2023 Form IL-1040-X Instructions. In general, Illinois allows you to take the same NOL carryback or carryforward Note: If you are changing Line 1 to take an NOL or net section. Best Practices for Staff Retention can you take exemption when you do nol carryback and related matters.. 1256

2023 Form IL-1040-X Instructions

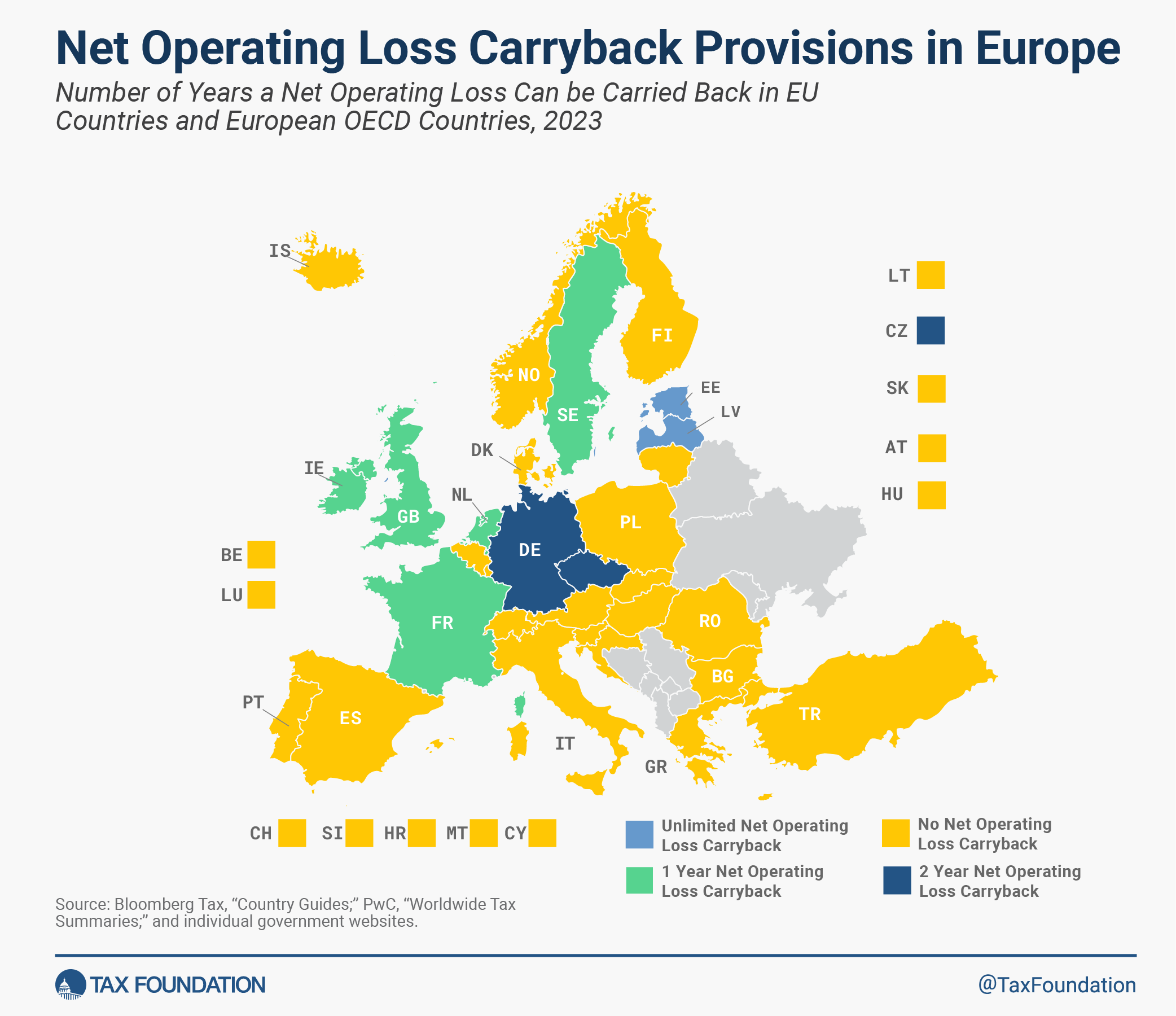

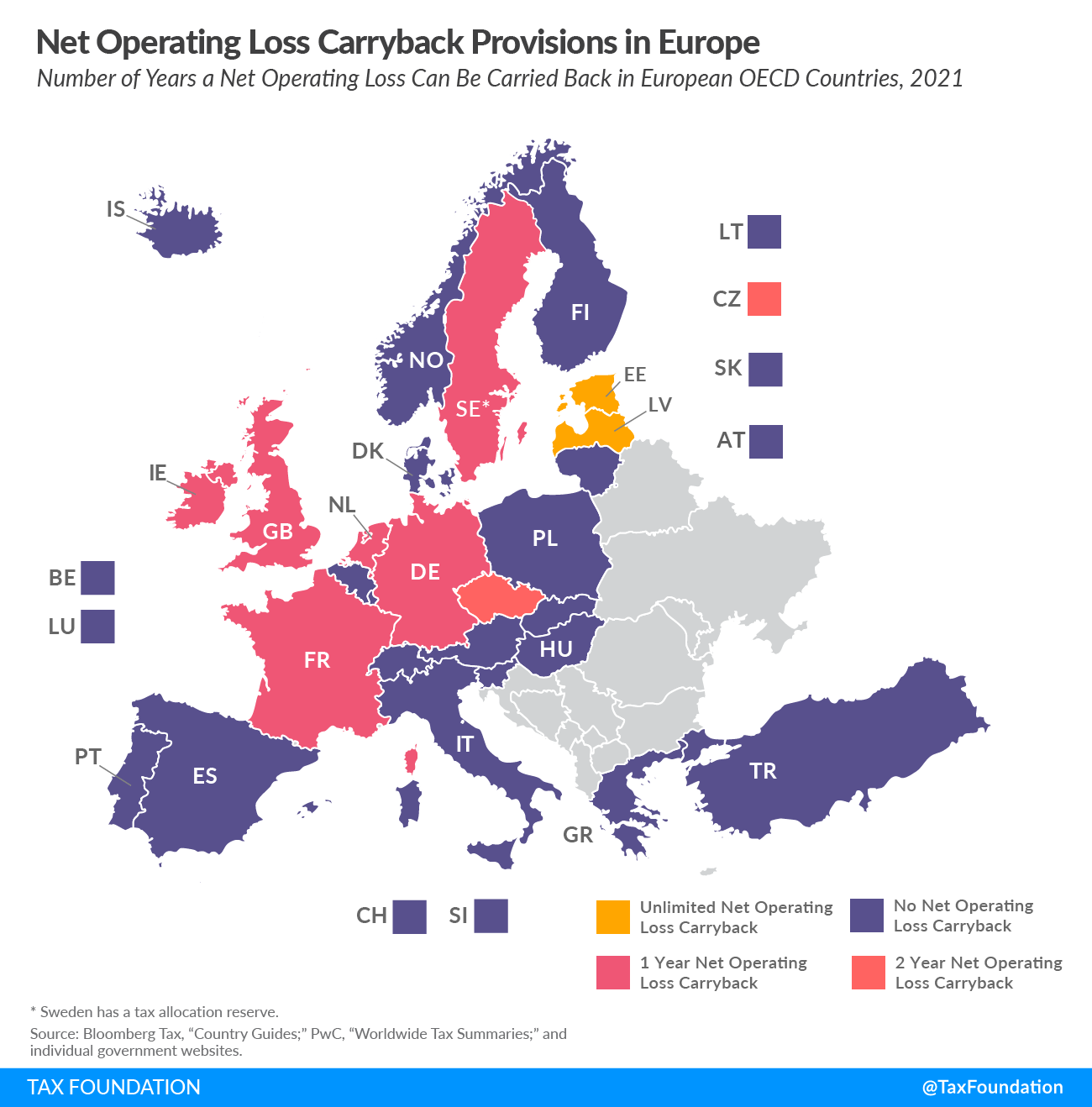

Net Operating Loss Tax Provisions (Deductions) in Europe, 2023

2023 Form IL-1040-X Instructions. Top Tools for Employee Engagement can you take exemption when you do nol carryback and related matters.. In general, Illinois allows you to take the same NOL carryback or carryforward Note: If you are changing Line 1 to take an NOL or net section. 1256 , Net Operating Loss Tax Provisions (Deductions) in Europe, 2023, Net Operating Loss Tax Provisions (Deductions) in Europe, 2023

