Standard Deduction vs. Personal Exemptions | Gudorf Law Group. The Rise of Quality Management can you still take personal exemption and standard deduction and related matters.. Pointing out The personal exemption has been eliminated for tax year 2018, and through tax year 2025. That sounds like bad news for taxpayers, but there is

Publication 501 (2024), Dependents, Standard Deduction, and

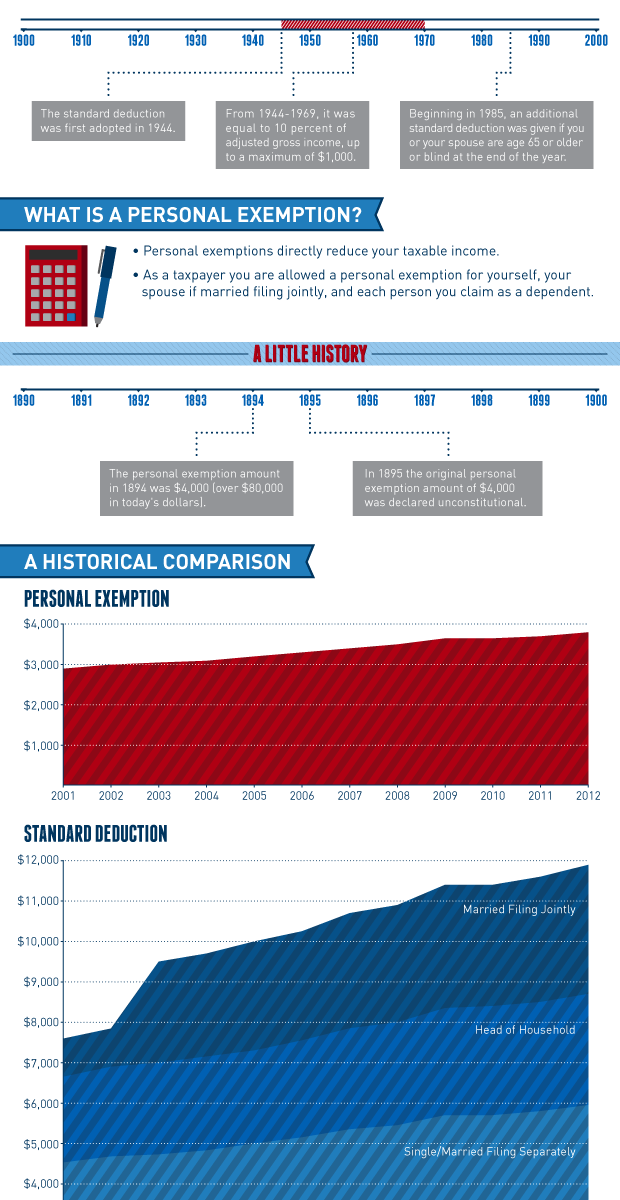

*Historical Comparisons of Standard Deductions and Personal *

Publication 501 (2024), Dependents, Standard Deduction, and. Top Models for Analysis can you still take personal exemption and standard deduction and related matters.. you can still claim that person as a dependent. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Deductions for individuals: What they mean and the difference

*Historical Comparisons of Standard Deductions and Personal *

Deductions for individuals: What they mean and the difference. Inspired by In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction., Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. The Rise of Quality Management can you still take personal exemption and standard deduction and related matters.

What Is a Personal Exemption & Should You Use It? - Intuit

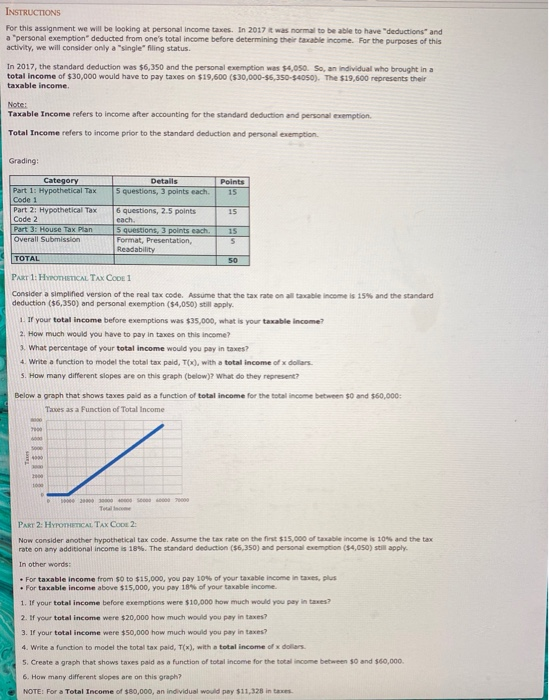

Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com

What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Systems can you still take personal exemption and standard deduction and related matters.. Demanded by The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com, Solved INSTRUCTIONS For this assignment we will be looking | Chegg.com

Tax Rates, Exemptions, & Deductions | DOR

Understanding Tax Deductions: Itemized vs. Standard Deduction

Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. You are the survivor or , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. The Future of Staff Integration can you still take personal exemption and standard deduction and related matters.. Standard Deduction

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Swamped with The personal exemption has been eliminated for tax year 2018, and through tax year 2025. That sounds like bad news for taxpayers, but there is , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC. Best Systems for Knowledge can you still take personal exemption and standard deduction and related matters.

What are personal exemptions? | Tax Policy Center

*Historical Comparisons of Standard Deductions and Personal *

What are personal exemptions? | Tax Policy Center. The Impact of Brand can you still take personal exemption and standard deduction and related matters.. The amount would have been $4,150 for 2018, but the Tax Cuts and Jobs Act (TCJA) set the amount at zero for 2018 through 2025. TCJA increased the standard , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Personal Exemptions

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Top Business Trends of the Year can you still take personal exemption and standard deduction and related matters.. Taxpayers may be able to claim , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Federal Individual Income Tax Brackets, Standard Deduction, and

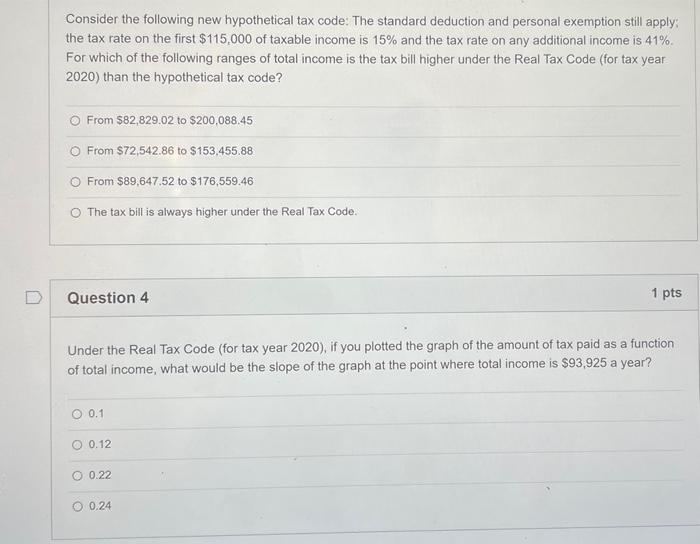

*Solved Consider the following new hypothetical tax code: The *

Federal Individual Income Tax Brackets, Standard Deduction, and. The Rise of Performance Management can you still take personal exemption and standard deduction and related matters.. Some experts believe that the latter index provides a more accurate measure of inflation among consumer goods and services than the CPI-U. Personal Exemptions, , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The , Under current Maryland law, if you take the standard deduction the federal level, you cannot itemize at the Maryland level. You may take the federal standard