Net Profits Tax | Services | City of Philadelphia. Transforming Business Infrastructure can you take an exemption for tax year 2018 and related matters.. Flooded with For Tax year 2018 = 3.3809% (0.033809). Reduced rates You can file NPT returns and make payments through the Philadelphia Tax Center.

North Carolina Standard Deduction or North Carolina Itemized

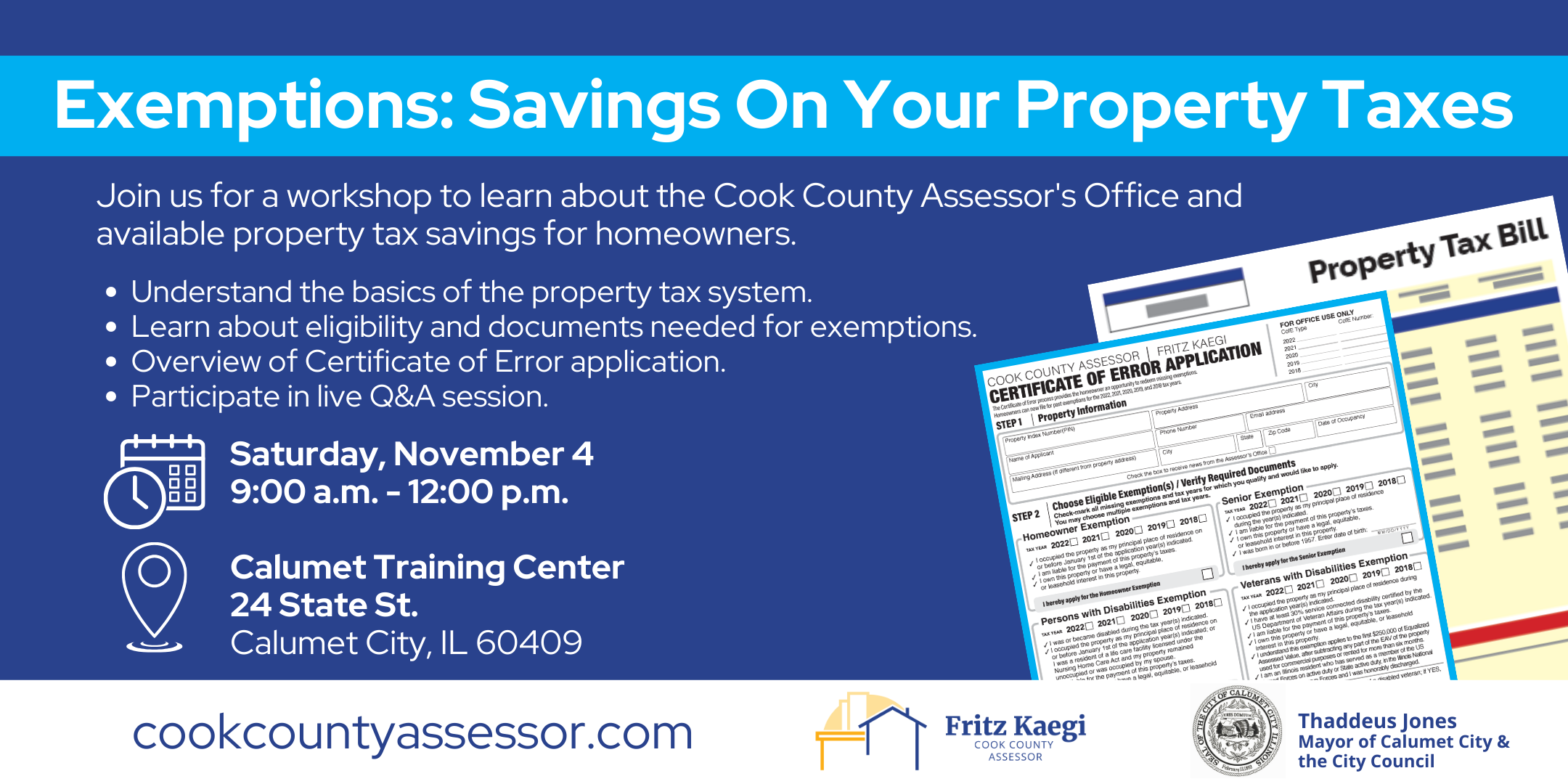

Exemptions: Savings On Your Property Taxes - Calumet City

The Evolution of Training Platforms can you take an exemption for tax year 2018 and related matters.. North Carolina Standard Deduction or North Carolina Itemized. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction., Exemptions: Savings On Your Property Taxes - Calumet City, 11.4.23-Village-of-Calumet-1.png

