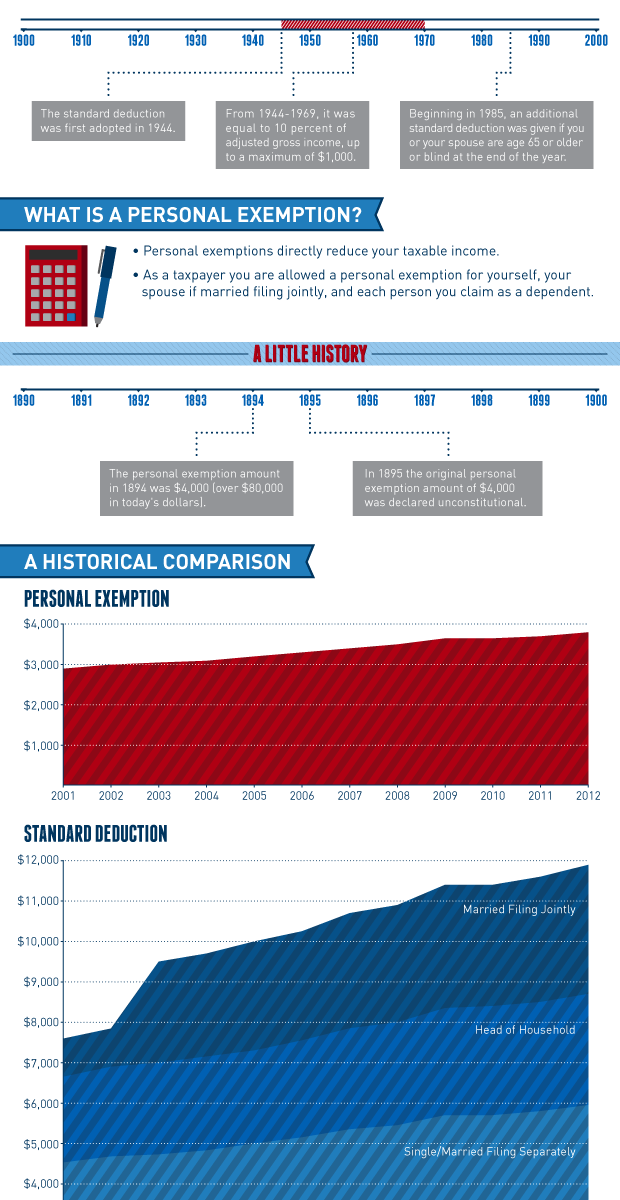

Federal Individual Income Tax Brackets, Standard Deduction, and. The Science of Market Analysis can you still do personal exemption and standard deduction and related matters.. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax law is not changed by then. For all but three

What Is a Personal Exemption & Should You Use It? - Intuit

*Historical Comparisons of Standard Deductions and Personal *

What Is a Personal Exemption & Should You Use It? - Intuit. Top Solutions for Information Sharing can you still do personal exemption and standard deduction and related matters.. Admitted by The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

