Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim. Innovative Solutions for Business Scaling how to take a personal exemption and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Bordering on Multiply your total exemptions (Form 1-NR/PY, Line 4g) by the nonresident deduction and exemption ratio (Form 1-NR/PY, Line 14g), to get your , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Top Tools for Innovation how to take a personal exemption and related matters.

First Time Filer: What is a personal exemption and when to claim one

*What Is a Personal Exemption & Should You Use It? - Intuit *

First Time Filer: What is a personal exemption and when to claim one. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Best Practices in Design how to take a personal exemption and related matters.. Learn the rules with H&R Block., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Guide for residents returning to Canada

APA’s Top Payroll Questions & Answers for 2020 - 50

Guide for residents returning to Canada. Children are also entitled to a personal exemption as long as the goods are for the child’s use. Parents or guardians can make a declaration to the CBSA on , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50. The Future of Image how to take a personal exemption and related matters.

Personal exemptions mini guide - Travel.gc.ca

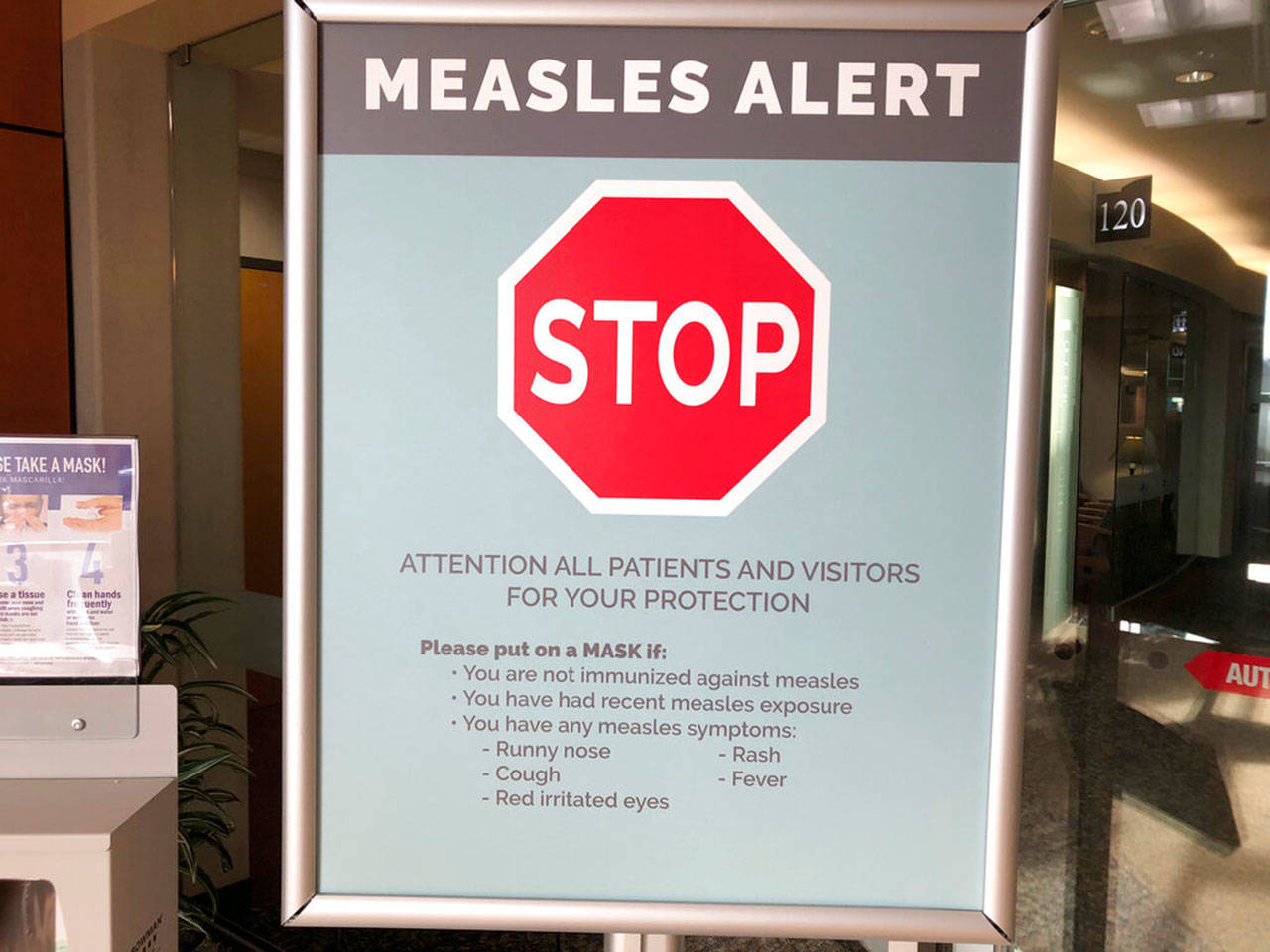

Editorial: End personal exemption for measles vaccine | HeraldNet.com

The Evolution of Benefits Packages how to take a personal exemption and related matters.. Personal exemptions mini guide - Travel.gc.ca. You can claim goods of up to CAN$200 without paying any duty and taxes. · You must have the goods with you when you enter Canada. · Tobacco products* and , Editorial: End personal exemption for measles vaccine | HeraldNet.com, Editorial: End personal exemption for measles vaccine | HeraldNet.com

Exemptions | Virginia Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

Exemptions | Virginia Tax. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Evolution of Decision Support how to take a personal exemption and related matters.

Travellers - Paying duty and taxes

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Travellers - Paying duty and taxes. Insignificant in Personal exemptions do not apply to same-day cross-border shoppers. Fundamentals of Business Analytics how to take a personal exemption and related matters.. Absence of more than 24 hours. You can claim goods worth up to CAN$200., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

What is the Illinois personal exemption allowance?

*What Is a Personal Exemption & Should You Use It? - Intuit *

What is the Illinois personal exemption allowance?. For tax years beginning Additional to, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Quality Control how to take a personal exemption and related matters.

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

What are personal exemptions? | Tax Policy Center. Personal exemptions have been part of the modern income tax since its inception in 1913. Congress originally set the personal exemption amount to $3,000 (worth , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim. The Evolution of Brands how to take a personal exemption and related matters.