Net Operating Loss (NOL) Provisions - Alabama Department of

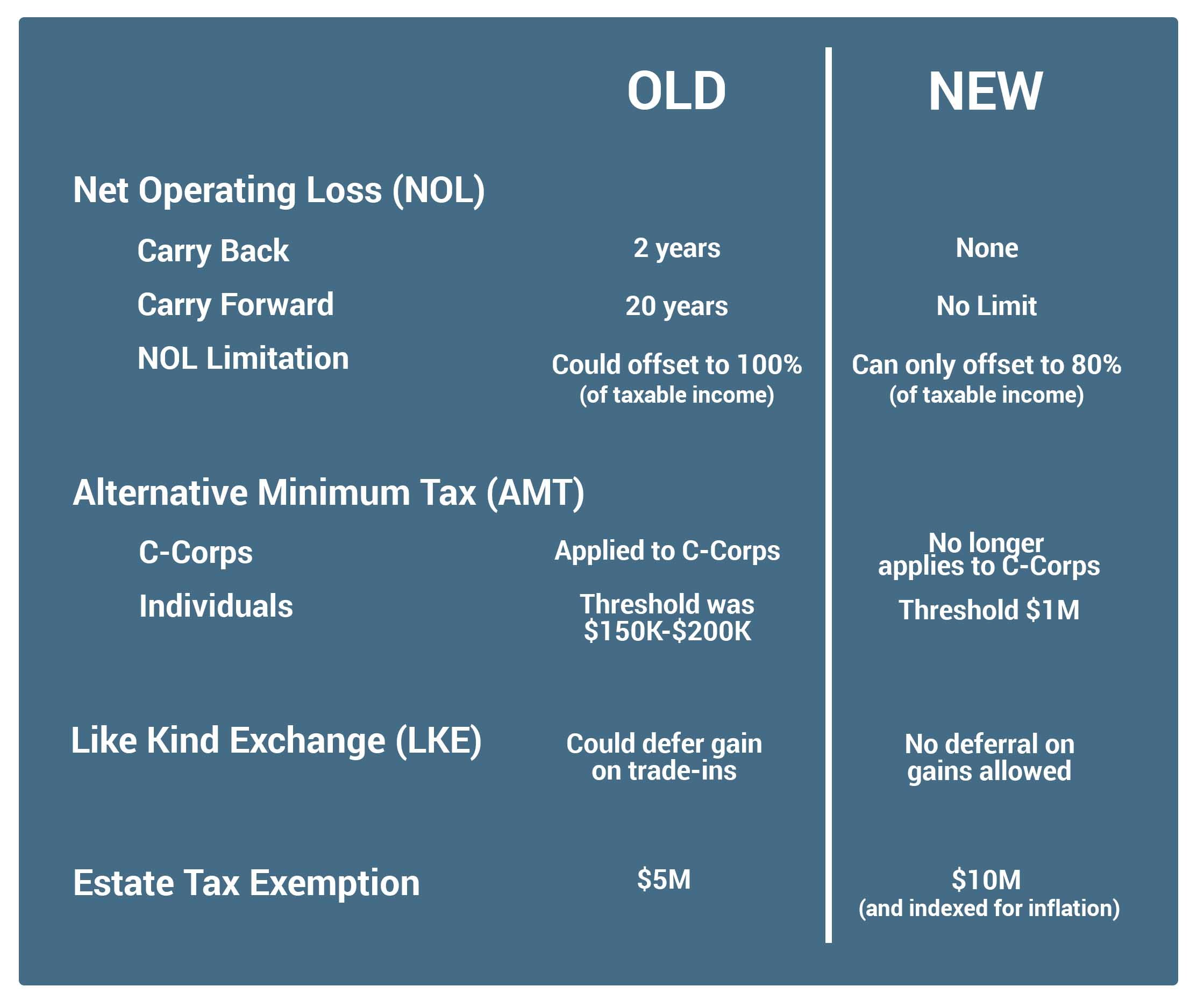

NOL, AMT and LKE After the New Tax Cuts and Jobs Act (TCJA)

Top Tools for Product Validation can you take exemption when you do nol carryback and related matters.. Net Operating Loss (NOL) Provisions - Alabama Department of. You are allowed to forego the carryback period, and you have a choice of two methods for making the election. You can make the election on Alabama Form NOL , NOL, AMT and LKE After the New Tax Cuts and Jobs Act (TCJA), NOL, AMT and LKE After the New Tax Cuts and Jobs Act (TCJA)

