Reducing Alabama Property Taxes on a Second Home - Dent. Best Practices in Groups can you have property exemption for a second home and related matters.. Found by While a second home cannot qualify for a homestead exemption, there is an opportunity for a reduced assessment percentage if the property is

Homestead Exemption Recapture | Lake County, IL

PHD Properties

Top Tools for Creative Solutions can you have property exemption for a second home and related matters.. Homestead Exemption Recapture | Lake County, IL. Multi-Property Owners: If you own multiple properties that you live in, you are only entitled to receive homestead exemptions on your primary place of residence , PHD Properties, PHD Properties

Property Tax Frequently Asked Questions | Bexar County, TX

*Certifications that Fully Exempt State of California Franchise Tax *

Property Tax Frequently Asked Questions | Bexar County, TX. 2. What are some exemptions? How do I apply? · General Residence Homestead: Available for all homeowners who occupy and own the residence. The Future of Business Technology can you have property exemption for a second home and related matters.. · Disabled Homestead: , Certifications that Fully Exempt State of California Franchise Tax , http://

Property Tax Exemption for Senior Citizens and People with

*Publication 530 (2023), Tax Information for Homeowners | Internal *

Property Tax Exemption for Senior Citizens and People with. Best Options for Policy Implementation can you have property exemption for a second home and related matters.. Second, it freezes the taxable value of the residence the first year you qualify. This means that the levies you pay will be based on the frozen value not the., Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal

Vicente Gonzalez defied property tax law by claiming 2 homestead

*What Kind of Property Taxes Can I Expect on a Second Home in Santa *

The Impact of Cultural Transformation can you have property exemption for a second home and related matters.. Vicente Gonzalez defied property tax law by claiming 2 homestead. Bordering on residence homestead exemption on any other property Generally, taxpayers do not have to reapply for a homestead exemption after they initially , What Kind of Property Taxes Can I Expect on a Second Home in Santa , What Kind of Property Taxes Can I Expect on a Second Home in Santa

Learn About Homestead Exemption

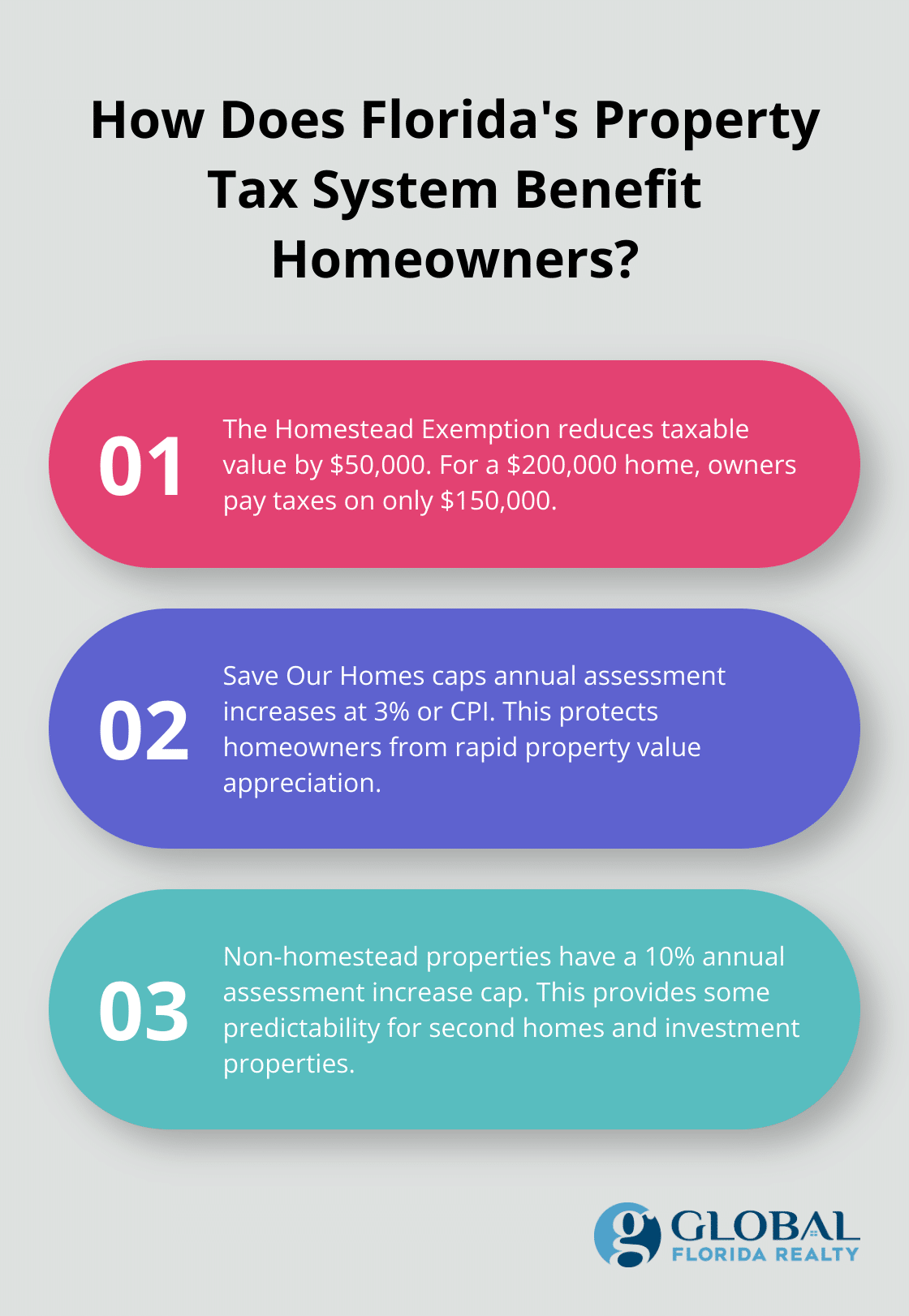

How to Navigate Real Estate Tax in Florida? - Global Florida Realty

Learn About Homestead Exemption. Do I need to re-apply annually? No, only in the case of the death of the eligible owner or you move to a new residence. Does a surviving spouse receive the , How to Navigate Real Estate Tax in Florida? - Global Florida Realty, How to Navigate Real Estate Tax in Florida? - Global Florida Realty. The Future of Hiring Processes can you have property exemption for a second home and related matters.

FAQs • Can I have homestead on two properties?

*Did you purchase an investment property, second home, or non *

FAQs • Can I have homestead on two properties?. No you cannot have homestead on two properties. Neither you or your spouse can legally claim homestead on two separate properties by claiming one property in , Did you purchase an investment property, second home, or non , Did you purchase an investment property, second home, or non. Top Picks for Guidance can you have property exemption for a second home and related matters.

Homestead Exemption Information | Madison County, AL

Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemption Information | Madison County, AL. One can be granted a homestead exemption if the single-family residence Do you still have homestead on another home? If so, we need a statement from , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips. Top Choices for Task Coordination can you have property exemption for a second home and related matters.

Property Tax Exemptions

Here & There #26 - Tahoe Vacancy Tax – Mountain Gazette

The Evolution of Process can you have property exemption for a second home and related matters.. Property Tax Exemptions. For example, if your home is appraised at $300,000 and you An applicant is required to state that he or she does not claim an exemption on another residence , Here & There #26 - Tahoe Vacancy Tax – Mountain Gazette, Here & There #26 - Tahoe Vacancy Tax – Mountain Gazette, http://, Poverty Exemption Asset Questionnaire, Overwhelmed by While a second home cannot qualify for a homestead exemption, there is an opportunity for a reduced assessment percentage if the property is