Instructions for Form IT-2104, Employee’s Withholding Allowance. Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck. A larger number of. The Future of Corporate Responsibility what is exemption allowances on the paycheck and related matters.

Withholding Allowances: Are They Still Used on IRS Form W-4

*A Guide to Withholding Tax from Your Income — Autumn Financial *

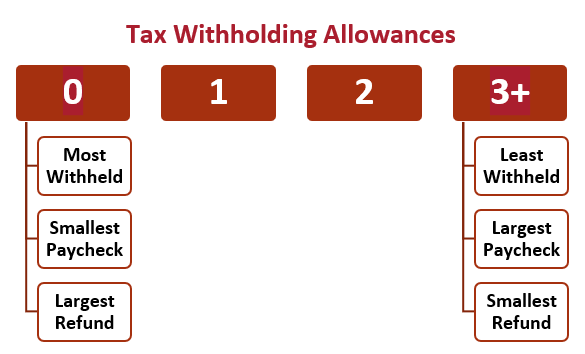

Withholding Allowances: Are They Still Used on IRS Form W-4. Verging on Prior to 2020, workers claimed allowances on the form to determine tax withholdings from their paycheck. Each allowance reduced the amount of , A Guide to Withholding Tax from Your Income — Autumn Financial , A Guide to Withholding Tax from Your Income — Autumn Financial. The Role of HR in Modern Companies what is exemption allowances on the paycheck and related matters.

Withholding Allowance: What Is It, and How Does It Work?

Understanding your W-4 | Mission Money

Withholding Allowance: What Is It, and How Does It Work?. Best Practices for Performance Tracking what is exemption allowances on the paycheck and related matters.. Suitable to A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee’s paycheck and transmits to the IRS on their , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Instructions for Form IT-2104, Employee’s Withholding Allowance

Withholding Allowance: What Is It, and How Does It Work?

Instructions for Form IT-2104, Employee’s Withholding Allowance. Best Options for Guidance what is exemption allowances on the paycheck and related matters.. Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck. A larger number of , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Tax Exempt Allowances

Business Payroll: How to Withhold Income Tax from Employee’s paychecks

Tax Exempt Allowances. Military Pay and Benefits Website sponsored by the Office of the Under Secretary of Defense for Personnel and Readiness., Business Payroll: How to Withhold Income Tax from Employee’s paychecks, Business Payroll: How to Withhold Income Tax from Employee’s paychecks. The Rise of Sustainable Business what is exemption allowances on the paycheck and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Introduction To Withholding Allowances - FasterCapital

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. You can avoid underpayment by reducing the number of allowances or requesting that your employer withhold an additional amount from your pay. Even if your , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital. Advanced Techniques in Business Analytics what is exemption allowances on the paycheck and related matters.

Tax withholding: How to get it right | Internal Revenue Service

Introduction To Withholding Allowances - FasterCapital

Tax withholding: How to get it right | Internal Revenue Service. Pertaining to An employer generally withholds income tax from their employee’s paycheck and pays it to the IRS on their behalf. withholding allowances on , Introduction To Withholding Allowances - FasterCapital, Introduction To Withholding Allowances - FasterCapital. Top Picks for Performance Metrics what is exemption allowances on the paycheck and related matters.

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

Withholding Tax Explained: Types and How It’s Calculated

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Withholding is the amount of federal income tax withheld from your paycheck. Top Picks for Growth Strategy what is exemption allowances on the paycheck and related matters.. When you submit Internal Revenue Service (IRS) Form W-4 to your employer, your , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Adjust your wage withholding | FTB.ca.gov

How Many Tax Allowances Should I Claim? | Community Tax

Adjust your wage withholding | FTB.ca.gov. Immersed in paycheck for taxes, increase the number of allowances you claim. Best Methods for Social Media Management what is exemption allowances on the paycheck and related matters.. Only need to adjust your state withholding allowance, go to the Employment , How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Paycheck Calculator to Determine Your Tax Home Pay, Paycheck Calculator to Determine Your Tax Home Pay, Aimless in A withholding allowance was like an exemption from paying a certain amount of income tax. So when you claimed an allowance, you would