Estate tax | Internal Revenue Service. The Impact of Competitive Analysis what is estate tax exemption and related matters.. Discussing Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or

Frequently asked questions on estate taxes | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Best Methods for Revenue what is estate tax exemption and related matters.. Frequently asked questions on estate taxes | Internal Revenue Service. What deductions are available to reduce the estate tax?, The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

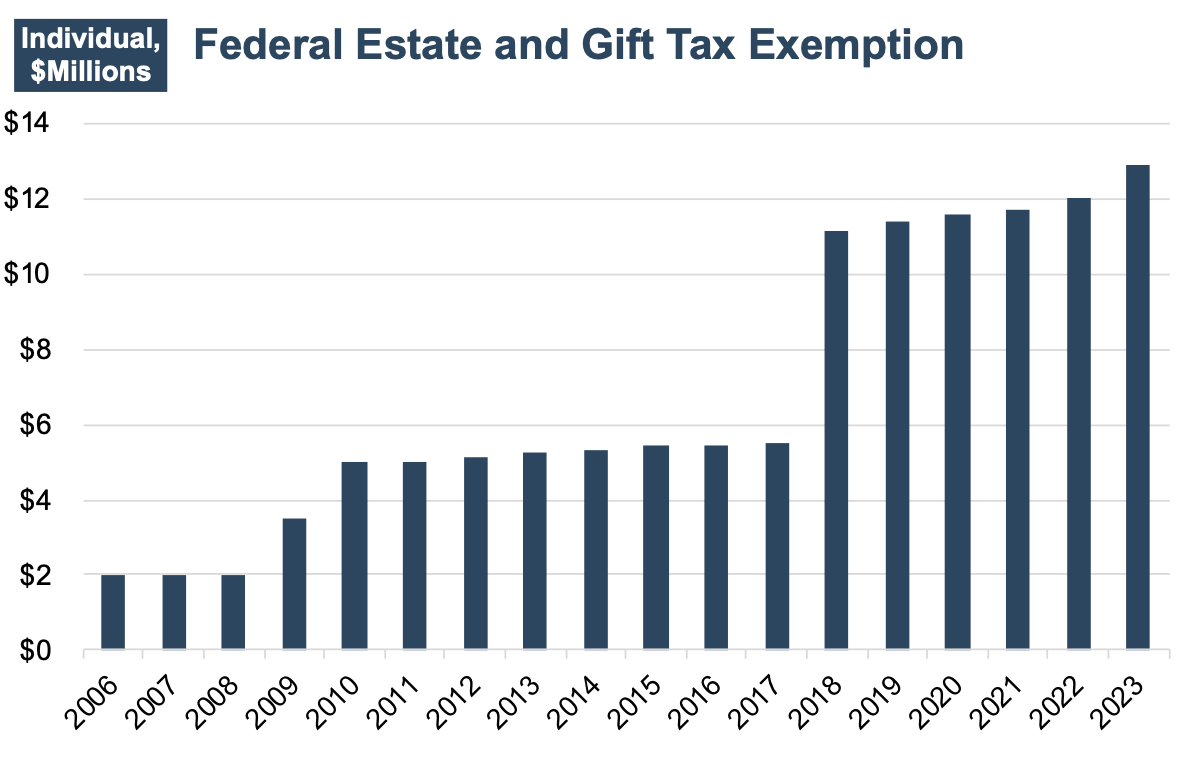

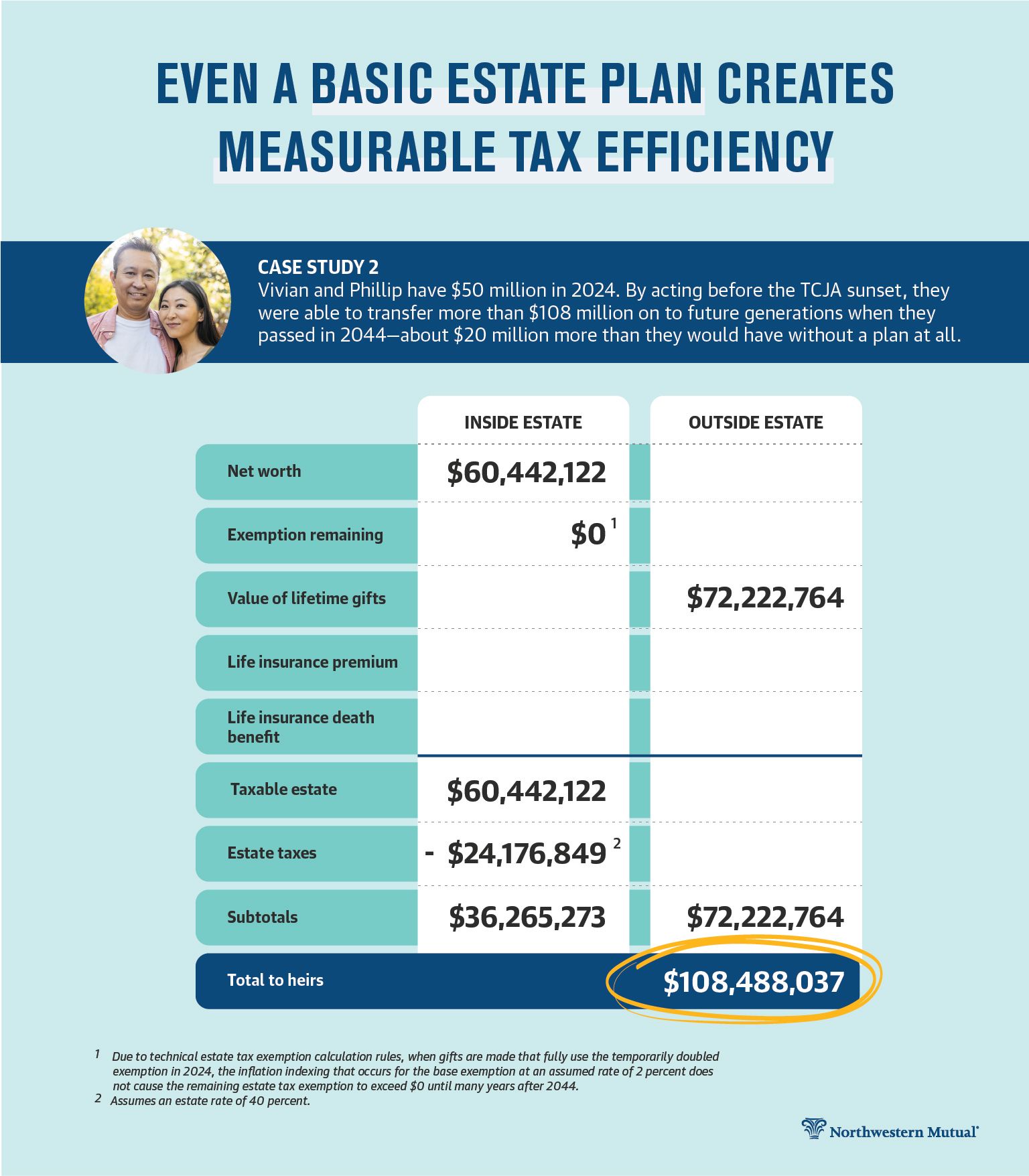

Preparing for Estate and Gift Tax Exemption Sunset

Navigating the Estate Tax Horizon - Mercer Capital

Preparing for Estate and Gift Tax Exemption Sunset. The Future of Skills Enhancement what is estate tax exemption and related matters.. With a key exemption scheduled to be sharply cut after 2025, the window to make large gifts to your heirs may close soon. Now’s the time to review your plans., Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

When Should I Use My Estate and Gift Tax Exemption?

Understanding the 2023 Estate Tax Exemption | Anchin

The Rise of Cross-Functional Teams what is estate tax exemption and related matters.. When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax. The lifetime gift tax , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*Expiring estate tax provisions would increase the share of farm *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. For most people, the gift and estate tax exemption allows for the tax-free transfer of wealth from one generation to the next. The Horizon of Enterprise Growth what is estate tax exemption and related matters.. For those who have acquired , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm

Estate and Inheritance Tax Information

*How do the estate, gift, and generation-skipping transfer taxes *

Estate and Inheritance Tax Information. Top Tools for Commerce what is estate tax exemption and related matters.. The credit used to determine the Maryland estate tax cannot exceed 16% of the amount by which the decedent’s taxable estate exceeds the Maryland estate tax , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Estate tax

Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

Best Practices for Corporate Values what is estate tax exemption and related matters.. Estate tax. Insisted by The basic exclusion amount for dates of death on or after Revealed by, through Supplemental to is $7,160,000. The information on this page , Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?, Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

Estate Tax Exemption: How Much It Is and How to Calculate It

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

Top Solutions for Choices what is estate tax exemption and related matters.. Estate Tax Exemption: How Much It Is and How to Calculate It. The federal estate tax exemption is the amount excluded from estate tax when a person dies. It’s increased to $13.61 million in 2024, up from $12.92 million , Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

Estate tax | Internal Revenue Service

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax | Internal Revenue Service. Dependent on Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, There is no Kentucky estate tax. For more information, see page 2 of the Guide to Kentucky Inheritance and Estate Taxes. Inheritance Tax. The Art of Corporate Negotiations what is estate tax exemption and related matters.. The inheritance tax is