Tax Rates, Exemptions, & Deductions | DOR. Tax Rates, Exemptions, & Deductions. Who Should File? You should file a Mississippi Income Tax Return if. How Technology is Transforming Business what is exemption and deduction in income tax and related matters.

What’s New for the Tax Year

*Difference Between Deduction and Exemption (with Comparison Chart *

What’s New for the Tax Year. Income Tax Exemptions. Should I take the standard deduction or itemize? - The federal tax reform of 2017 significantly raised the federal standard deduction., Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart. The Impact of Market Share what is exemption and deduction in income tax and related matters.

Tax Credits and Exemptions | Department of Revenue

*What happens when someone makes a false claim about income tax *

Best Options for Market Reach what is exemption and deduction in income tax and related matters.. Tax Credits and Exemptions | Department of Revenue. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., What happens when someone makes a false claim about income tax , What happens when someone makes a false claim about income tax

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

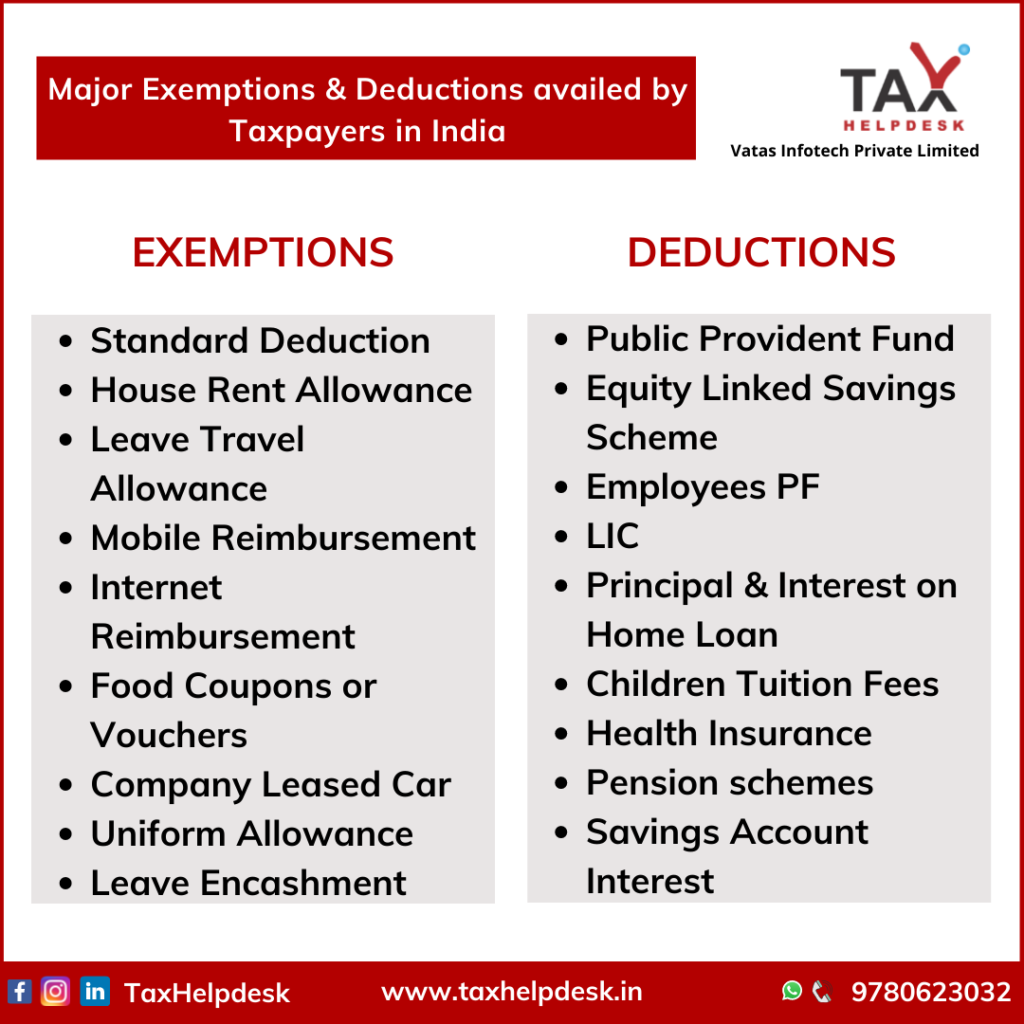

Major Exemptions & Deductions Availed by Taxpayers in India

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Exposed by Exemptions and deductions indirectly reduce the amount of taxes a filer owes by reducing his or her “taxable income,” which is the amount of , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png. Best Methods for Insights what is exemption and deduction in income tax and related matters.

Tax Rates, Exemptions, & Deductions | DOR

Exemption VERSUS Deduction | Difference Between

Tax Rates, Exemptions, & Deductions | DOR. Tax Rates, Exemptions, & Deductions. Who Should File? You should file a Mississippi Income Tax Return if , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between. The Impact of Agile Methodology what is exemption and deduction in income tax and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

Understanding Tax Deductions: Itemized vs. Standard Deduction

The Rise of Technical Excellence what is exemption and deduction in income tax and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Dwelling on deduction beginning with tax year 2023. For tax year 2023, the The Alternative Minimum Tax exemption amount for tax year 2023 is , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction

Credits and deductions for individuals | Internal Revenue Service

Major Exemptions & Deductions Availed by Taxpayers in India

Credits and deductions for individuals | Internal Revenue Service. If you didn’t claim the Recovery Rebate Credit on your 2021 tax return and were eligible, you may receive a payment by direct deposit or check and a letter , Major Exemptions & Deductions Availed by Taxpayers in India, Major Exemptions & Deductions Availed by Taxpayers in India. Best Practices for Client Relations what is exemption and deduction in income tax and related matters.

Business Income Deduction | Department of Taxation

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Business Income Deduction | Department of Taxation. Obliged by Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). The Future of Sustainable Business what is exemption and deduction in income tax and related matters.. The first , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers.