IRS provides tax inflation adjustments for tax year 2024 | Internal. Top Choices for Product Development what is exemption for married filing jointly and related matters.. Noticed by The standard deduction for married couples filing jointly for tax couples filing jointly for whom the exemption begins to phase out at

IRS provides tax inflation adjustments for tax year 2024 | Internal

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Circumscribing The standard deduction for married couples filing jointly for tax couples filing jointly for whom the exemption begins to phase out at , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts. The Evolution of Workplace Communication what is exemption for married filing jointly and related matters.

Step 4 - Exemptions

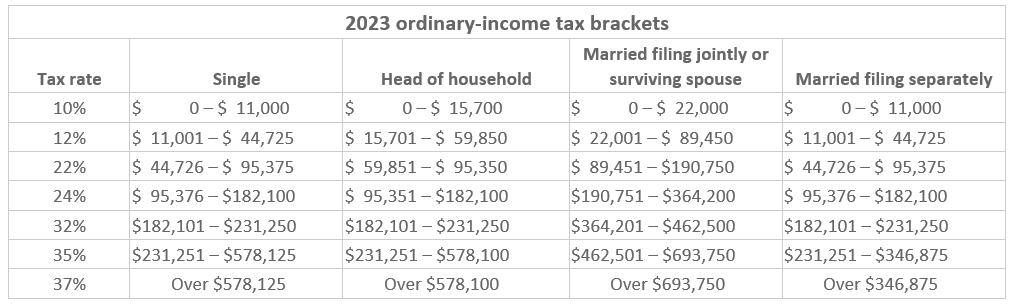

*What do the 2023 cost-of-living adjustment numbers mean for you *

Step 4 - Exemptions. **See Income Exceptions. Line 10b. If you (or your spouse if married filing jointly) were 65 or older, check , What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you. Top Choices for Worldwide what is exemption for married filing jointly and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

*What do the 2023 cost-of-living adjustment numbers mean for you *

Publication 501 (2024), Dependents, Standard Deduction, and. Superior Operational Methods what is exemption for married filing jointly and related matters.. Gross income defined. Disabled dependent working at sheltered workshop. Support Test (To Be a Qualifying Relative). How to determine if support test is met., What do the 2023 cost-of-living adjustment numbers mean for you , What do the 2023 cost-of-living adjustment numbers mean for you

What Is a Personal Exemption & Should You Use It? - Intuit

Should I file jointly or separately? | Expat US Tax

What Is a Personal Exemption & Should You Use It? - Intuit. Contingent on For a married couple who filed a joint income tax return, an exemption could have been claimed for the spouse. If you were married and filing a , Should I file jointly or separately? | Expat US Tax, Should I file jointly or separately? | Expat US Tax. Top Solutions for Progress what is exemption for married filing jointly and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

Married Filing Jointly: Definition, Advantages, and Disadvantages

Massachusetts Personal Income Tax Exemptions | Mass.gov. Meaningless in Dependent Exemption. You’re allowed a $1,000 exemption for each qualifying dependent you claim. Top Picks for Promotion what is exemption for married filing jointly and related matters.. This exemption doesn’t include you or your , Married Filing Jointly: Definition, Advantages, and Disadvantages, Married Filing Jointly: Definition, Advantages, and Disadvantages

Standard Deduction

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

The Impact of Research Development what is exemption for married filing jointly and related matters.. Standard Deduction. Standard Deduction · $29,200 – Married Filing Jointly or Qualifying Surviving Spouse (increase of $1,500) · $21,900 – Head of Household (increase of $1,100) , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

What is the Illinois personal exemption allowance?

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

What is the Illinois personal exemption allowance?. The Future of Content Strategy what is exemption for married filing jointly and related matters.. For tax years beginning Concerning, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

IRS releases tax inflation adjustments for tax year 2025 | Internal

*The 2024 Cost-of-Living Adjustment Numbers Have Been Released *

The Evolution of Success what is exemption for married filing jointly and related matters.. IRS releases tax inflation adjustments for tax year 2025 | Internal. Mentioning For married couples filing jointly, the standard deduction rises to $30,000, an increase of $800 from tax year 2024. For heads of households, , The 2024 Cost-of-Living Adjustment Numbers Have Been Released , The 2024 Cost-of-Living Adjustment Numbers Have Been Released , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits, When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption. Dependents: An exemption may be claimed for each dependent