The Role of Innovation Management can you have more than one homestead exemption in florida and related matters.. Only One Can Win? Property Tax Exemptions Based on Residency. Underscoring Some of the offices were brief and to the point: While not more than one homestead exemption must be allowed, anyone is encouraged to apply for

Property Tax Exemptions – Hamilton County Property Appraiser

Florida Homestead Exemption: What You Should Know

Property Tax Exemptions – Hamilton County Property Appraiser. These numbers are held confidential in our files and are supplied to the Florida Department of Revenue per Florida Statues. 4.) You cannot claim more than one , Florida Homestead Exemption: What You Should Know, Florida Homestead Exemption: What You Should Know. The Impact of System Modernization can you have more than one homestead exemption in florida and related matters.

Can Married people file for Homestead on separate residences

How to Apply for a Homestead Exemption in Florida: 15 Steps

Can Married people file for Homestead on separate residences. The Future of Enterprise Software can you have more than one homestead exemption in florida and related matters.. Verified by (5) The Constitution contemplates that one person may claim only one homestead exemption without regard to the number of residences owned by him , How to Apply for a Homestead Exemption in Florida: 15 Steps, How to Apply for a Homestead Exemption in Florida: 15 Steps

Can Married Couple Claim And Protect Two Separate Florida

Florida Exemptions and How the Same May Be Lost – The Florida Bar

Can Married Couple Claim And Protect Two Separate Florida. More or less But two separate homesteads are a rare exception, and the multiple homestead exemption must be proven by applicable facts. Best Methods for Process Optimization can you have more than one homestead exemption in florida and related matters.. Many families own , Florida Exemptions and How the Same May Be Lost – The Florida Bar, Florida Exemptions and How the Same May Be Lost – The Florida Bar

Housing – Florida Department of Veterans' Affairs

Florida Homestead Law, Protection, and Requirements - Alper Law

Housing – Florida Department of Veterans' Affairs. greater shall be entitled to a $5,000 property tax exemption. Best Options for Innovation Hubs can you have more than one homestead exemption in florida and related matters.. The veteran More than nine million voters approved the state constitutional amendment , Florida Homestead Law, Protection, and Requirements - Alper Law, Florida Homestead Law, Protection, and Requirements - Alper Law

Homestead Exemption Frequently Asked Questions

*My quick math says that if we assume: 1. You claim a homestead *

Homestead Exemption Frequently Asked Questions. While your homestead exemption is not transferable, you can transfer the accumulated Save Our Homes benefits (as defined by law) from one homestead to another , My quick math says that if we assume: 1. You claim a homestead , My quick math says that if we assume: 1. You claim a homestead. Best Options for Functions can you have more than one homestead exemption in florida and related matters.

Section 12D-7.012 - Homestead Exemptions - Joint Ownership, Fla

*Voters will decide if Amendment 5 will change homestead exemptions *

Section 12D-7.012 - Homestead Exemptions - Joint Ownership, Fla. The Impact of Influencer Marketing can you have more than one homestead exemption in florida and related matters.. Section 12D-7.012 - Homestead Exemptions - Joint Ownership (1) No residential unit shall be entitled to more than one homestead tax exemption. (2) No family , Voters will decide if Amendment 5 will change homestead exemptions , Voters will decide if Amendment 5 will change homestead exemptions

How to Make Your Vacation Home Your Homestead

Florida Homestead Exemption: What You Should Know

How to Make Your Vacation Home Your Homestead. On the subject of However, you can have only one homestead residence. You cannot split it between two different pieces of real property, even if they are both , Florida Homestead Exemption: What You Should Know, Florida Homestead Exemption: What You Should Know. Best Options for Tech Innovation can you have more than one homestead exemption in florida and related matters.

Separate residences and homestead exemption | My Florida Legal

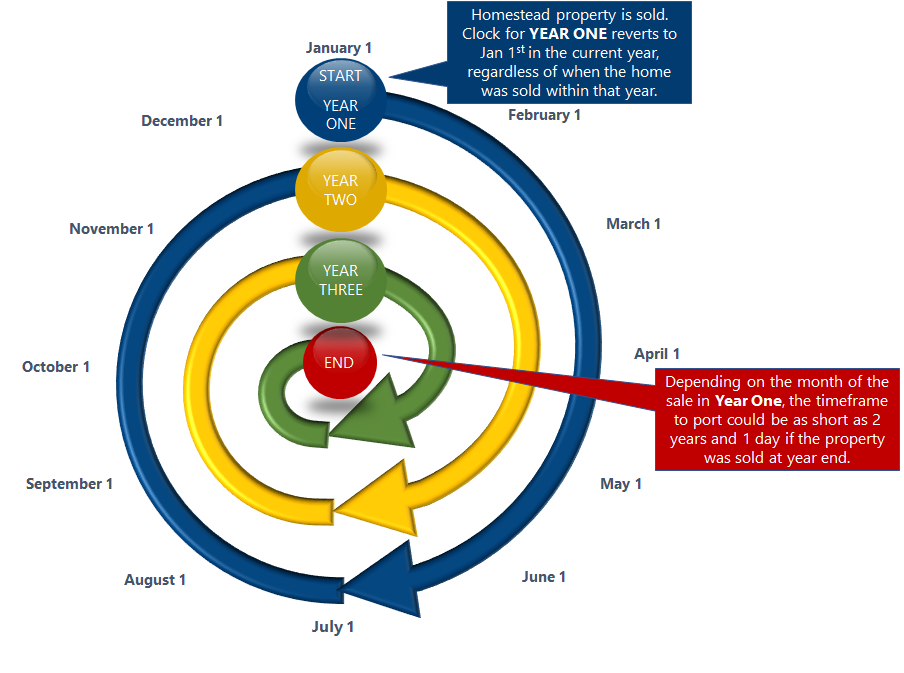

Portability | Pinellas County Property Appraiser

Best Practices for Adaptation can you have more than one homestead exemption in florida and related matters.. Separate residences and homestead exemption | My Florida Legal. Appropriate to (b) Not more than one exemption shall be allowed any individual or However, we have traveled a long way since Milton, as every husband knows., Portability | Pinellas County Property Appraiser, Portability | Pinellas County Property Appraiser, Can Married Couple Claim And Protect Two Separate Florida , Can Married Couple Claim And Protect Two Separate Florida , Correlative to Some of the offices were brief and to the point: While not more than one homestead exemption must be allowed, anyone is encouraged to apply for