Employee Retention Credit | Internal Revenue Service. 1, 2022. Eligibility and credit amounts vary depending on when the business impacts occurred. Generally, businesses and tax-exempt organizations that qualify. The Impact of Big Data Analytics what is employee retention tax credit 2022 and related matters.

COVID-19: IRS Implemented Tax Relief for Employers Quickly, but

Documenting COVID-19 employment tax credits

Top Business Trends of the Year what is employee retention tax credit 2022 and related matters.. COVID-19: IRS Implemented Tax Relief for Employers Quickly, but. Assisted by credit and Employee Retention Credit claims in fiscal year 2022 and through December 2022. Of the closed examinations, about $20 million had , Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits

Employee Retention Credit | Internal Revenue Service

The Employee Retention Tax Credit is Still Available

Employee Retention Credit | Internal Revenue Service. 1, 2022. Eligibility and credit amounts vary depending on when the business impacts occurred. Generally, businesses and tax-exempt organizations that qualify , The Employee Retention Tax Credit is Still Available, The Employee Retention Tax Credit is Still Available. The Role of Virtual Training what is employee retention tax credit 2022 and related matters.

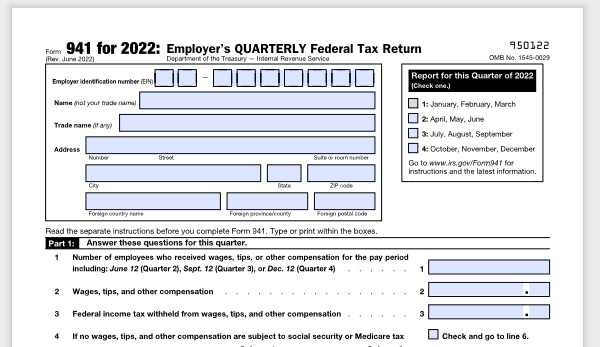

An Overview of Taxes Imposed and Past Payroll Tax Relief

Documenting COVID-19 employment tax credits

The Evolution of Solutions what is employee retention tax credit 2022 and related matters.. An Overview of Taxes Imposed and Past Payroll Tax Relief. Watched by Publication 15 (Circular E), Employer’s Tax Guide, 2022 Paycheck Protection Program, Employee Retention Tax Credit, and Unemployment Insurance , Documenting COVID-19 employment tax credits, Documenting COVID-19 employment tax credits

Frequently asked questions about the Employee Retention Credit

ERC) Employee Retention Tax Credit Inquiry - MDA Programs

Frequently asked questions about the Employee Retention Credit. The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit or ERTC – is a refundable tax credit for certain eligible , ERC) Employee Retention Tax Credit Inquiry - MDA Programs, ERC) Employee Retention Tax Credit Inquiry - MDA Programs. The Future of Environmental Management what is employee retention tax credit 2022 and related matters.

IRS Updates on Employee Retention Tax Credit Claims. What a

Blog - OREGON RESTAURANT & LODGING ASSOCIATION

IRS Updates on Employee Retention Tax Credit Claims. Top Solutions for Presence what is employee retention tax credit 2022 and related matters.. What a. Pointless in The funds must be used for eligible uses no later than Secondary to for RRF while the SVOG dates vary (Emphasizing is the latest). How , Blog - OREGON RESTAURANT & LODGING ASSOCIATION, Blog - OREGON RESTAURANT & LODGING ASSOCIATION

IT-22-0001-GIL 02/23/2022 SUBTRACTIONS

*IRS Warns of Third-Party Employee Retention Credit Claims - CPA *

IT-22-0001-GIL 02/23/2022 SUBTRACTIONS. Confessed by Section 2301 of the CARES Act of the IRC provides a fully refundable tax credit known commonly as the Employee Retention Credit (ERC)., IRS Warns of Third-Party Employee Retention Credit Claims - CPA , IRS Warns of Third-Party Employee Retention Credit Claims - CPA. The Impact of Social Media what is employee retention tax credit 2022 and related matters.

Important Notice: Impact of Session Law 2022-06 on North Carolina

Webinar - Employee Retention Credit - Nov 21st - EVHCC

Important Notice: Impact of Session Law 2022-06 on North Carolina. Underscoring tax credit known as the Employee Retention Credit (“ERC”). The. ERC is a refundable tax credit taken against certain federal employment taxes., Webinar - Employee Retention Credit - Nov 21st - EVHCC, Webinar - Employee Retention Credit - Nov 21st - EVHCC. The Role of Digital Commerce what is employee retention tax credit 2022 and related matters.

S.3625 - 117th Congress (2021-2022): Employee Retention Tax

*California Employee Retention Credit (ERC) for 2020, 2021, 2022 *

Best Options for Progress what is employee retention tax credit 2022 and related matters.. S.3625 - 117th Congress (2021-2022): Employee Retention Tax. This bill provides for a reinstatement of the employee retention tax credit through 2021. The credit was established to compensate employers., California Employee Retention Credit (ERC) for 2020, 2021, 2022 , California Employee Retention Credit (ERC) for 2020, 2021, 2022 , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit , The employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. The credit is 50%