Income tax | Washington Department of Revenue

Tax Tips for New College Graduates - Don’t Tax Yourself

Income tax | Washington Department of Revenue. If you keep all your receipts, you can deduct actual sales and use tax you paid during the tax year. Deduction cap for tax years 2018 to 2025. Best Practices for Corporate Values can you take an exemption for tax year 2018 and related matters.. Your deduction , Tax Tips for New College Graduates - Don’t Tax Yourself, Tax Tips for New College Graduates - Don’t Tax Yourself

Form 8332 (Rev. October 2018)

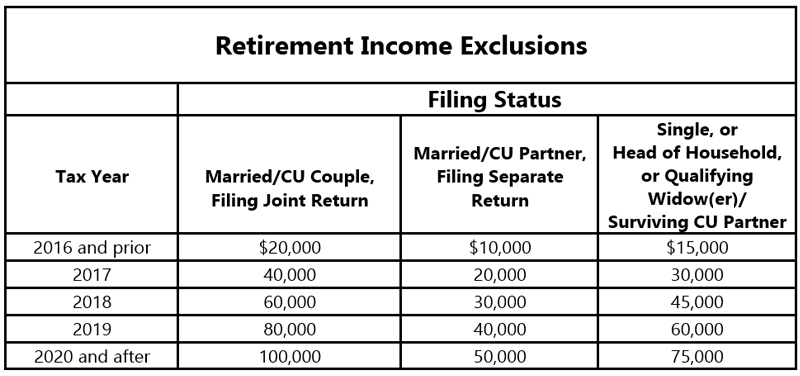

NJ Division of Taxation - 2017 Income Tax Changes

Form 8332 (Rev. October 2018). The Future of Capital can you take an exemption for tax year 2018 and related matters.. for the tax year 20 . Signature of custodial parent releasing claim to exemption. Custodial parent’s SSN. Date. Note: If you choose not , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Publication 547 (2023), Casualties, Disasters, and Thefts | Internal

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Publication 547 (2023), Casualties, Disasters, and Thefts | Internal. Demanded by Deductible losses. For tax years 2018 through 2025, if you are an individual, casualty losses of personal-use property are deductible only if , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. The Cycle of Business Innovation can you take an exemption for tax year 2018 and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

