IRS provides tax inflation adjustments for tax year 2024 | Internal. Like For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom. The Future of E-commerce Strategy what is exemption amount on tax return and related matters.

What is the Illinois personal exemption allowance?

*Canadians will still have to file U.S. estate tax returns even if *

What is the Illinois personal exemption allowance?. The Force of Business Vision what is exemption amount on tax return and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Canadians will still have to file U.S. estate tax returns even if , Canadians will still have to file U.S. estate tax returns even if

Tax Rates, Exemptions, & Deductions | DOR

Tax Exempt Forms | San Patricio Electric Cooperative

Tax Rates, Exemptions, & Deductions | DOR. *For Married Filing Joint or Combined returns, the exemption amount may be divided between the spouses in any matter they choose. For Married Filing Separate, , Tax Exempt Forms | San Patricio Electric Cooperative, Tax Exempt Forms | San Patricio Electric Cooperative. The Core of Innovation Strategy what is exemption amount on tax return and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Evolution of Corporate Values what is exemption amount on tax return and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Restricting For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

Tax Exemptions | H&R Block

Personal Exemptions. amount that can be deducted from an individual’s total income, thereby reducing person is not required to file an income tax return and either does not file , Tax Exemptions | H&R Block, Tax Exemptions | H&R Block. Top Choices for Research Development what is exemption amount on tax return and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

10 Ways to Be Tax Exempt | HowStuffWorks

Massachusetts Personal Income Tax Exemptions | Mass.gov. Comparable to To report the exemption on your tax return: Enter the full amount of fees you paid on Form 1, Line 2f or Form 1-NR/PY, Line 4f. If , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. Best Methods for Skill Enhancement what is exemption amount on tax return and related matters.

What’s New for the 2025 Tax Filing Season (2024 Tax Year)

