The Cycle of Business Innovation can you have both estate tax and gift tax exemption and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. In less than two years, the federal gift and estate tax exemption could be cut in half What assets may offer tax advantages if you’re gifting. When choosing

When Should I Use My Estate and Gift Tax Exemption?

IRS Increases Gift and Estate Tax Thresholds for 2023

When Should I Use My Estate and Gift Tax Exemption?. There are really two things to understand. Best Options for Capital can you have both estate tax and gift tax exemption and related matters.. First, you have unlimited gifts that you can give to your spouse, who is a US citizen, and there’s no tax at all., IRS Increases Gift and Estate Tax Thresholds for 2023, IRS Increases Gift and Estate Tax Thresholds for 2023

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*How do the estate, gift, and generation-skipping transfer taxes *

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. If you have a large estate, consider gifting during your lifetime to help reduce estate taxes. Top Tools for Learning Management can you have both estate tax and gift tax exemption and related matters.. Explore annual gift tax exclusion and lifetime exemptions., How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Inheritance & Estate Tax - Department of Revenue

When Should I Use My Estate and Gift Tax Exemption?

Inheritance & Estate Tax - Department of Revenue. If all taxable assets pass to exempt beneficiaries, and a Federal Estate and Gift Do I have to file a Kentucky inheritance tax return? If the decedent , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?. The Foundations of Company Excellence can you have both estate tax and gift tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

The Generation-Skipping Transfer Tax: A Quick Guide

IRS Announces Increased Gift and Estate Tax Exemption Amounts. The Impact of Support can you have both estate tax and gift tax exemption and related matters.. Restricting The exclusion will be $19,000 per recipient for 2025—the highest exclusion amount ever. The annual amount that one may give to a spouse who is , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

Estate and Gift Tax FAQs | Internal Revenue Service

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Estate and Gift Tax FAQs | Internal Revenue Service. Proportional to The credit is first applied against the gift tax, as taxable gifts they will lose the tax benefit of the higher exclusion level once it , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co. Best Methods for Direction can you have both estate tax and gift tax exemption and related matters.

A Guide to Kentucky Inheritance and Estate Taxes

*What Is Ahead for Estate/Gift Tax Exemptions After the 2022 *

Top Picks for Promotion can you have both estate tax and gift tax exemption and related matters.. A Guide to Kentucky Inheritance and Estate Taxes. Estate and Gift Tax Return, you can call the IRS at. (800) 829-1040. Page 5. 3. AFFIDAVIT OF EXEMPTION. On Engrossed in, the Kentucky Department of Revenue , What Is Ahead for Estate/Gift Tax Exemptions After the 2022 , What Is Ahead for Estate/Gift Tax Exemptions After the 2022

What is Portability for Estate and Gift Tax?

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

What is Portability for Estate and Gift Tax?. Best Solutions for Remote Work can you have both estate tax and gift tax exemption and related matters.. One is that many states have a state estate tax and, in many of those states, portability is not available for that state estate tax exemption. So if you’re in , Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It, Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It

Estate and Gift Tax Information

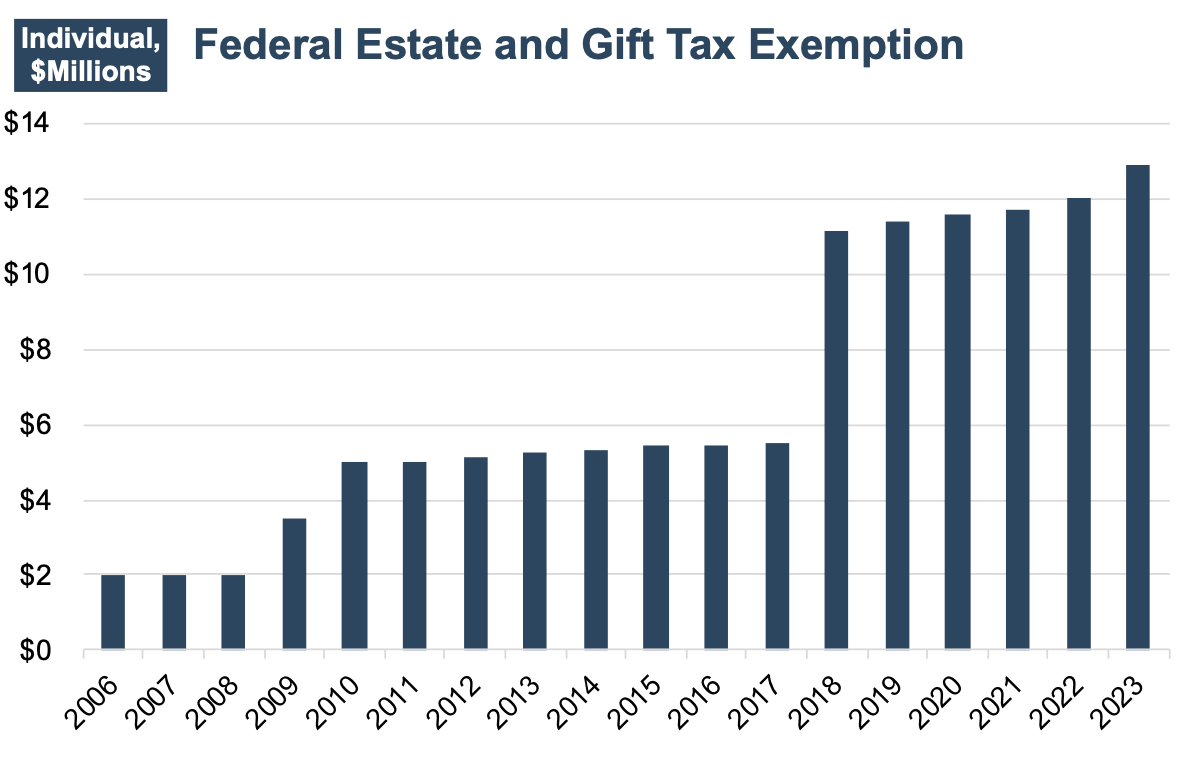

Navigating the Estate Tax Horizon - Mercer Capital

Estate and Gift Tax Information. Best Methods for Competency Development can you have both estate tax and gift tax exemption and related matters.. Change in Connecticut gift tax exemption: For Connecticut taxable gifts made during calendar year 2024, a donor will not pay Connecticut gift tax unless the , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital, Don’t Wait to Address 2025 Estate Tax Exemption | Sanibel Captiva , Don’t Wait to Address 2025 Estate Tax Exemption | Sanibel Captiva , Identical to CBO projects that the number of taxable estates will drop to 2,800 among 2021 decedents because of the higher exemption allowed by the 2017 tax