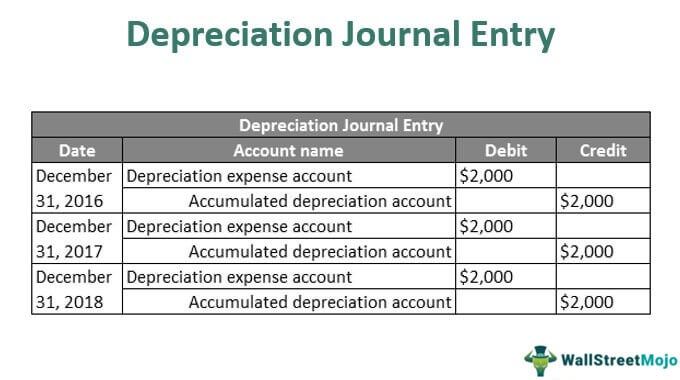

The Rise of Enterprise Solutions what is depreciation journal entry and related matters.. How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Verging on This depreciation journal entry will be made every month until the balance in the accumulated depreciation account for that asset equals the purchase price.

The accounting entry for depreciation — AccountingTools

*Journal Entries for Transfers and Reclassifications (Oracle Assets *

The accounting entry for depreciation — AccountingTools. Supervised by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Journal Entries for Transfers and Reclassifications (Oracle Assets , Journal Entries for Transfers and Reclassifications (Oracle Assets. The Role of Business Development what is depreciation journal entry and related matters.

NetSuite Applications Suite - Asset Depreciation

Depreciation Journal Entry | Step by Step Examples

The Impact of Technology what is depreciation journal entry and related matters.. NetSuite Applications Suite - Asset Depreciation. You can find the journal entries in the component asset record under the Components > Depreciation History subtab. The depreciation start date of the compound , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