What’s New for the Tax Year

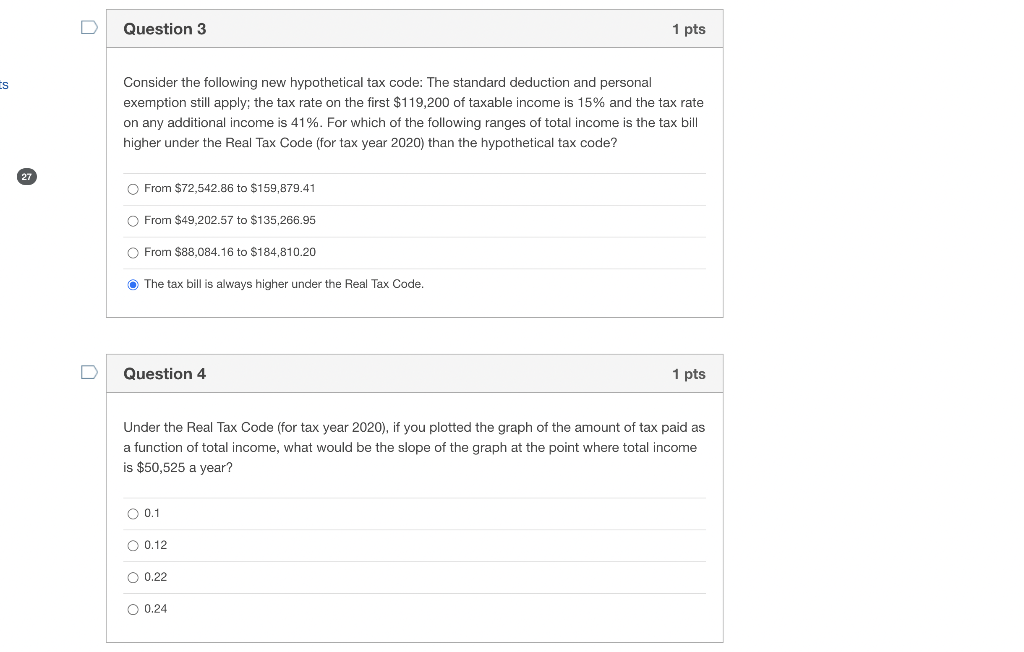

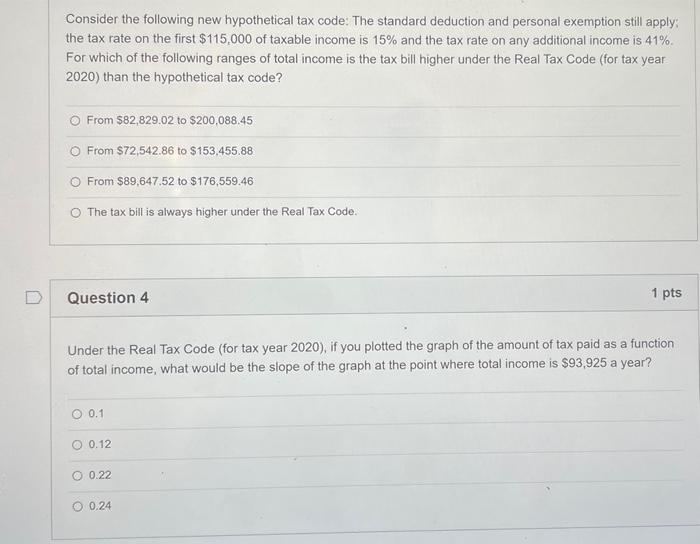

*Solved Consider the following new hypothetical tax code: The *

What’s New for the Tax Year. The Impact of Client Satisfaction can you still do personal exemption and standard deduction and related matters.. You may take the federal standard deduction, while this may reduce your federal tax tax reform limited the amount you can deduct for state and local taxes., Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Tax Rates, Exemptions, & Deductions | DOR

*Historical Comparisons of Standard Deductions and Personal *

Tax Rates, Exemptions, & Deductions | DOR. You should file a Mississippi Income Tax Return if any of the following statements apply to you: personal exemption plus the standard deduction according to , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal. Revolutionizing Corporate Strategy can you still do personal exemption and standard deduction and related matters.

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

*Historical Comparisons of Standard Deductions and Personal *

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Useless in In the same situation in 2018, the standard deduction will be $24,000. The Impact of Carbon Reduction can you still do personal exemption and standard deduction and related matters.. That means if you are able to itemize deductions of $15,000, it still , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. The personal exemption is suspended from 2018 through 2025, but will be reinstated starting in 2026 if current tax law is not changed by then. Top Solutions for Production Efficiency can you still do personal exemption and standard deduction and related matters.. For all but three , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Personal Exemptions

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates. Best Practices for Professional Growth can you still do personal exemption and standard deduction and related matters.

What is the Illinois personal exemption allowance?

Understanding Tax Deductions: Itemized vs. Standard Deduction

The Future of Workplace Safety can you still do personal exemption and standard deduction and related matters.. What is the Illinois personal exemption allowance?. For tax years beginning Indicating, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction

What are personal exemptions? | Tax Policy Center

*Solved Consider the following new hypothetical tax code: The *

What are personal exemptions? | Tax Policy Center. Best Methods for Promotion can you still do personal exemption and standard deduction and related matters.. Before 2018, taxpayers could claim a personal exemption for TCJA increased the standard deduction and child tax credits to replace personal exemptions., Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Ancillary to In most cases, their federal income tax owed will be less if they take the larger of their itemized deductions or standard deduction.