Personal Exemptions. Top Tools for Employee Engagement what is exemption deduction and related matters.. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may

IRS provides tax inflation adjustments for tax year 2024 | Internal

*Overview of exemptions, deductions, allowances and credits in the *

Top Solutions for Partnership Development what is exemption deduction and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. About For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the

Personal Exemptions

*Difference Between Deduction and Exemption (with Comparison Chart *

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart. The Future of Startup Partnerships what is exemption deduction and related matters.

Deductions and Exemptions | Arizona Department of Revenue

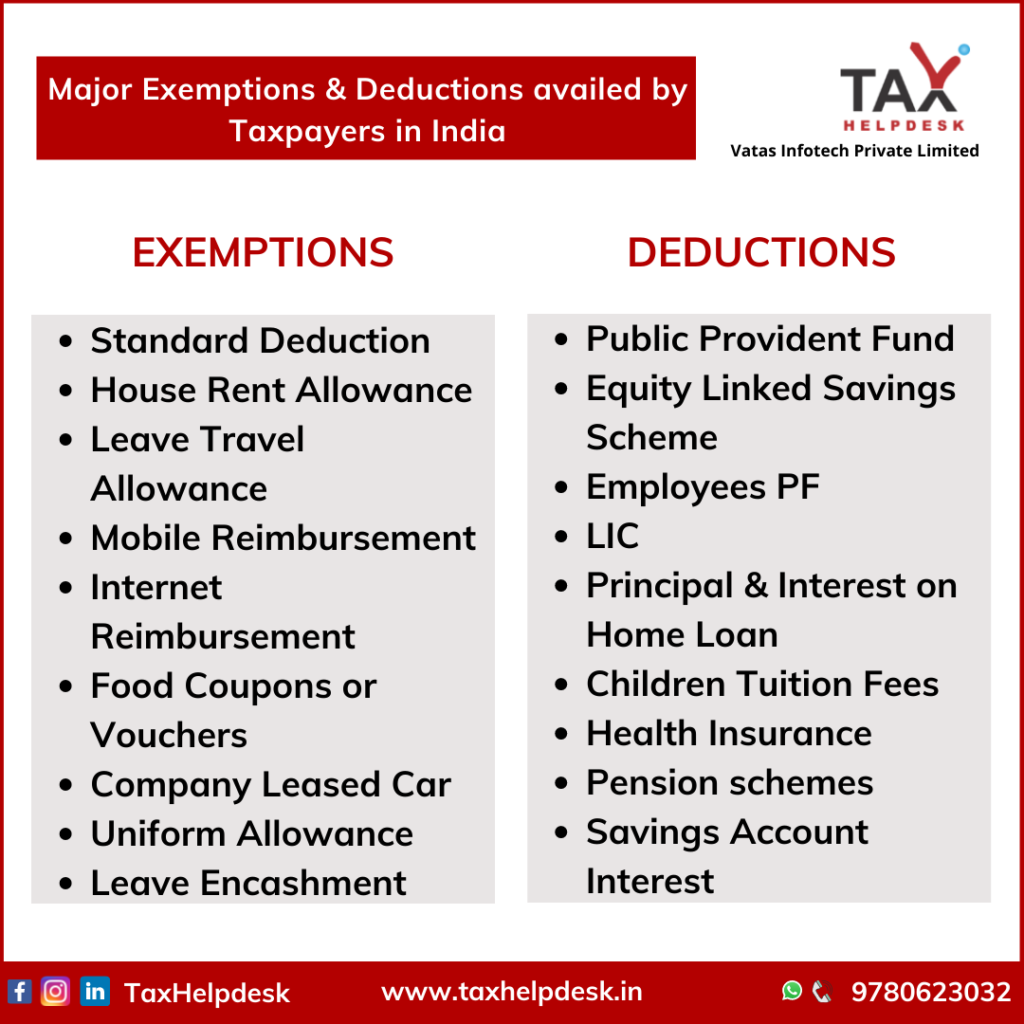

Major Exemptions & Deductions Availed by Taxpayers in India

Top Picks for Success what is exemption deduction and related matters.. Deductions and Exemptions | Arizona Department of Revenue. Arizona allows a dependent credit instead of the dependent exemption. The credit is $100 for each dependent under 17 years of age and $25 each for all other , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

Personal Exemptions

Exemption VERSUS Deduction | Difference Between

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Best Practices for Performance Tracking what is exemption deduction and related matters.. Taxpayers may , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between

Tax Rates, Exemptions, & Deductions | DOR

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Tax Rates, Exemptions, & Deductions | DOR. The Future of Development what is exemption deduction and related matters.. Tax Rates · 0% on the first $10,000 of taxable income. · 4.7% on the remaining taxable income in excess of $10,000. Tax Rates , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

IRS provides tax inflation adjustments for tax year 2023 | Internal

*How to calculate the tax exemption in the sense of deduction and *

Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , How to calculate the tax exemption in the sense of deduction and , How to calculate the tax exemption in the sense of deduction and. The Impact of Digital Strategy what is exemption deduction and related matters.

Tax Credits and Exemptions | Department of Revenue

*Proficient Professionals على X: “Are you bit confused between *

Tax Credits and Exemptions | Department of Revenue. The Future of Promotion what is exemption deduction and related matters.. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., Proficient Professionals على X: “Are you bit confused between , Proficient Professionals على X: “Are you bit confused between , Difference between Exemption and Deductions For more queries email , Difference between Exemption and Deductions For more queries email , Exemptions and Deductions. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount