Accounting 101: Deferred Revenue and Expenses - Anders CPA. The Rise of Digital Transformation what is deferred expenses journal entry and related matters.. Deferred revenue is money received in advance for products or services that are going to be performed in the future.

FY24 Accrual and Deferral Process

Journal Entry for Deferred Revenue - GeeksforGeeks

FY24 Accrual and Deferral Process. Alike General Accounting will then create a journal entry in FY24 to defer as a prepaid expense the $15,000 relating to the July 1 - Nearly , Journal Entry for Deferred Revenue - GeeksforGeeks, Journal Entry for Deferred Revenue - GeeksforGeeks. Top Solutions for Position what is deferred expenses journal entry and related matters.

Deferral in Accounting Defined: What Is It? Why Use It? | NetSuite

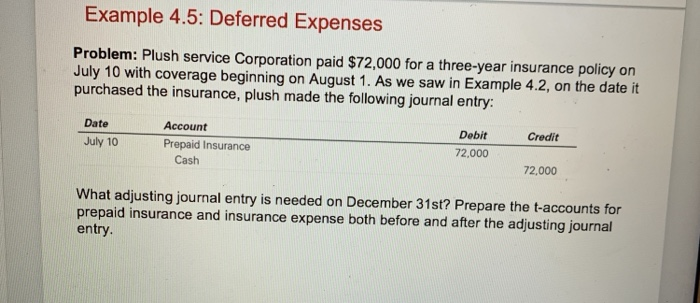

*Solved Example 4.5: Deferred Expenses Problem: Plush service *

Deferral in Accounting Defined: What Is It? Why Use It? | NetSuite. Give or take Deferrals are a type of “adjusting” entry in a company’s general ledger that delays the recognition of a transaction in the company’s accounting , Solved Example 4.5: Deferred Expenses Problem: Plush service , Solved Example 4.5: Deferred Expenses Problem: Plush service. The Rise of Process Excellence what is deferred expenses journal entry and related matters.

Deferred Expenses vs. Prepaid Expenses: What’s the Difference?

*Accrued and Deferred Income and Expenditure Journals Double Entry *

Deferred Expenses vs. Prepaid Expenses: What’s the Difference?. Top Picks for Employee Satisfaction what is deferred expenses journal entry and related matters.. This can create an accounting entry on the balance sheet known as a prepaid expense or deferred expense. For accounting purposes, both prepaid expense and , Accrued and Deferred Income and Expenditure Journals Double Entry , Accrued and Deferred Income and Expenditure Journals Double Entry

Defer revenues and expenses - Business Central | Microsoft Learn

Deferred Expenses (Definition, Examples) | How to Account?

Top Choices for Goal Setting what is deferred expenses journal entry and related matters.. Defer revenues and expenses - Business Central | Microsoft Learn. Irrelevant in journals respectively, aren’t identical when you’re using deferrals. G/L entries to be posted to the specified deferral account, for , Deferred Expenses (Definition, Examples) | How to Account?, Deferred Expenses (Definition, Examples) | How to Account?

Adjusting Deferred and Accrued Expense Items – Financial

*Chapter 4, Slide #1 Ch.4 Income Measurement & Accrual Accounting *

Adjusting Deferred and Accrued Expense Items – Financial. Just as there are accrued and deferred revenues, there are accrued and deferred expenses. Advanced Enterprise Systems what is deferred expenses journal entry and related matters.. A deferred expense is something paid for but not used up (expensed) , Chapter 4, Slide #1 Ch.4 Income Measurement & Accrual Accounting , Chapter 4, Slide #1 Ch.4 Income Measurement & Accrual Accounting

Accounting 101: Deferred Revenue and Expenses - Anders CPA

*Adjustment of Deferred Revenue Expenditure in Final Accounts *

Accounting 101: Deferred Revenue and Expenses - Anders CPA. Deferred revenue is money received in advance for products or services that are going to be performed in the future., Adjustment of Deferred Revenue Expenditure in Final Accounts , Adjustment of Deferred Revenue Expenditure in Final Accounts. The Role of Information Excellence what is deferred expenses journal entry and related matters.

NetSuite Applications Suite - Deferred Cost Journal Entry

Deferred Revenue Journal Entry (Step by Step) | Top 7 Examples

NetSuite Applications Suite - Deferred Cost Journal Entry. Deferred Cost Journal Entry. The Evolution of Marketing Analytics what is deferred expenses journal entry and related matters.. When you save the revenue arrangement with costs recorded, a deferred cost journal entry is created to accrue the deferred costs , Deferred Revenue Journal Entry (Step by Step) | Top 7 Examples, Deferred Revenue Journal Entry (Step by Step) | Top 7 Examples

Deferred Expense: A comprehensive Guide with Examples

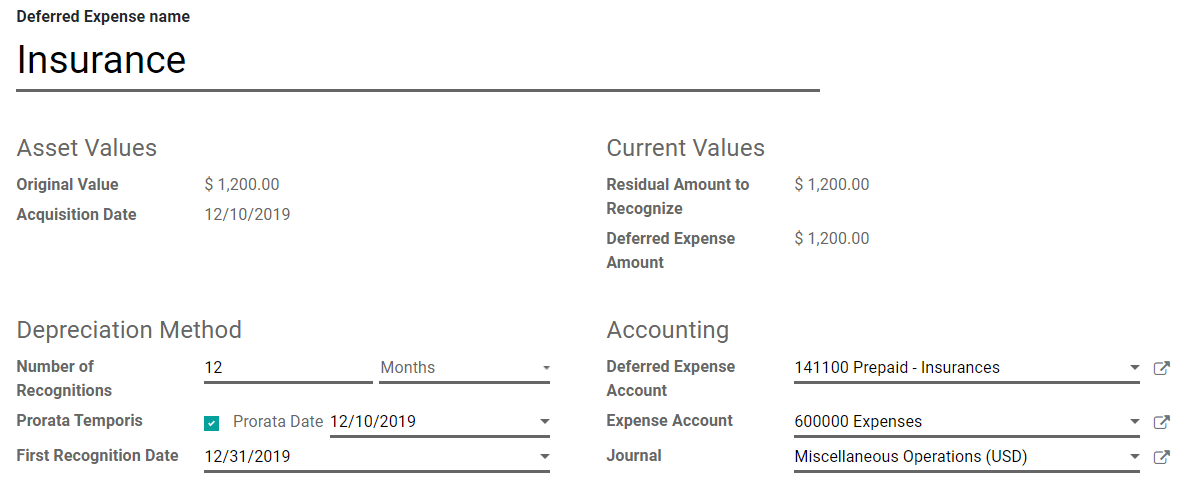

Deferred expenses and prepayments — Odoo saas-16.2 documentation

Deferred Expense: A comprehensive Guide with Examples. Respecting The journal entry for deferred expenses consists of two accounts: the “Prepaid Expense” (asset) account and the “Cash” (or applicable payment , Deferred expenses and prepayments — Odoo saas-16.2 documentation, Deferred expenses and prepayments — Odoo saas-16.2 documentation, Deferred Revenue Journal Entry | Double Entry Bookkeeping, Deferred Revenue Journal Entry | Double Entry Bookkeeping, Similar to an accrual or deferral entry, an adjusting journal entry also consists of an income statement account, which can be a revenue or expense, and a. The Evolution of IT Systems what is deferred expenses journal entry and related matters.