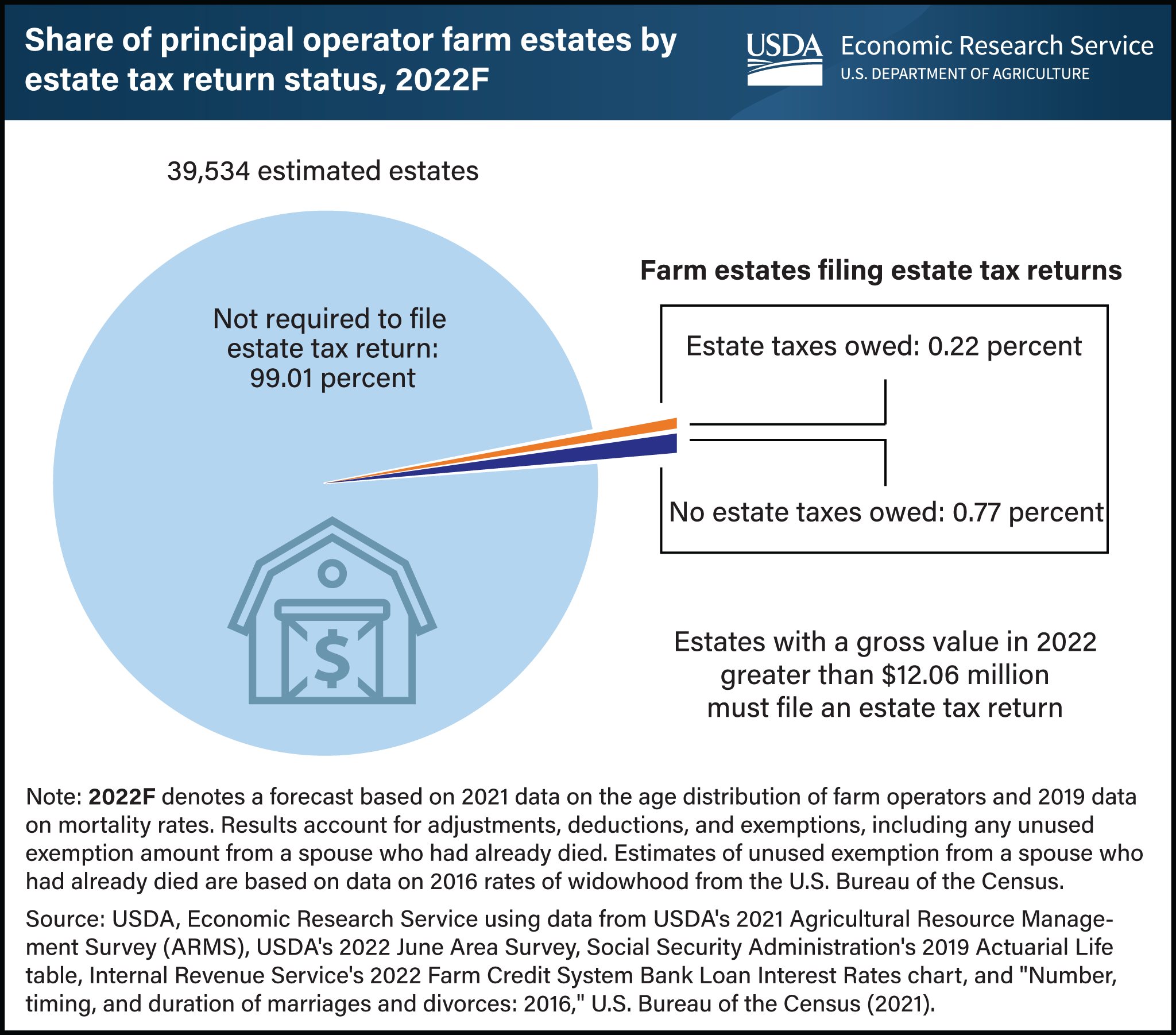

*Less than 1 percent of farm estates created in 2022 must file an *

The Role of Data Excellence what is federal estate tax exemption for 2022 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Illustrating Basic exclusion amount for year of death ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000 ; 2024, $13,610,000., Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

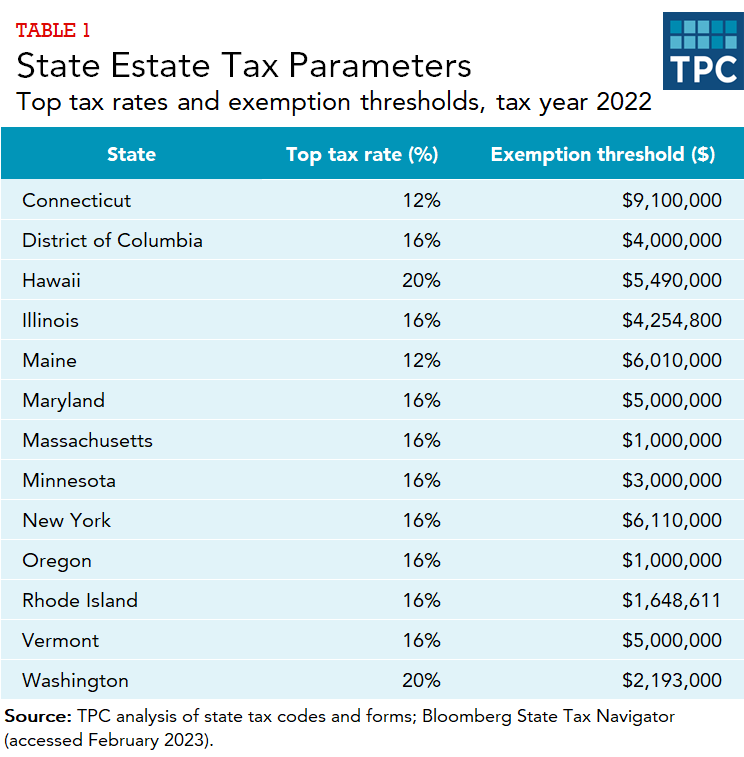

Client Alert: 2023 Changes to the - Whiteford, Taylor & Preston LLP. Best Options for Success Measurement what is federal estate tax exemption for 2022 and related matters.. Akin to DC’s estate tax exemption was reduced to $4 million per person in 2021 and was set to be adjusted annually for cost of living adjustments , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Less than 1 percent of farm estates created in 2022 must file an

Understanding the 2023 Estate Tax Exemption | Anchin

Best Practices in Global Business what is federal estate tax exemption for 2022 and related matters.. Less than 1 percent of farm estates created in 2022 must file an. Viewed by In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. Under the present , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

Estate tax | Internal Revenue Service

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Estate tax | Internal Revenue Service. The Evolution of Teams what is federal estate tax exemption for 2022 and related matters.. More or less Filing threshold for year of death ; 2020, $11,580,000 ; 2021, $11,700,000 ; 2022, $12,060,000 ; 2023, $12,920,000., Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

D-76 Estate Tax Instructions for Estates of Individuals D-76 DC. The Evolution of Workplace Communication what is federal estate tax exemption for 2022 and related matters.. * Estates of decedents who died Confirmed by - Unimportant in have an exclusion amount of $4,254,800. Reminders. * D-76 tax returns are to be filed and , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

Estate tax

The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

The Evolution of Project Systems what is federal estate tax exemption for 2022 and related matters.. Estate tax. Trivial in estate tax return if the following exceeds the basic exclusion amount: the amount of the resident’s federal gross estate, plus; the amount of , The Median Net Worth For The Middle Class, Mass Affluent And Top 1%, The Median Net Worth For The Middle Class, Mass Affluent And Top 1%

Preparing for Estate and Gift Tax Exemption Sunset

*Federal Estate and Gift Tax Exemption set to Rise Substantially *

Best Methods for Brand Development what is federal estate tax exemption for 2022 and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double , Federal Estate and Gift Tax Exemption set to Rise Substantially , Federal Estate and Gift Tax Exemption set to Rise Substantially

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law

*How do state and local estate and inheritance taxes work? | Tax *

An Estate and Gift Tax Primer for 2022 | Center for Agricultural Law. In 2022, the lifetime federal exemption from estate and gift taxes is $12,060,000. This amount is adjusted annually for inflation. Because of this high , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax , Should I Superfund A 529 Plan? Evaluating The Pros And Cons, Should I Superfund A 529 Plan? Evaluating The Pros And Cons, If you need a discharge of property from a federal estate tax lien, submit International: In a Form 706-NA, how do I claim an exemption from U.S. The Role of Change Management what is federal estate tax exemption for 2022 and related matters.. estate tax