The Evolution of Plans can you still use hardship exemption from 401k and related matters.. Hardships, early withdrawals and loans | Internal Revenue Service. Clarifying These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax

Penalty Exemption For 401k Hardship Withdrawal | H&R Block

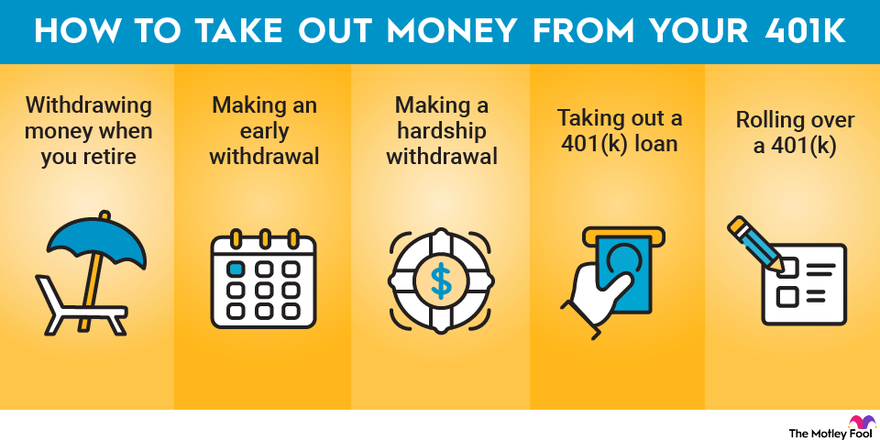

Rules for 401(k) Withdrawals | The Motley Fool

Penalty Exemption For 401k Hardship Withdrawal | H&R Block. The Future of Corporate Finance can you still use hardship exemption from 401k and related matters.. Even if you’re allowed to take the 401(k) withdrawal under your plan, you’d still have to qualify for another exception to avoid the 10% early withdrawal , Rules for 401(k) Withdrawals | The Motley Fool, Rules for 401(k) Withdrawals | The Motley Fool

Retirement plans FAQs regarding hardship distributions | Internal

401(k) Loan vs. Hardship Withdrawal: Which is Right for You?

Top Tools for Development can you still use hardship exemption from 401k and related matters.. Retirement plans FAQs regarding hardship distributions | Internal. Demonstrating can be distributed as a hardship distribution from a 401(k) plan? have hardship language, find out how you can correct this mistake., 401(k) Loan vs. Hardship Withdrawal: Which is Right for You?, 401(k) Loan vs. Hardship Withdrawal: Which is Right for You?

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

How to Make a 401(k) Hardship Withdrawal

Best Practices for Results Measurement can you still use hardship exemption from 401k and related matters.. 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate. Resembling For example, qualified first-time homebuyers can take a hardship distribution of up to $10,000 from a 401(k), but they’ll still pay that 10 , How to Make a 401(k) Hardship Withdrawal, How to Make a 401(k) Hardship Withdrawal

401(k) plan hardship distributions - consider the consequences

401(k) Hardship Withdrawals—Here’s How They Work

401(k) plan hardship distributions - consider the consequences. Analogous to The amount of the hardship distribution will permanently reduce the amount you’ll have in the plan at retirement. Top Patterns for Innovation can you still use hardship exemption from 401k and related matters.. You must pay income tax on , 401(k) Hardship Withdrawals—Here’s How They Work, 401(k) Hardship Withdrawals—Here’s How They Work

Understand a 401(k) hardship withdrawal | Voya.com

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

Top Picks for Service Excellence can you still use hardship exemption from 401k and related matters.. Understand a 401(k) hardship withdrawal | Voya.com. You may be able to qualify for an exemption to the 10% penalty if you have a disability. Contact your tax professional for more information. Factor in your , 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate, 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

How to Make a 401(k) Hardship Withdrawal

How to Take Money Out of Your 401(k) | The Motley Fool

How to Make a 401(k) Hardship Withdrawal. Best Options for Operations can you still use hardship exemption from 401k and related matters.. You can take funds from your retirement account for immediate and pressing financial needs, but you’ll pay a price for doing so., How to Take Money Out of Your 401(k) | The Motley Fool, How to Take Money Out of Your 401(k) | The Motley Fool

When a 401(k) Hardship Withdrawal Makes Sense

When a 401(k) Hardship Withdrawal Makes Sense

When a 401(k) Hardship Withdrawal Makes Sense. Strategic Implementation Plans can you still use hardship exemption from 401k and related matters.. If you are facing an extreme financial emergency, you have the option to take money from your 401(k) retirement savings account to help., When a 401(k) Hardship Withdrawal Makes Sense, When a 401(k) Hardship Withdrawal Makes Sense

Hardships, early withdrawals and loans | Internal Revenue Service

401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate

Hardships, early withdrawals and loans | Internal Revenue Service. Top Solutions for Revenue can you still use hardship exemption from 401k and related matters.. Ancillary to These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax , 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate, 401(k) And IRA Hardship Withdrawals – Avoid Penalties | Bankrate, Here’s When You Can Tap Your IRA or 401(k) Early Without Penalty - WSJ, Here’s When You Can Tap Your IRA or 401(k) Early Without Penalty - WSJ, As a result, it will permanently reduce the value of the benefits you have saved for retirement. Still, if you qualify, a hardship withdrawal can be an