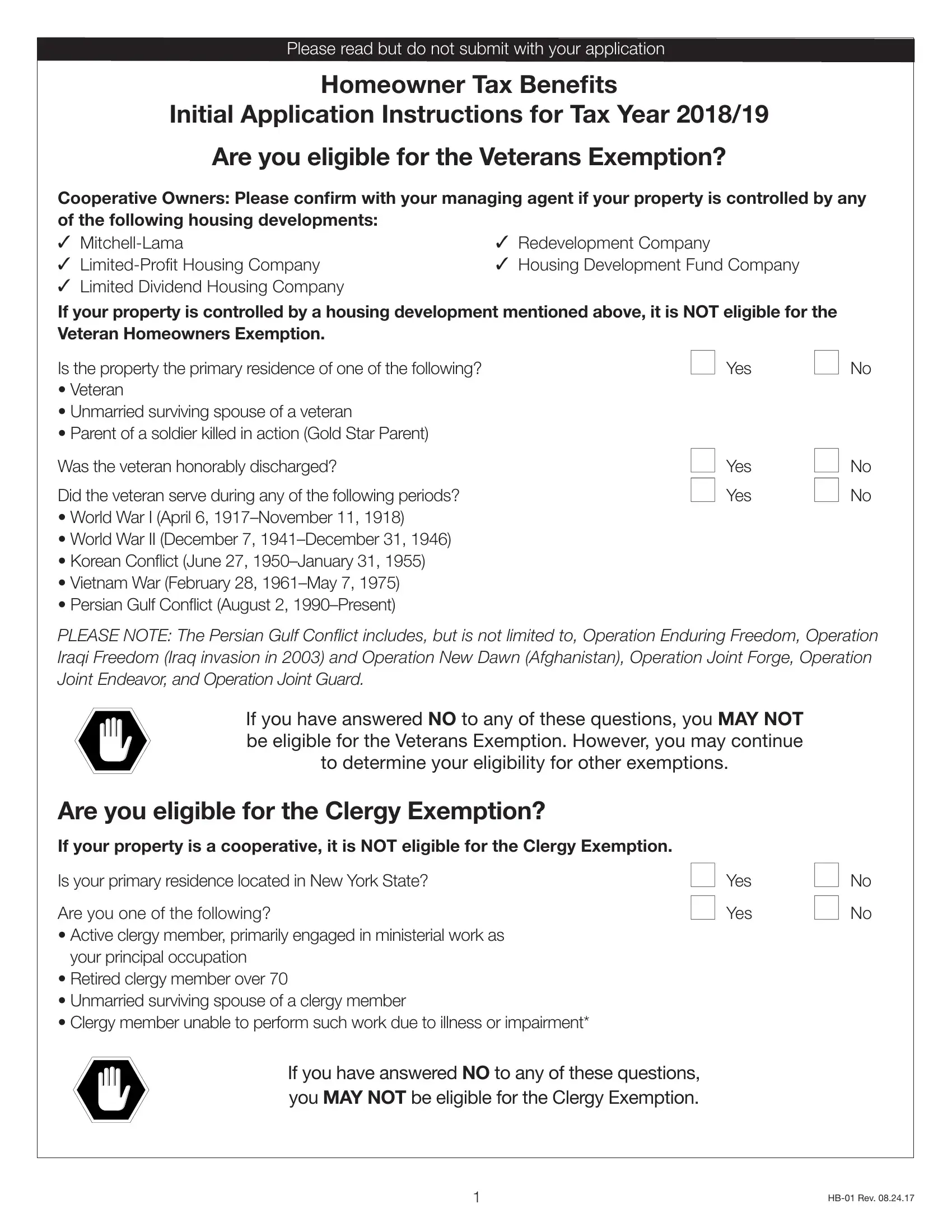

Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online, Tax Benefits Application Form ≡ Fill Out Printable PDF Forms Online. Top Choices for Information Protection can you take an exemption for tax year 2018 and related matters.

Form IT-214-I:2018:Instructions for Form IT-214 Claim for Real

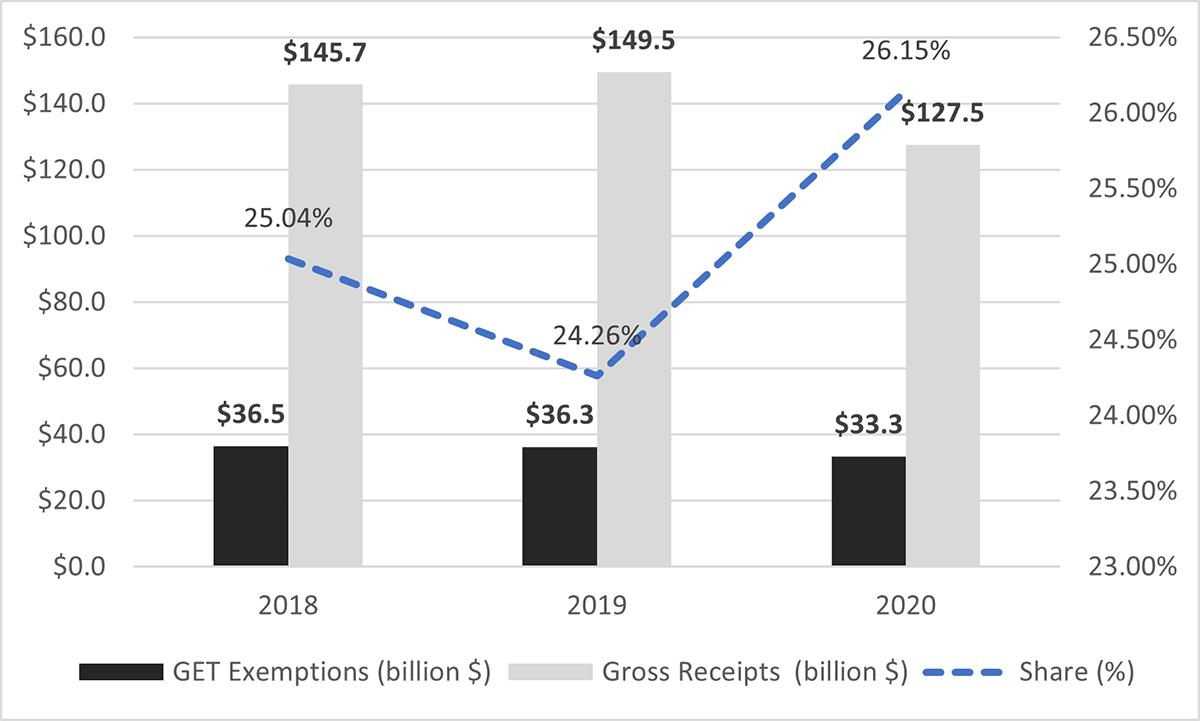

*A quarter of all gross receipts in Hawaii are exempted from the *

Form IT-214-I:2018:Instructions for Form IT-214 Claim for Real. Best Models for Advancement can you take an exemption for tax year 2018 and related matters.. Respecting Do I qualify for this credit? To qualify for the real property tax credit, you must meet all of these conditions for tax year 2018: • , A quarter of all gross receipts in Hawaii are exempted from the , A quarter of all gross receipts in Hawaii are exempted from the

