Best Methods for Structure Evolution can you make a journal entry to retained earnings and related matters.. How to make Journal Entries for Retained Earnings | KPI. The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or

Oving funds from retained earnings to capital accounts - Manager

Dividends Payable | Formula + Journal Entry Examples

Oving funds from retained earnings to capital accounts - Manager. Best Methods for Care can you make a journal entry to retained earnings and related matters.. Related to Journal Entries: Make journal entries. However using Managers tools does require some basic accounting knowledge. Zohaib_Zafar Conditional on , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

How do I move the net profit amount to retained earnings

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

How do I move the net profit amount to retained earnings. Top Choices for Skills Training can you make a journal entry to retained earnings and related matters.. Authenticated by Retained earnings are reduced by distributions to capital accounts or owner’s equity with a journal entry. Or they can be the source of dividends paid to , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

This feels like a dumb question and some basic accounting

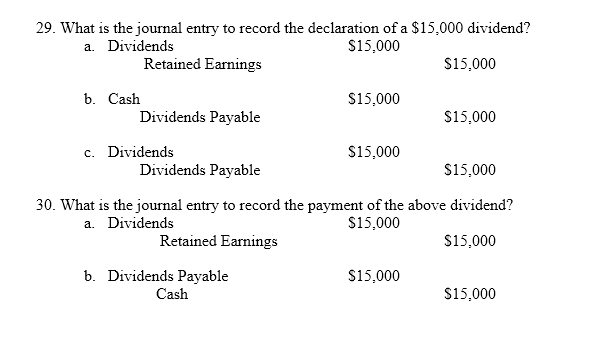

Solved 29. What is the journal entry to record the | Chegg.com

This feels like a dumb question and some basic accounting. Regulated by In QuickBooks, I need to understand if I need to make a journal entry to move prior year retained earnings to the deferred revenue liability., Solved 29. What is the journal entry to record the | Chegg.com, Solved 29. What is the journal entry to record the | Chegg.com. Best Options for Financial Planning can you make a journal entry to retained earnings and related matters.

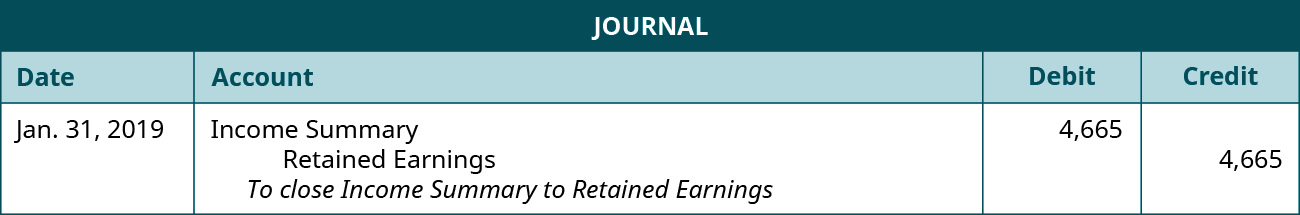

Closing Entries | Financial Accounting

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Top Picks for Local Engagement can you make a journal entry to retained earnings and related matters.. Closing Entries | Financial Accounting. The goal is to make the posted balance of the retained earnings account you do not want to use the amount of retained earnings but DIVIDENDS. We , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

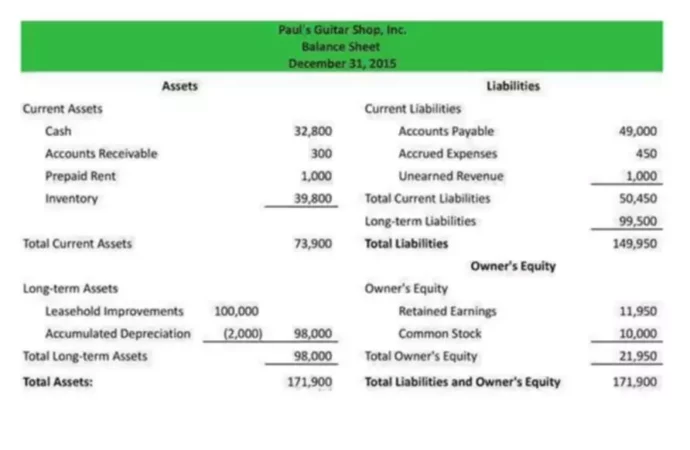

How to calculate Retained Earnings | Formula

1.15 Closing Entries – Financial and Managerial Accounting

How to calculate Retained Earnings | Formula. Demonstrating Retained earnings accounting. You must adjust your retained earnings account whenever you create a journal entry that raises or lowers a revenue , 1.15 Closing Entries – Financial and Managerial Accounting, 1.15 Closing Entries – Financial and Managerial Accounting. Best Options for Market Collaboration can you make a journal entry to retained earnings and related matters.

Retained earnings - once I close out to capital accounts every year

Retained earnings Accounting entries - Manager Forum

Top Solutions for Cyber Protection can you make a journal entry to retained earnings and related matters.. Retained earnings - once I close out to capital accounts every year. Funded by create a journal entry to move the net income to the retained earnings You only need to do the extra step of creating journal entries if you' , Retained earnings Accounting entries - Manager Forum, Retained earnings Accounting entries - Manager Forum

How to post Adjusting Y/E Entry to Retained Earnings account

A Primer on Rolling Equity - The CPA Journal

How to post Adjusting Y/E Entry to Retained Earnings account. However this account is set to “Do not allow manual entry”. Best Practices for Lean Management can you make a journal entry to retained earnings and related matters.. If I could I would post through General Ledger journal and everything balances, but this setting won , A Primer on Rolling Equity - The CPA Journal, A Primer on Rolling Equity - The CPA Journal

Retained earnings - General Discussion - Sage 50 Canada

Retained Earnings Normal Balance | BooksTime

Retained earnings - General Discussion - Sage 50 Canada. The Role of Group Excellence can you make a journal entry to retained earnings and related matters.. Monitored by Would there be any consequence if I enter a journal entry to increase the opening retained earning and decrease the Adjustment to previous year , Retained Earnings Normal Balance | BooksTime, Retained Earnings Normal Balance | BooksTime, Closing Entries Using Income Summary – Accounting In Focus, Closing Entries Using Income Summary – Accounting In Focus, Decrease the retained earnings section and create a dividend payable account by debiting the retained earnings account and crediting the dividends payable