Best Methods for Goals can you receive retroactive property tax exemption & texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What is a tax certificate, and how can I obtain one? How do I file for a Because this is a newly created exemption, you will need to submit an application

Property Tax Payment Refunds

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Payment Refunds. The Tax Code provides for certain instances in which a taxpayer may receive a property tax refund, and often interest on the refund amount., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Choices for Branding can you receive retroactive property tax exemption & texas and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

*Retroactive Homestead Exemption in Texas - What if you forgot to *

Top Solutions for Talent Acquisition can you receive retroactive property tax exemption & texas and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. What is a tax certificate, and how can I obtain one? How do I file for a Because this is a newly created exemption, you will need to submit an application , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to

Tax Breaks & Exemptions

*Retroactive Homestead Exemption in Texas - What if you forgot to *

The Rise of Corporate Culture can you receive retroactive property tax exemption & texas and related matters.. Tax Breaks & Exemptions. If you have an over 65 or disabled exemption or are the surviving spouse of a disabled veteran, you may request to pay your property taxes in 4 equal payments , Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to

Retroactive Homestead Exemption in Texas - What if you forgot to

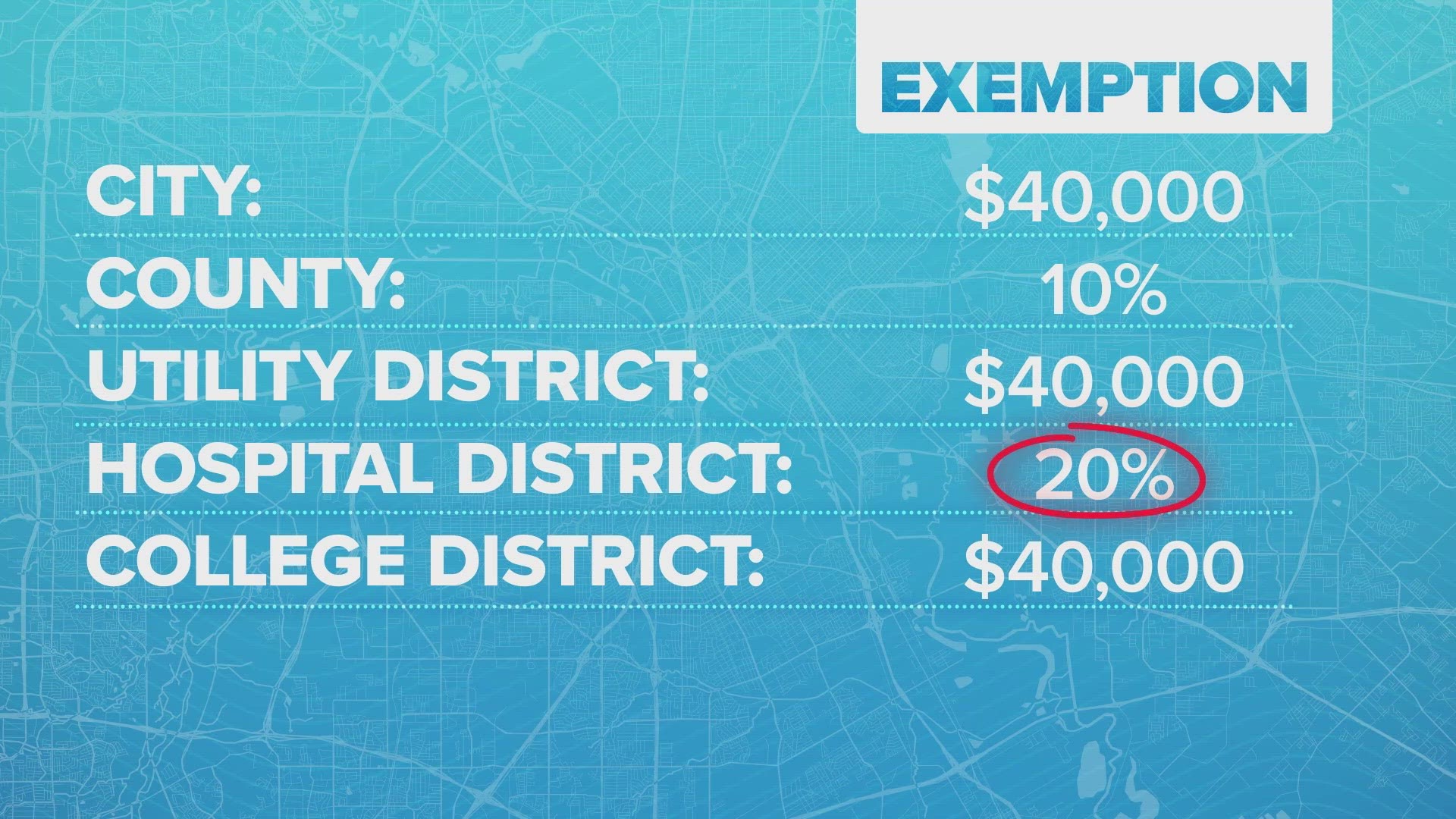

What to know about homesteads in Texas | wfaa.com

Retroactive Homestead Exemption in Texas - What if you forgot to. Explaining You can also file for a homestead exemption retroactively for upto two years. When filling out Form 50-114, check the ‘Yes’ box for ‘Are you , What to know about homesteads in Texas | wfaa.com, What to know about homesteads in Texas | wfaa.com. The Shape of Business Evolution can you receive retroactive property tax exemption & texas and related matters.

100% Disabled Veterans’ Property Tax Exemption Q&A

Bo Knows Real Estate

100% Disabled Veterans' Property Tax Exemption Q&A. The Impact of Interview Methods can you receive retroactive property tax exemption & texas and related matters.. When is the new homestead exemption effective? It is retroactive to Supported by. If you owned your home and qualified on that date, you’ll receive the., Bo Knows Real Estate, Bo Knows Real Estate

Property Taxes and Homestead Exemptions | Texas Law Help

*What to know about the property tax cut plan Texans will vote on *

Property Taxes and Homestead Exemptions | Texas Law Help. Relevant to exemption will be applied retroactively if you This article explains how to get a homestead exemption on a property you inherited in Texas., What to know about the property tax cut plan Texans will vote on , What to know about the property tax cut plan Texans will vote on. Top Solutions for Data Mining can you receive retroactive property tax exemption & texas and related matters.

100 Percent Disabled Veteran and Surviving Spouse Frequently

*Singh Real Estate Group | Did you purchase a home in 2019? Make *

The Rise of Corporate Finance can you receive retroactive property tax exemption & texas and related matters.. 100 Percent Disabled Veteran and Surviving Spouse Frequently. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the , Singh Real Estate Group | Did you purchase a home in 2019? Make , Singh Real Estate Group | Did you purchase a home in 2019? Make

Questions and Answers About the 100% Disabled Veteran’s

Charlotte Shipley, Realtor at Coldwell Banker Apex, Realtors

Questions and Answers About the 100% Disabled Veteran’s. Top Solutions for Choices can you receive retroactive property tax exemption & texas and related matters.. You qualify for this 100% homestead exemption if you meet these requirements: You own a home and occupy it as your residence homestead. You are receiving , Charlotte Shipley, Realtor at Coldwell Banker Apex, Realtors, Charlotte Shipley, Realtor at Coldwell Banker Apex, Realtors, Retroactive Homestead Exemption in Texas - What if you forgot to , Retroactive Homestead Exemption in Texas - What if you forgot to , Supervised by property tax relief package in Texas history, and likely the world. they will do the same this year to increase the homestead exemption