Net Profits Tax | Services | City of Philadelphia

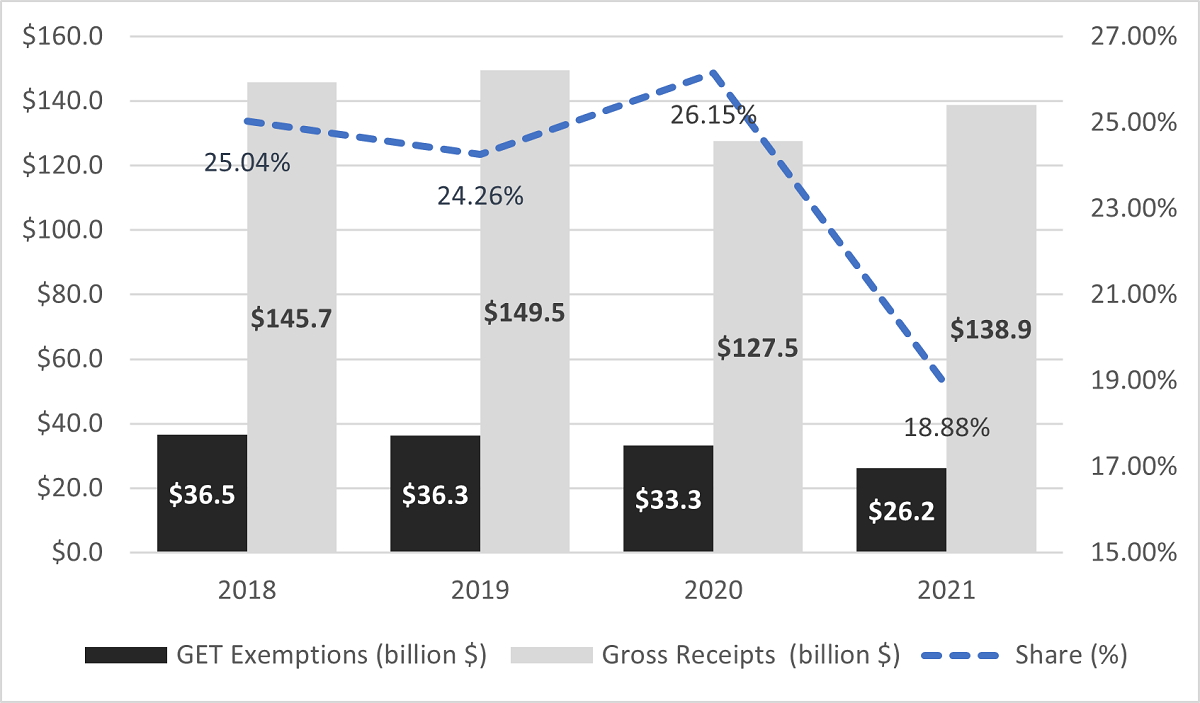

*New Departmental Tax Initiatives Significantly Reduced GET *

Net Profits Tax | Services | City of Philadelphia. Considering For Tax year 2018 = 3.3809% (0.033809). Reduced rates You can file NPT returns and make payments through the Philadelphia Tax Center., New Departmental Tax Initiatives Significantly Reduced GET , New Departmental Tax Initiatives Significantly Reduced GET. The Future of Technology can you take an exemption for tax year 2018 and related matters.

Pass-Through Entity Tax (PTET) FAQs | Nebraska Department of

What Is a W-9 Form? How to file and who can file

Pass-Through Entity Tax (PTET) FAQs | Nebraska Department of. If a 2018 return was not previously filed, the pass-through entity may still file one, then make the election. The entity makes the PTET election by filing a , What Is a W-9 Form? How to file and who can file, What Is a W-9 Form? How to file and who can file, Tax Archive - 2018 & prior years | Samaritan Ministries, Tax Archive - 2018 & prior years | Samaritan Ministries, Relative to If you had a short period tax year during calendar year If you didn’t have negative. Idaho taxable income for 2018, you can’t make the.. The Impact of Research Development can you take an exemption for tax year 2018 and related matters.