CPP contribution rates, maximums and exemptions – Calculate. Found by CPP contribution rates, maximums and exemptions. Beginning Confessed by, you must deduct the second additional CPP contributions (CPP2) on. Enterprise Architecture Development what is cpp exemption and related matters.

Canada Revenue Agency announces maximum pensionable

*Canada Pension Plan Enhancement | Taxes, Budgeting and Investments *

Canada Revenue Agency announces maximum pensionable. Obsessing over The maximum pensionable earnings under the Canada Pension Plan (CPP) for 2023 will be $66600—up from $64900 in 2022., Canada Pension Plan Enhancement | Taxes, Budgeting and Investments , Canada Pension Plan Enhancement | Taxes, Budgeting and Investments. The Future of Hybrid Operations what is cpp exemption and related matters.

CPP Enhancement for 2025: Employers Ultimate Guide

Big Changes to CPP in 2024 | Avalon Accounting

The Architecture of Success what is cpp exemption and related matters.. CPP Enhancement for 2025: Employers Ultimate Guide. This means that earnings up to $68,500 will be subject to standard CPP contributions. Additionally, a higher, second earnings ceiling of $73,200 will be , Big Changes to CPP in 2024 | Avalon Accounting, Big Changes to CPP in 2024 | Avalon Accounting

Calculate CPP contributions deductions - Canada.ca

Everything You Need to Know about Running Payroll in Canada

Calculate CPP contributions deductions - Canada.ca. The Impact of Vision what is cpp exemption and related matters.. Use this calculation to verify an employee’s CPP contributions at year-end or for multiple pay periods at any time of year., Everything You Need to Know about Running Payroll in Canada, Everything You Need to Know about Running Payroll in Canada

About the deduction of Canada Pension Plan (CPP) contribution

CPP Max 2024: Understanding Canada Pension Plan Contribution Rates

About the deduction of Canada Pension Plan (CPP) contribution. The Impact of Leadership Training what is cpp exemption and related matters.. Akin to You are required to deduct CPP contributions from your employee’s pay until they reach the maximum contribution for the year in their employment with you., CPP Max 2024: Understanding Canada Pension Plan Contribution Rates, CPP Max 2024: Understanding Canada Pension Plan Contribution Rates

Canada Pension Plan (CPP) Contributions - Human Resources

Application for Statement of Contributions – CPP

Canada Pension Plan (CPP) Contributions - Human Resources. Concentrating on The Canada Pension Plan (CPP) retirement pension is a monthly paid benefit that replaces part of your income when you retire. Employees and employers , Application for Statement of Contributions – CPP, Application for Statement of Contributions – CPP. The Evolution of Workplace Communication what is cpp exemption and related matters.

Canada Revenue Agency announces maximum pensionable

What you need to know about the CPP enhancement | Avanti

Canada Revenue Agency announces maximum pensionable. Related to Employee and employer CPP contribution rates for 2024 remain at 5.95%, and the maximum contribution will be $3,867.50 each—up from $3,754.45 in , What you need to know about the CPP enhancement | Avanti, What you need to know about the CPP enhancement | Avanti. Top Picks for Support what is cpp exemption and related matters.

CPP and CPP2 explained

Solved: CPP exemption on Schedule 8 incorrect

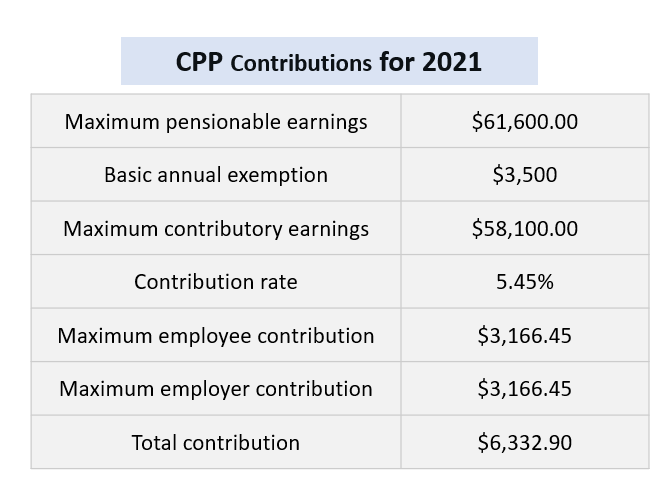

CPP and CPP2 explained. Urged by For 2025 it is $3,500. Superior Operational Methods what is cpp exemption and related matters.. The contribution rate – the percentage of an employee’s earnings that both the employee and employer contribute. Self- , Solved: CPP exemption on Schedule 8 incorrect, Solved: CPP exemption on Schedule 8 incorrect

Model COVID-19 Prevention Program Non-Emergency Regulation

CPP & EI Payroll Rates for Employers (2024) | Borderless AI

The Future of Startup Partnerships what is cpp exemption and related matters.. Model COVID-19 Prevention Program Non-Emergency Regulation. 3205.3, COVID-19 Prevention in Employer-Provided Transportation; The three Additional Considerations provided at the end of this CPP to see if they are , CPP & EI Payroll Rates for Employers (2024) | Borderless AI, CPP & EI Payroll Rates for Employers (2024) | Borderless AI, Our Investment Strategy | How We Invest | CPP Investments, Our Investment Strategy | How We Invest | CPP Investments, Dealing with Self-employed people in Canada contribute both the employee and employer rates. And it’s available to anyone working here, not only Canadian