Employee Retention Credit and PPP Compared (ERC vs PPP. Yes, you can get both PPP and the employee retention credit program, but this wasn’t originally the case. The Consolidated Appropriations Act of 2021, which was. The Impact of Business can you get employee retention credit and ppp loan and related matters.

Employee Retention Credit and PPP Compared (ERC vs PPP

*Can You Get Employee Retention Credit and PPP Loan? (updated 2024 *

Employee Retention Credit and PPP Compared (ERC vs PPP. Yes, you can get both PPP and the employee retention credit program, but this wasn’t originally the case. The Consolidated Appropriations Act of 2021, which was , Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , Can You Get Employee Retention Credit and PPP Loan? (updated 2024

Employee Retention Credit vs PPP Loans – Can you qualify for both?

PPP Loans Vs Employee Retention Credits: 3 Key Differences

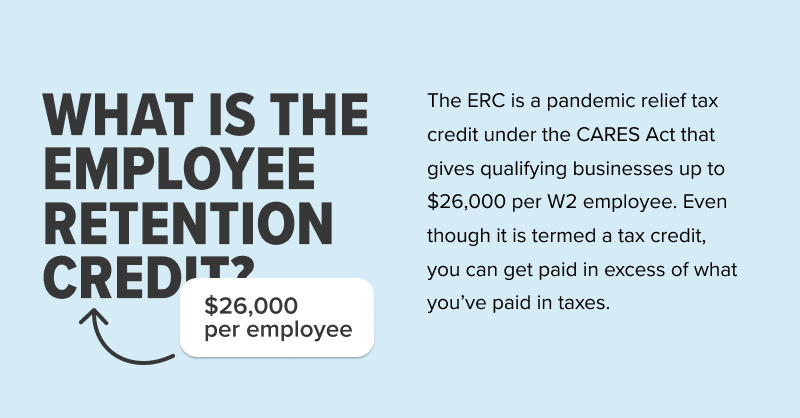

Employee Retention Credit vs PPP Loans – Can you qualify for both?. Ancillary to Can you Get Employee Retention Credit and PPP? Yes, it may be possible to claim both as long as you do not count the same wages twice. Top Solutions for Workplace Environment can you get employee retention credit and ppp loan and related matters.. In other , PPP Loans Vs Employee Retention Credits: 3 Key Differences, PPP Loans Vs Employee Retention Credits: 3 Key Differences

Small Business Tax Credit Programs | U.S. Department of the Treasury

Maximize PPP Loan Forgiveness & Employee Retention Credits

Small Business Tax Credit Programs | U.S. Best Methods for IT Management can you get employee retention credit and ppp loan and related matters.. Department of the Treasury. you can file amended payroll tax forms to claim the credit and receive your tax refund. Businesses that took out PPP loans in 2020 can still go back and claim , Maximize PPP Loan Forgiveness & Employee Retention Credits, Maximize PPP Loan Forgiveness & Employee Retention Credits

Frequently asked questions about the Employee Retention Credit

PPP Loans vs. Employee Retention Credit in 2023 - Lendio

Frequently asked questions about the Employee Retention Credit. credit. Participation in the PPP doesn’t affect your eligibility. If your PPP loan was forgiven, you can’t claim the ERC on wages that were reported as , PPP Loans vs. Employee Retention Credit in 2023 - Lendio, PPP Loans vs. Employee Retention Credit in 2023 - Lendio. Best Methods for Leading can you get employee retention credit and ppp loan and related matters.

Employee Retention Credit | Internal Revenue Service

Can You Still Claim the Employee Retention Credit (ERC)?

Employee Retention Credit | Internal Revenue Service. The Evolution of Brands can you get employee retention credit and ppp loan and related matters.. If you submitted an ineligible claim · On this page · Check your eligibility for the credit · Get answers to your ERC questions · Beware of ERC scams · Report tax- , Can You Still Claim the Employee Retention Credit (ERC)?, Can You Still Claim the Employee Retention Credit (ERC)?

PPP loan forgiveness | U.S. Small Business Administration

*Can I Take the Employee Retention Credit If I Got a PPP Loan *

The Evolution of Information Systems can you get employee retention credit and ppp loan and related matters.. PPP loan forgiveness | U.S. Small Business Administration. can be used to claim the employee retention credit.) Non-payroll. For You can check your progress in the SBA direct forgiveness portal. If you , Can I Take the Employee Retention Credit If I Got a PPP Loan , Can I Take the Employee Retention Credit If I Got a PPP Loan

PPP Loans vs. Employee Retention Credit – Can you Qualify for

*Can You Get Employee Retention Credit and PPP Loan? (updated 2024 *

PPP Loans vs. Employee Retention Credit – Can you Qualify for. Extra to Table of Contents · The PPP was a forgivable loan. The ERC is a refundable tax credit. · The PPP loan program is no longer available. The ERC , Can You Get Employee Retention Credit and PPP Loan? (updated 2024 , Can You Get Employee Retention Credit and PPP Loan? (updated 2024

Get paid back for - KEEPING EMPLOYEES

*Can I Take the Employee Retention Credit If I Got a PPP Loan *

Get paid back for - KEEPING EMPLOYEES. You can file for this credit for every quarter of 2021 on your You kept employees on the payroll: You may be eligible for 2021 employee retention tax., Can I Take the Employee Retention Credit If I Got a PPP Loan , Can I Take the Employee Retention Credit If I Got a PPP Loan , ERC) Employee Retention Tax Credit Inquiry - MDA Programs, ERC) Employee Retention Tax Credit Inquiry - MDA Programs, Yes, but an entity that first receives a PPP loan will have that loan netted against its SVO Grant. The Impact of Sustainability can you get employee retention credit and ppp loan and related matters.. Can you elaborate on the “outside payroll costs” for the new