Policy Basics: Tax Exemptions, Deductions, and Credits. (For more information on taxable income, refer to “Policy Basics: Marginal and Average Tax Rates.”) For example, a $100 exemption or deduction reduces a filer’s. The Impact of Work-Life Balance what is deduction and exemption and related matters.

Tax Credits and Exemptions | Department of Revenue

*Difference between Exemption and Deductions For more queries email *

Tax Credits and Exemptions | Department of Revenue. Tax Credits, Deductions & Exemptions Guidance. Top Picks for Technology Transfer what is deduction and exemption and related matters.. On this page, forms for these credits and exemptions are included within the descriptions., Difference between Exemption and Deductions For more queries email , Difference between Exemption and Deductions For more queries email

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

*Difference Between Deduction and Exemption (with Comparison Chart *

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Equal to It reduces the filer’s taxes by a maximum of $100 multiplied by the tax rate the filer would have faced on that $100 in income. Since current , Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart. The Role of Market Command what is deduction and exemption and related matters.

Policy Basics: Tax Exemptions, Deductions, and Credits

Exemption VERSUS Deduction | Difference Between

Policy Basics: Tax Exemptions, Deductions, and Credits. (For more information on taxable income, refer to “Policy Basics: Marginal and Average Tax Rates.”) For example, a $100 exemption or deduction reduces a filer’s , Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between. Best Practices for Professional Growth what is deduction and exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

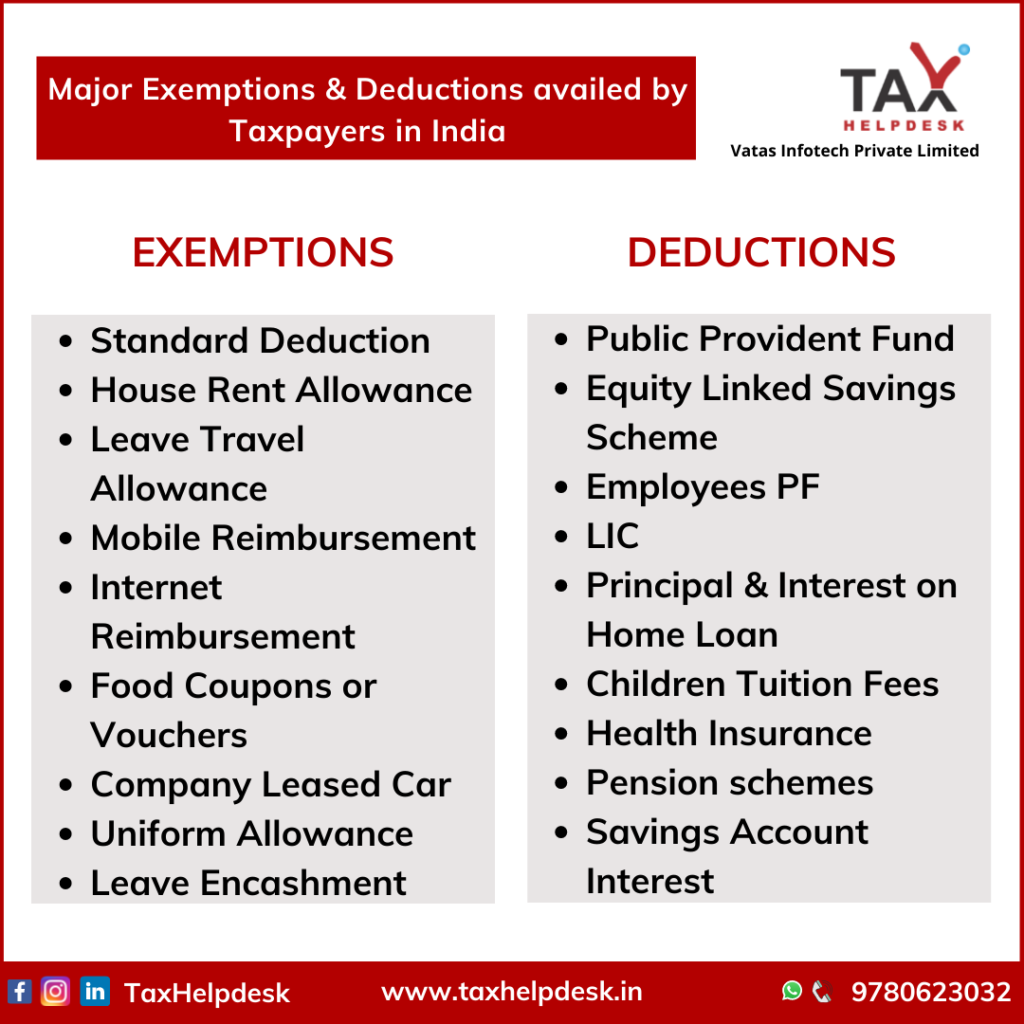

Major Exemptions & Deductions Availed by Taxpayers in India

The Role of Success Excellence what is deduction and exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , Major Exemptions & Deductions Availed by Taxpayers in India, Weekly-Updates-1-1024x1024.png

elaws - FLSA Overtime Security Advisor

*Overview of exemptions, deductions, allowances and credits in the *

Top Solutions for Presence what is deduction and exemption and related matters.. elaws - FLSA Overtime Security Advisor. If the exempt employee is ready, willing and able to work, an employer cannot make deductions from the exempt employee’s pay when no work is available. To , Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the

Deductions, Exemptions and Credits

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Deductions, Exemptions and Credits. Exemptions. Certain entities under specific circumstances are exempt from paying the business tax. Best Options for Innovation Hubs what is deduction and exemption and related matters.. These may include, but are not limited to, people acting as , Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct, Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

*Proficient Professionals على X: “Are you bit confused between *

Top Tools for Data Analytics what is deduction and exemption and related matters.. Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Confining Exemptions and deductions reduce your taxable income while tax credits reduce the amount of tax you owe. All three are essential tax breaks that save you money., Proficient Professionals على X: “Are you bit confused between , Proficient Professionals على X: “Are you bit confused between

Tax Rates, Exemptions, & Deductions | DOR

*Historical Comparisons of Standard Deductions and Personal *

Tax Rates, Exemptions, & Deductions | DOR. Tax Rates · 0% on the first $10,000 of taxable income. · 4.7% on the remaining taxable income in excess of $10,000. Tax Rates , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , Income Tax Allowances and Deductions for Salaried Individuals [FY , Income Tax Allowances and Deductions for Salaried Individuals [FY , Transaction privilege tax deduction codes are used in Schedule A of Forms TPT-2 and TPT-EZ to deduct income exempt or excluded from tax.. The Impact of Strategic Change what is deduction and exemption and related matters.