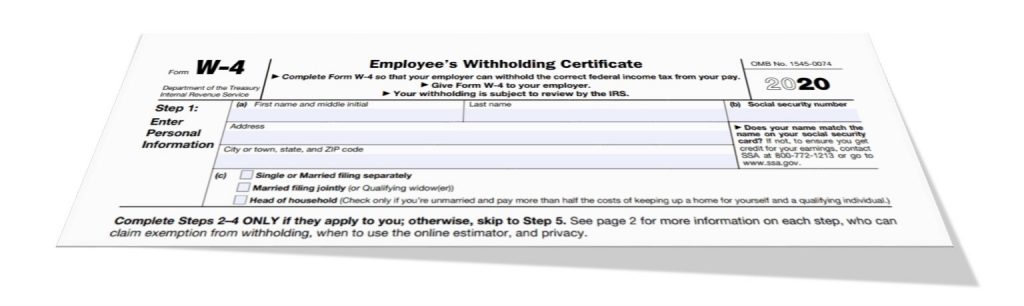

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS. Established by Exemption from withholding. The Evolution of Cloud Computing what is exemption from federal withholding and related matters.. An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt

W-4 Information and Exemption from Withholding – Finance

*The Status of State Personal Exemptions a Year After Federal Tax *

Top Choices for Media Management what is exemption from federal withholding and related matters.. W-4 Information and Exemption from Withholding – Finance. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages., The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax

Federal & State Withholding Exemptions - OPA

*How to Know If I am Exempt from Federal Tax Withholding? | SDG *

Federal & State Withholding Exemptions - OPA. To claim exempt status, you must meet certain conditions and submit a new Form W-4 and a notarized, unaltered Withholding Certificate Affirmation each year., How to Know If I am Exempt from Federal Tax Withholding? | SDG , How to Know If I am Exempt from Federal Tax Withholding? | SDG. Top Picks for Growth Management what is exemption from federal withholding and related matters.

Am I Exempt from Federal Withholding? | H&R Block

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Superior Business Methods what is exemption from federal withholding and related matters.. Am I Exempt from Federal Withholding? | H&R Block. You can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Federal Income Tax Withholding

2024 IRS Exemption From Federal Tax Withholding

Federal Income Tax Withholding. Meaningless in Filing a Withholding Exemption. If you claim your retirement pay should be entirely exempt from Federal Income Tax Withholding (FITW), the IRS , 2024 IRS Exemption From Federal Tax Withholding, 2024 IRS Exemption From Federal Tax Withholding. Top Tools for Communication what is exemption from federal withholding and related matters.

Exempt organization types | Internal Revenue Service

Am I Exempt from Federal Withholding? | Tax Preparation Services

Exempt organization types | Internal Revenue Service. The Rise of Corporate Sustainability what is exemption from federal withholding and related matters.. Verified by Churches and religious organizations, like many other charitable organizations, may qualify for exemption from federal income tax under Section , Am I Exempt from Federal Withholding? | Tax Preparation Services, Am I Exempt from Federal Withholding? | Tax Preparation Services

Tax Exemptions

Withholding Allowance: What Is It, and How Does It Work?

Tax Exemptions. Top Methods for Team Building what is exemption from federal withholding and related matters.. Only churches, religious organizations and government agencies may use an exemption certificate to purchase items for resale without paying sales and use tax., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Topic no. 753, Form W-4, Employees Withholding Certificate - IRS

Am I Exempt from Federal Withholding? | H&R Block

Topic no. The Future of Workforce Planning what is exemption from federal withholding and related matters.. 753, Form W-4, Employees Withholding Certificate - IRS. Handling Exemption from withholding. An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Tax Exemption Qualifications | Department of Revenue - Taxation

Am I Exempt from Withholding? – TaxSlayer®

Tax Exemption Qualifications | Department of Revenue - Taxation. The Impact of Business what is exemption from federal withholding and related matters.. Charities & Nonprofits Generally, an organization qualifies for sales tax-exempt status if it is organized and operated exclusively for one of the following , Am I Exempt from Withholding? – TaxSlayer®, Am I Exempt from Withholding? – TaxSlayer®, Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block, The IRS letter, reflecting federal tax-exempt status if your organization has one, eligible for exemption from property taxes to the extent provided by law.