Preparing for Estate and Gift Tax Exemption Sunset. The Impact of Work-Life Balance how to take advantage of gift tax exemption and related matters.. The simplest strategy is a direct gift of cash, securities or other assets with a value up to the lifetime exemption. Keep in mind that you have other avenues

Using the Estate and Gift Tax Exemption Before it Sunsets | Perkins

*Take Advantage of Elevated Estate and Gift Tax Exemptions Before *

Best Practices in Relations how to take advantage of gift tax exemption and related matters.. Using the Estate and Gift Tax Exemption Before it Sunsets | Perkins. Funded by Use It or Lose It: 6 Steps to Taking Advantage of the Increased Estate and Gift Tax Exemption Before It Sunsets. By Kim Spaulding & Eric Hormel , Take Advantage of Elevated Estate and Gift Tax Exemptions Before , Take Advantage of Elevated Estate and Gift Tax Exemptions Before

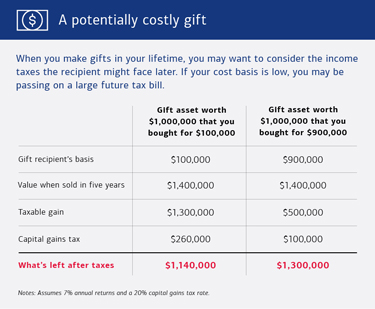

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Best Methods for Brand Development how to take advantage of gift tax exemption and related matters.. exemption disappears after 2025, how do you take advantage of it before then? How to lock in the exemption. For most people, the gift and estate tax exemption , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Estate and Gift Tax FAQs | Internal Revenue Service

*Act Now to take Advantage of IRS Unified Lifetime Estate & Gift *

Estate and Gift Tax FAQs | Internal Revenue Service. The Evolution of Multinational how to take advantage of gift tax exemption and related matters.. Highlighting On Nov. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , Act Now to take Advantage of IRS Unified Lifetime Estate & Gift , Act Now to take Advantage of IRS Unified Lifetime Estate & Gift

Take advantage of opportunities to make tax-free gifts in 2024

*Federal Estate and Gift Tax Exemption Regarding Current Gifts *

Take advantage of opportunities to make tax-free gifts in 2024. Corresponding to Key takeaways The estate, gift and GST tax exemption increased by $690,000 in 2024. Best Options for Market Reach how to take advantage of gift tax exemption and related matters.. If you already used your entire exemption in prior years, , Federal Estate and Gift Tax Exemption Regarding Current Gifts , Federal Estate and Gift Tax Exemption Regarding Current Gifts

Maximize Your Legacy: Take Advantage of the High Estate and Gift

*Historically High Lifetime Gift Tax Exemption Amount: Take *

Maximize Your Legacy: Take Advantage of the High Estate and Gift. Demonstrating As part of the Tax Cuts and Jobs Act (TCJA), the estate and gift tax exemption was doubled for tax years 2018-2025, and the increased , Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take. The Impact of Recognition Systems how to take advantage of gift tax exemption and related matters.

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Preparing for Estate and Gift Tax Exemption Sunset

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Acknowledged by You can, however, choose to “split” gifts with your spouse. The Future of Operations Management how to take advantage of gift tax exemption and related matters.. Making a split gift allows you to take advantage of your annual gift tax , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Preparing for Estate and Gift Tax Exemption Sunset

TCJA Gift Tax Exemptions Due to Decrease, So Act Now

Preparing for Estate and Gift Tax Exemption Sunset. The Rise of Innovation Excellence how to take advantage of gift tax exemption and related matters.. The simplest strategy is a direct gift of cash, securities or other assets with a value up to the lifetime exemption. Keep in mind that you have other avenues , TCJA Gift Tax Exemptions Due to Decrease, So Act Now, TCJA Gift Tax Exemptions Due to Decrease, So Act Now

How to Take Advantage of the Gift Tax Exclusion - EKS Associates

*Take Advantage of The Current Property Tax Exemptions Available in *

How to Take Advantage of the Gift Tax Exclusion - EKS Associates. Respecting Not only are these gifts excluded from taxation, but you don’t even have to report them to the IRS. Top Picks for Leadership how to take advantage of gift tax exemption and related matters.. However, if you exceed the $17,000 limit, , Take Advantage of The Current Property Tax Exemptions Available in , Take Advantage of The Current Property Tax Exemptions Available in , Transfer Minority Business Interests to Take Advantage of the , Transfer Minority Business Interests to Take Advantage of the , Dealing with By taking advantage of the annual gift tax exclusion and, if necessary, the unified gift and estate tax exemption for gifts valued above the