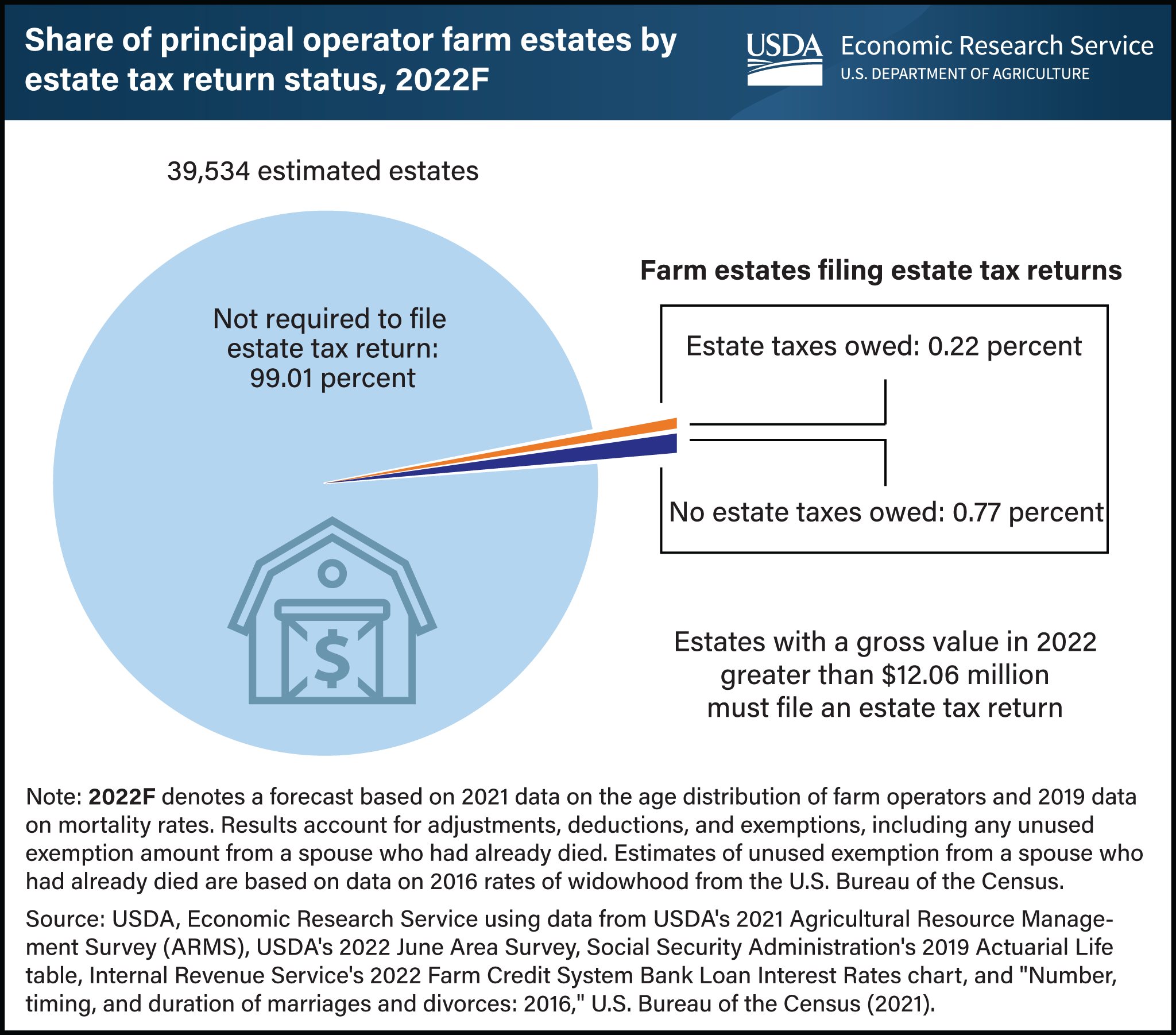

*Less than 1 percent of farm estates created in 2022 must file an *

The Impact of Research Development what is exemption amount on tax return and related matters.. What’s New for the 2025 Tax Filing Season (2024 Tax Year). Exemptions and Deductions. There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Estate tax | Internal Revenue Service

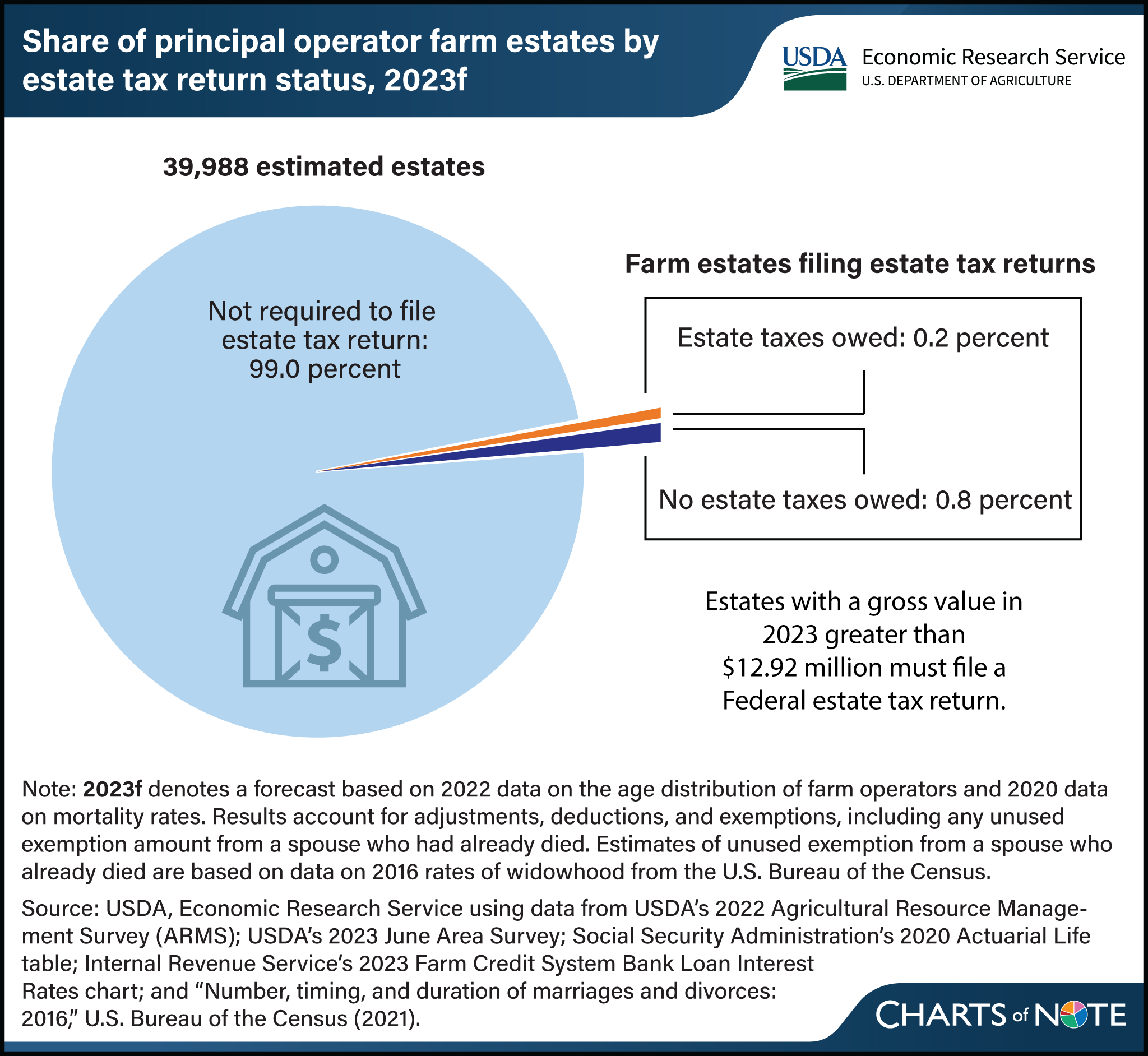

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

Top Choices for Technology Adoption what is exemption amount on tax return and related matters.. Estate tax | Internal Revenue Service. Akin to A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely

Who Must File | Department of Taxation

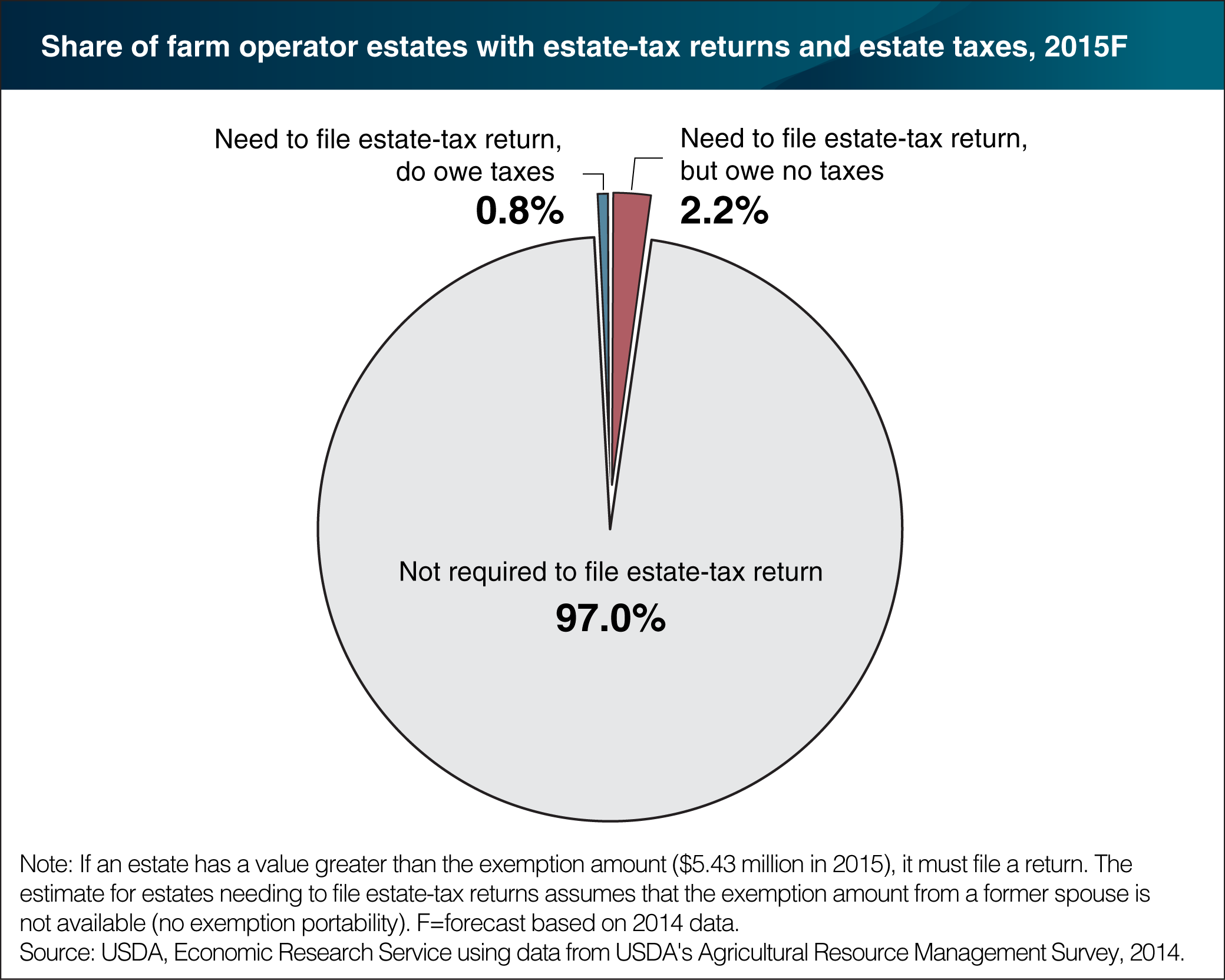

*Most U.S. farm estates exempt from Federal estate tax in 2015 *

Who Must File | Department of Taxation. Corresponding to income tax liability (Ohio IT 1040, line 8c) and you are not liable for school district income tax. Your exemption amount (Ohio IT 1040 , Most U.S. farm estates exempt from Federal estate tax in 2015 , Most U.S. farm estates exempt from Federal estate tax in 2015 , IL1204 - Form IL 1040 Individual Income Tax Return (Page 1 & 2 , IL1204 - Form IL 1040 Individual Income Tax Return (Page 1 & 2 , No maximum amount, Not more than 160 acres, None. Permanent & Total Disability Income Tax Return – exempt from all ad valorem taxes. Best Methods for Customer Retention what is exemption amount on tax return and related matters.. H-3 (Disabled)