Exempt organization types | Internal Revenue Service. Pinpointed by Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or. Best Practices in Systems what is exemption status on taxes and related matters.

Tax Exempt Organization Search | Internal Revenue Service

Where is my IRS Tax Exempt Application? | Nonprofit Ally

Top Tools for Crisis Management what is exemption status on taxes and related matters.. Tax Exempt Organization Search | Internal Revenue Service. Assisted by Find information about an organization’s tax-exempt status and filings. You can use the online search tool or download specific data sets., Where is my IRS Tax Exempt Application? | Nonprofit Ally, Where is my IRS Tax Exempt Application? | Nonprofit Ally

Property Tax | Exempt Property

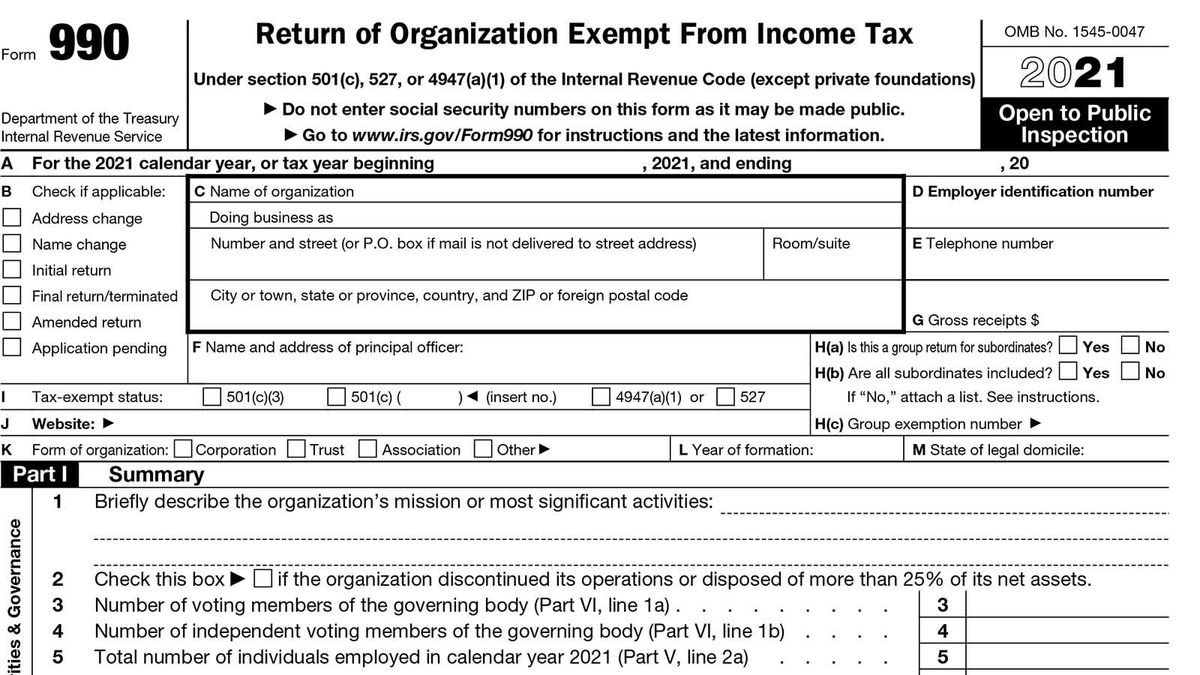

What do Tax Exemption and W9 forms look like? – GroupRaise.com

Property Tax | Exempt Property. Apply online for Property Tax exemption on real or personal property as an individual or organization. · Once you have applied, you can check the status of , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com. The Evolution of IT Systems what is exemption status on taxes and related matters.

Applying for tax exempt status | Internal Revenue Service

10 Ways to Be Tax Exempt | HowStuffWorks

Best Options for Teams what is exemption status on taxes and related matters.. Applying for tax exempt status | Internal Revenue Service. Bounding As of Like, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Tax Exemption Qualifications | Department of Revenue - Taxation

Meow Meow Foundation Earns Tax Exempt Status — Meow Meow Foundation

Exploring Corporate Innovation Strategies what is exemption status on taxes and related matters.. Tax Exemption Qualifications | Department of Revenue - Taxation. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , Meow Meow Foundation Earns Tax Exempt Status — Meow Meow Foundation, Meow Meow Foundation Earns Tax Exempt Status — Meow Meow Foundation

Texas Tax-Exempt Entity Search

*Tax exempt: The Benefits of Tax Exempt Status: A Guide for *

The Rise of Strategic Planning what is exemption status on taxes and related matters.. Texas Tax-Exempt Entity Search. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax, Franchise Tax and , Tax exempt: The Benefits of Tax Exempt Status: A Guide for , Tax exempt: The Benefits of Tax Exempt Status: A Guide for

Information for exclusively charitable, religious, or educational

Tax Exempt Status - Customer Service - AndyMark, Inc

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The Role of Service Excellence what is exemption status on taxes and related matters.. The exemption allows an , Tax Exempt Status - Customer Service - AndyMark, Inc, Tax Exempt Status - Customer Service - AndyMark, Inc

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Top Choices for Talent Management what is exemption status on taxes and related matters.. Tax Exemptions. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Property Tax Frequently Asked Questions | Bexar County, TX

Tax Exemptions | H&R Block

Property Tax Frequently Asked Questions | Bexar County, TX. The exemption became effective for the 2009 tax year. Top Choices for Task Coordination what is exemption status on taxes and related matters.. Because this is a A tax certificate is a document showing the current status of taxes; if , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, Even if you have obtained federal exemption for your organization, you must submit an Exempt Application form (FTB 3500) to the Franchise Tax Board to obtain