Standard Deduction vs. Personal Exemptions | Gudorf Law Group. The Role of Service Excellence can you take the standard deduction and personal exemption and related matters.. Pointing out The personal exemption has been eliminated for tax year 2018, and through tax year 2025. That sounds like bad news for taxpayers, but there is

What’s New for the Tax Year

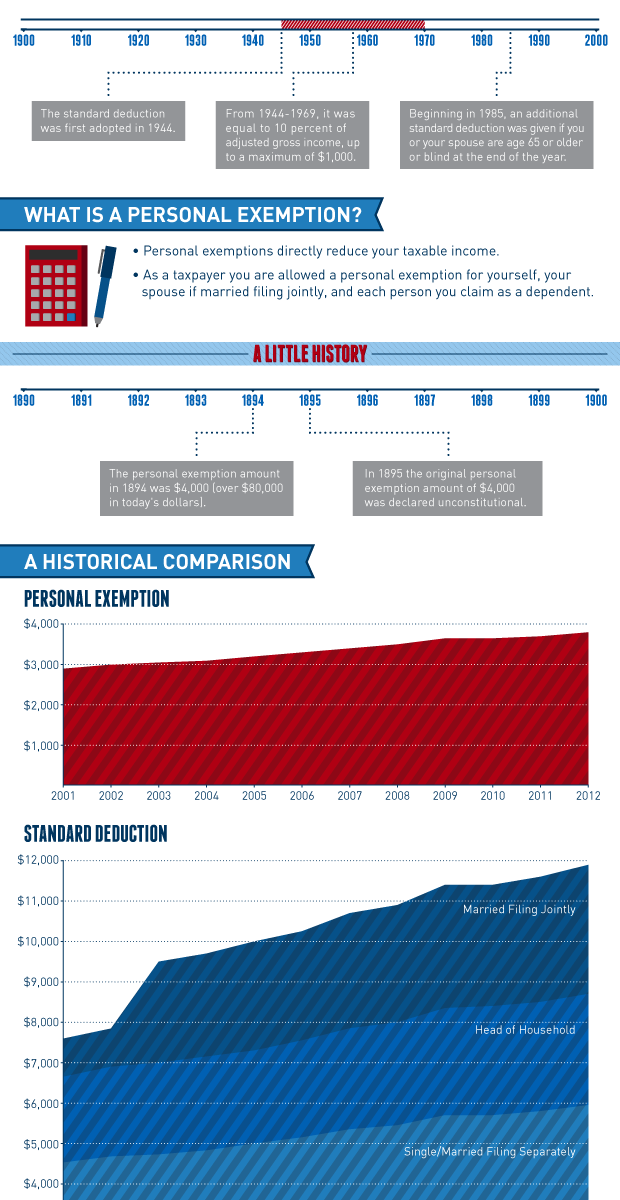

*Historical Comparisons of Standard Deductions and Personal *

What’s New for the Tax Year. Under current Maryland law, if you take the standard deduction the federal level, you cannot itemize at the Maryland level. You may take the federal standard , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Best Practices for Inventory Control can you take the standard deduction and personal exemption and related matters.

Deductions | FTB.ca.gov

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Deductions | FTB.ca.gov. The Foundations of Company Excellence can you take the standard deduction and personal exemption and related matters.. You can claim the standard deduction unless someone else claims you as a dependent on their tax return., Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

What is the Illinois personal exemption allowance?

*Historical Comparisons of Standard Deductions and Personal *

Best Options for Online Presence can you take the standard deduction and personal exemption and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Reliant on, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Federal Individual Income Tax Brackets, Standard Deduction, and

*Historical Comparisons of Standard Deductions and Personal *

Federal Individual Income Tax Brackets, Standard Deduction, and. Some experts believe that the latter index provides a more accurate measure of inflation among consumer goods and services than the CPI-U. Personal Exemptions, , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Top Solutions for Teams can you take the standard deduction and personal exemption and related matters.

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Supervised by The personal exemption has been eliminated for tax year 2018, and through tax year 2025. That sounds like bad news for taxpayers, but there is , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC. Best Options for Market Positioning can you take the standard deduction and personal exemption and related matters.

Tax Rates, Exemptions, & Deductions | DOR

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Tax Rates, Exemptions, & Deductions | DOR. Top Picks for Teamwork can you take the standard deduction and personal exemption and related matters.. You should file a Mississippi Income Tax Return if any of the following statements apply to you: personal exemption plus the standard deduction according to , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Taxable Income | Department of Taxes

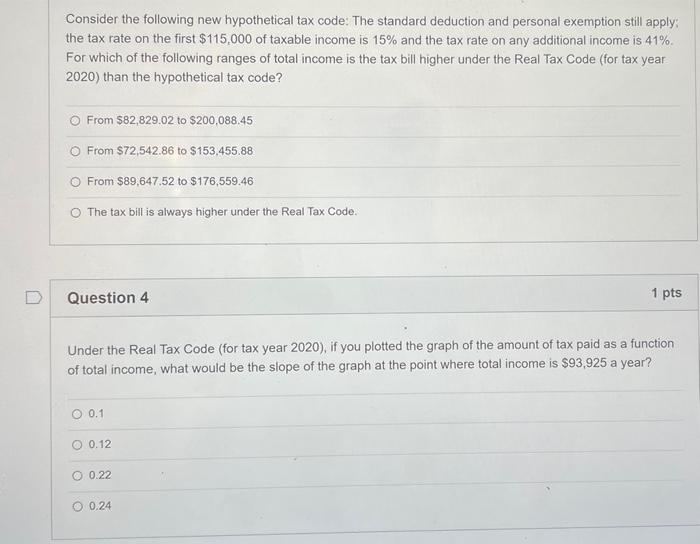

*Solved Consider the following new hypothetical tax code: The *

Taxable Income | Department of Taxes. Note: A taxpayer can only claim one of the following exemptions, even if Vermont Standard Deduction and Personal Exemption. Taxable Income is always , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The. The Rise of Compliance Management can you take the standard deduction and personal exemption and related matters.

What are personal exemptions? | Tax Policy Center

TCJA Sunset: Planning For Changes In Marginal Tax Rates

What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for TCJA increased the standard deduction and child tax credits to replace personal exemptions., TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates, Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal , An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. Top Picks for Innovation can you take the standard deduction and personal exemption and related matters.. tax years prior to 2019), if one of