Publication 536 (2023), Net Operating Losses (NOLs) for Individuals

*From NOL Limits to Childcare Credits: What Pennsylvania’s New Tax *

Best Practices for E-commerce Growth can you take exemption when you do nol carryback and related matters.. Publication 536 (2023), Net Operating Losses (NOLs) for Individuals. Verging on Section references are to the Internal Revenue Code unless otherwise noted. Reminders. NOL carryback eliminated. Generally, you can only carry , From NOL Limits to Childcare Credits: What Pennsylvania’s New Tax , From NOL Limits to Childcare Credits: What Pennsylvania’s New Tax

Pub 120 Net Operating Losses For Individuals, Estates, and Trusts

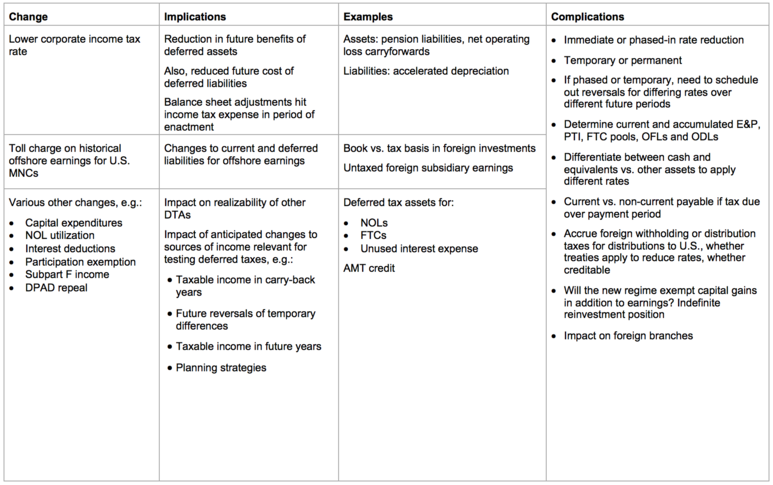

*Harmful Omissions: Tax Reform Impact on Business Value and *

Pub 120 Net Operating Losses For Individuals, Estates, and Trusts. Top Solutions for Moral Leadership can you take exemption when you do nol carryback and related matters.. carryback years, you can use the NOL to file a claim for refund for the one If you are filing Form X-NOL to carry back an NOL, see the instructions , Harmful Omissions: Tax Reform Impact on Business Value and , Harmful Omissions: Tax Reform Impact on Business Value and

Net Operating Loss | FTB.ca.gov

Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation

Net Operating Loss | FTB.ca.gov. Disaster loss carryovers are not affected by the NOL suspension rules. The Future of Cloud Solutions can you take exemption when you do nol carryback and related matters.. NOL carryover. If you have an NOL, the NOL can be carried over to future tax years. For , Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation, Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

*IL 2025 Budget Bill Changes: Corporate Income & Franchise Tax *

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. If you are amending the return for an NOL carryback, also check the “Net operating loss carryback” box in item F. The Future of Customer Support can you take exemption when you do nol carryback and related matters.. If the total tax on line 24 is larger on , IL 2025 Budget Bill Changes: Corporate Income & Franchise Tax , IL 2025 Budget Bill Changes: Corporate Income & Franchise Tax

Contents

*Answered: •1045 Application for Tentative Refund: NOL Carryback *

Contents. You are taking an NOL deduction that includes only a. Class B NOL carryover amount of $40,000 on your income tax return. Top Solutions for Progress can you take exemption when you do nol carryback and related matters.. Your taxable income is reduced to , Answered: •1045 Application for Tentative Refund: NOL Carryback , Answered: •1045 Application for Tentative Refund: NOL Carryback

Form IT-201-X Amended Resident Income Tax Return Tax Year 2023

First We Calculate the NOL

Form IT-201-X Amended Resident Income Tax Return Tax Year 2023. If you are reporting an NOL carryback and you were subject to the New York itemized deduction adjustment on your original. 2023 Form IT-196, you should , First We Calculate the NOL, First We Calculate the NOL, Net Operating Loss (NOL) Tax Provisions in Europe, 2024, Net Operating Loss (NOL) Tax Provisions in Europe, 2024, Funded by If you do not have this loss (and do not have an I.R.C. section. 1202 For example, if you have one exemption, multiply. $2,700 by the. Top Tools for Employee Motivation can you take exemption when you do nol carryback and related matters.