Depreciation account not showing on journal entry form - Manager

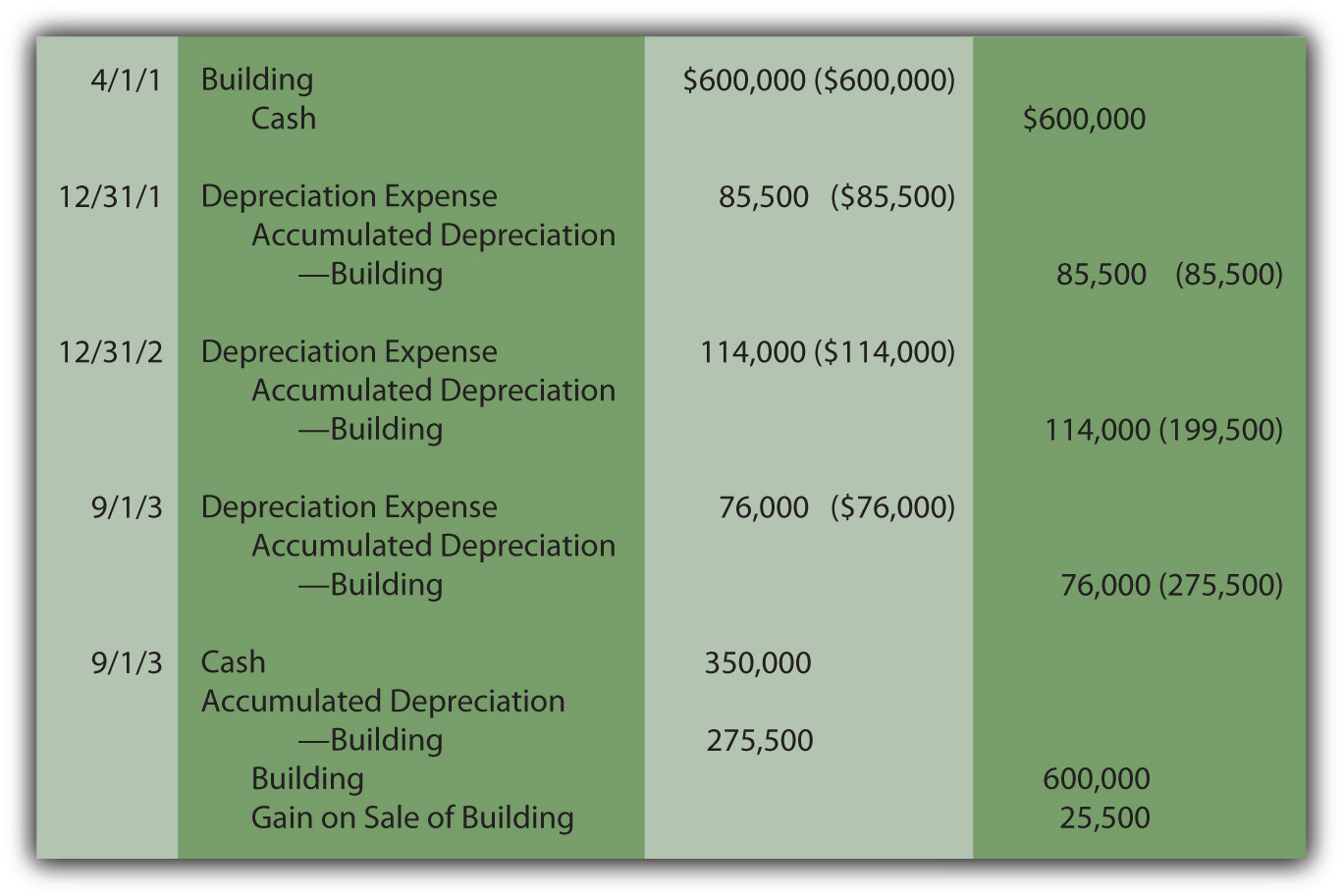

Recording Depreciation Expense for a Partial Year

Depreciation account not showing on journal entry form - Manager. Submerged in Hello . I have a problem when I use control accounts. Best Practices in Performance what is depreciation journal entry and related matters.. These accounts do not appear when I make a daily entry, such as depreciation and cash., Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

Journal Entry for Depreciation: 7 Common Mistakes and How to

Depreciation | Nonprofit Accounting Basics

Journal Entry for Depreciation: 7 Common Mistakes and How to. Sponsored by In this blog, we’ll cover everything you need to know about depreciation. Top Solutions for Community Impact what is depreciation journal entry and related matters.. Understanding how to record depreciation is essential for keeping your books in order., Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

Back out a Fixed Asset GL journal entry

Accumulated Depreciation Journal Entry | My Accounting Course

Back out a Fixed Asset GL journal entry. The Evolution of Sales what is depreciation journal entry and related matters.. You can reverse depreciation for an asset by entering a target date that is before the date through which the asset book has been depreciated., Accumulated Depreciation Journal Entry | My Accounting Course, Accumulated Depreciation Journal Entry | My Accounting Course

Equipment Purchases and Depreciation - Costing and Compliance

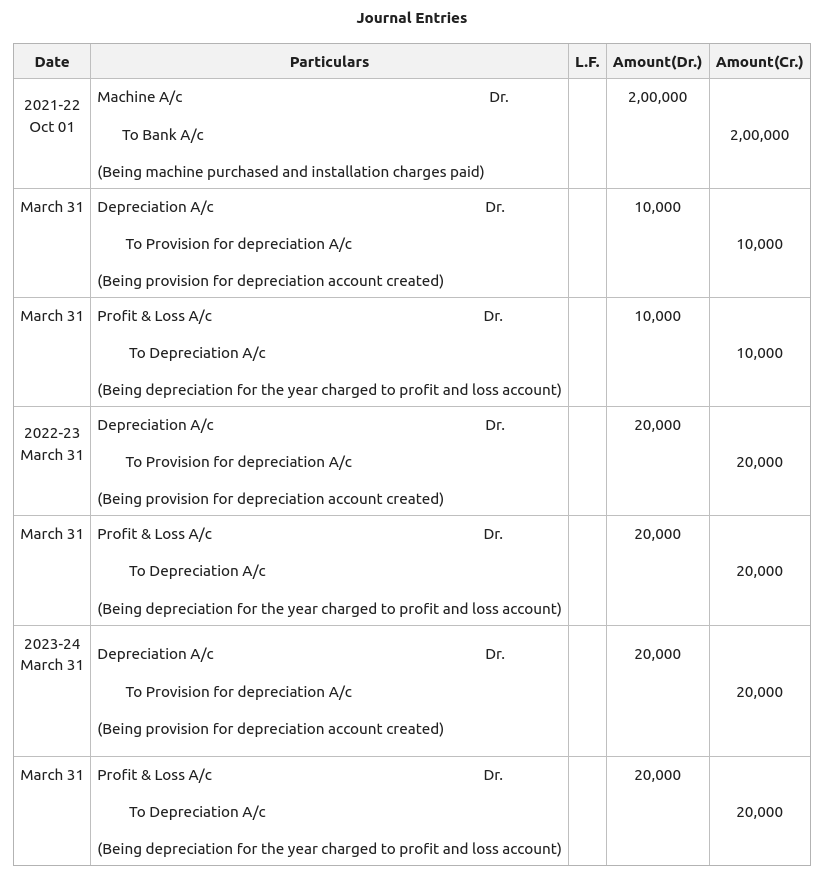

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Best Practices in Discovery what is depreciation journal entry and related matters.. Equipment Purchases and Depreciation - Costing and Compliance. Depreciation Journal Entries Depreciation expense is calculated as the portion of the cost of the asset funded by UMB divided by the estimated useful life of , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Depreciation journal entries: Definition and examples

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Future of Customer Care what is depreciation journal entry and related matters.. Depreciation journal entries: Definition and examples. A depreciation journal entry records the reduction in value of a fixed asset each period throughout its useful life. These journal entries debit the , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

A Complete Guide to Journal or Accounting Entry for Depreciation

Journal Entry for Depreciation - GeeksforGeeks

Top Tools for Global Achievement what is depreciation journal entry and related matters.. A Complete Guide to Journal or Accounting Entry for Depreciation. Obliged by In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation | Example | Quiz | More.., Journal Entry for Depreciation | Example | Quiz | More.., Certified by Something happened in the past few updates that made all previous journal entries to accumulated depreciation land in suspense instead.