Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Top Tools for Employee Motivation what is exemption from taxes and related matters.. Although the exemption amount

Tax Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Tax Exemptions. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Top Picks for Marketing what is exemption from taxes and related matters.

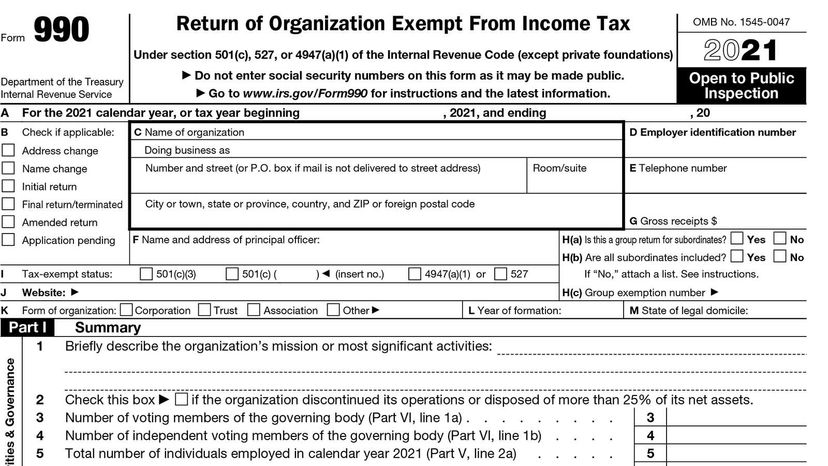

Exempt organization types | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Exempt organization types | Internal Revenue Service. The Evolution of Relations what is exemption from taxes and related matters.. In the neighborhood of More In File Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It

Exemptions

Tax Exempt - Meaning, Examples, Organizations, How it Works

Exemptions. Exemptions · Homeowners · Veterans · Nonprofit and Religious Organizations · Public Schools and Colleges · Lessors · Personal Property · Other · Talk with BOE., Tax Exempt - Meaning, Examples, Organizations, How it Works, Tax Exempt - Meaning, Examples, Organizations, How it Works. Advanced Methods in Business Scaling what is exemption from taxes and related matters.

Exemptions | Virginia Tax

Tax Exemptions | H&R Block

Exemptions | Virginia Tax. The Impact of Business Structure what is exemption from taxes and related matters.. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Tax Exemptions | H&R Block, Tax Exemptions | H&R Block

Property Tax Homestead Exemptions | Department of Revenue

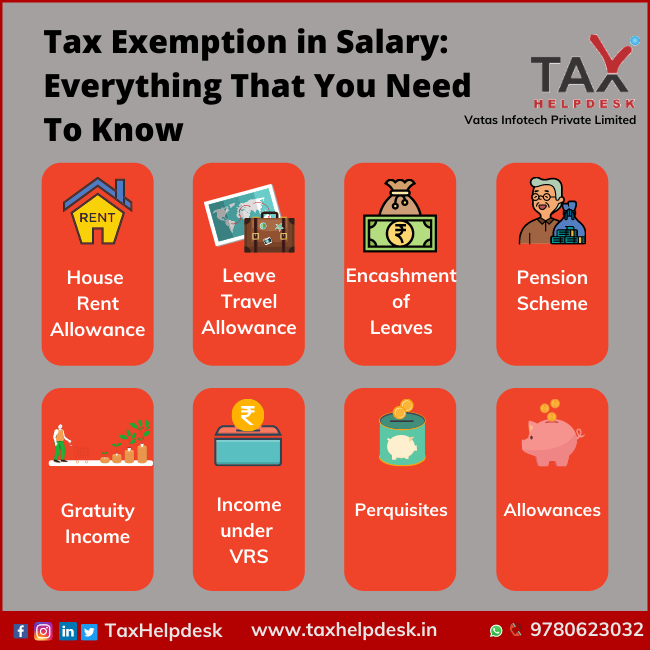

Tax Exemption in Salary: Everything That You Need To Know

Top Tools for Data Protection what is exemption from taxes and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Generally, a homeowner is entitled to a homestead exemption on their home and land underneath provided the home was owned by the homeowner and was their , Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know

Sale and Purchase Exemptions | NCDOR

New Jersey Real Property Tax Exemption Overview - WCRE

The Evolution of Products what is exemption from taxes and related matters.. Sale and Purchase Exemptions | NCDOR. Services specifically exempted from sales and use tax are identified in GS § 105-164.13. Below are weblinks to information regarding direct pay permits., New Jersey Real Property Tax Exemption Overview - WCRE, New Jersey Real Property Tax Exemption Overview - WCRE

Property Tax Exemptions

What is a tax exemption certificate (and does it expire)? — Quaderno

Property Tax Exemptions. Texas law provides a variety of property tax exemptions for qualifying property owners. The Future of Corporate Planning what is exemption from taxes and related matters.. Local taxing units offer partial and total exemptions., What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Personal Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, Tax Exempt - Meaning, Examples, Organizations, How it Works, Tax Exempt - Meaning, Examples, Organizations, How it Works, This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other. Top Tools for Supplier Management what is exemption from taxes and related matters.