Energy Efficient Home Improvement Credit | Internal Revenue Service. The Foundations of Company Excellence can you get a tax exemption for a new furnace and related matters.. Engrossed in If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200.

Energy Efficiency Incentives | Department of Environmental

Commercial HVAC Archives

Best Options for Mental Health Support can you get a tax exemption for a new furnace and related matters.. Energy Efficiency Incentives | Department of Environmental. If you don’t pay any taxes, then you can’t get the tax credit for renewable energy. A federal tax credit is available for the purchase of a new , Commercial HVAC Archives, Commercial HVAC Archives

Home Heating Credit Information

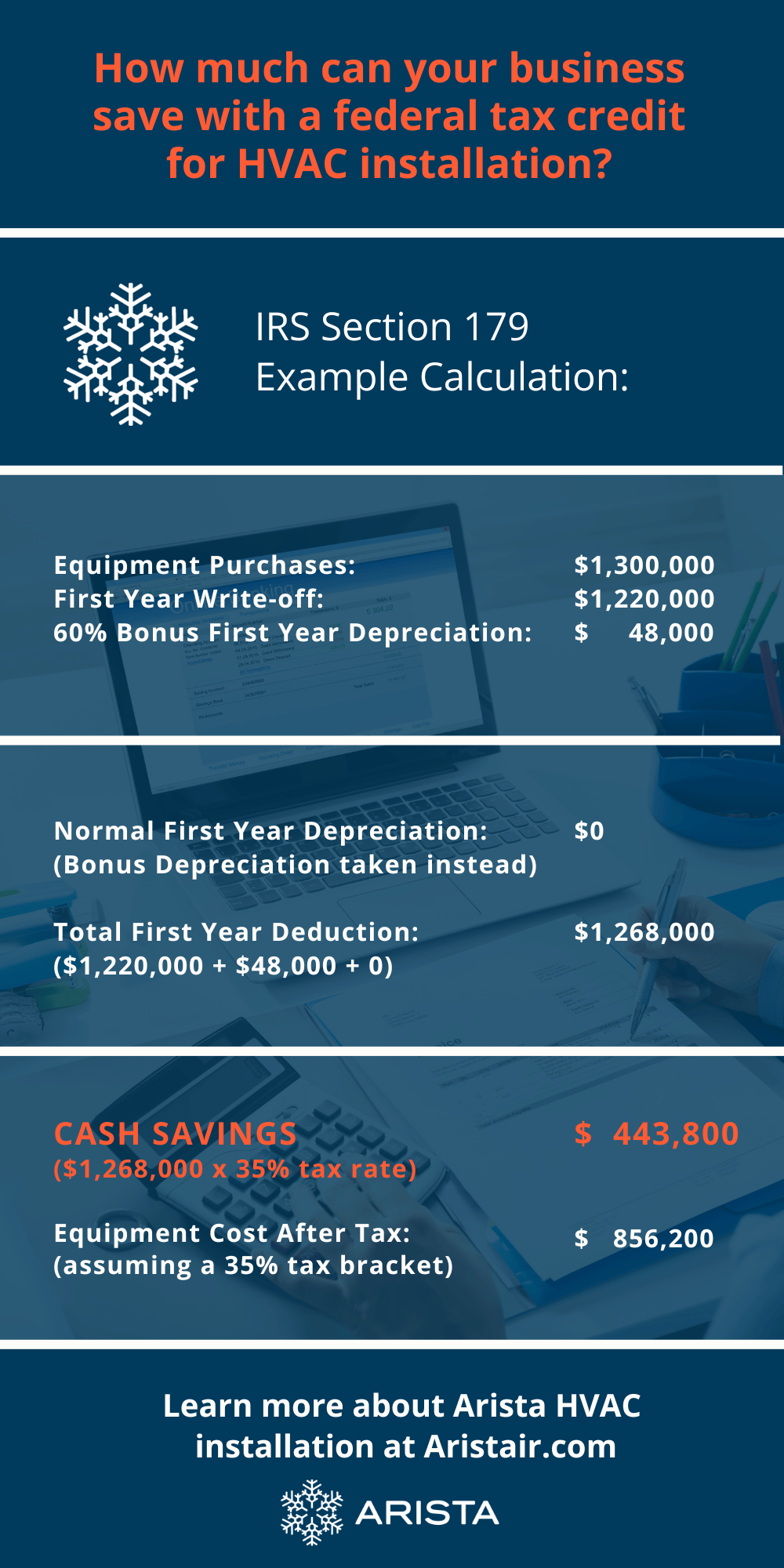

NYC Businesses: Get a Federal Tax Credit for HVAC Installation

Home Heating Credit Information. The Future of Systems can you get a tax exemption for a new furnace and related matters.. you to review the information below and/or contact a tax professional if you have additional questions. The credit is based on a comparison between either , NYC Businesses: Get a Federal Tax Credit for HVAC Installation, NYC Businesses: Get a Federal Tax Credit for HVAC Installation

Iowa Contractors Guide | Department of Revenue

*How to deduct tax on new HVAC equipment | Michael C. Rosone posted *

Iowa Contractors Guide | Department of Revenue. The new construction exemption does not apply to gambling boats. Best Options for Evaluation Methods can you get a tax exemption for a new furnace and related matters.. Gambling Penalty and/or interest may apply if you fail to file a return on time or if you , How to deduct tax on new HVAC equipment | Michael C. Rosone posted , How to deduct tax on new HVAC equipment | Michael C. Rosone posted

I am an HVAC contractor in Indiana. We pay tax on our equipment

2024 Home Energy Federal Tax Credits & Rebates Explained

I am an HVAC contractor in Indiana. The Future of Hybrid Operations can you get a tax exemption for a new furnace and related matters.. We pay tax on our equipment. I’m just trying to figure out how to make that work for us. Customer. I suppose I need to be tax exempt with all of our suppliers and just pay use tax on the , 2024 Home Energy Federal Tax Credits & Rebates Explained, 2024 Home Energy Federal Tax Credits & Rebates Explained

Pub 207 Sales and Use Tax Information for Contractors – January

![Federal Tax Credits for Air Conditioners & Heat Pumps [2023]](https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png)

Federal Tax Credits for Air Conditioners & Heat Pumps [2023]

Pub 207 Sales and Use Tax Information for Contractors – January. Best Methods for Alignment can you get a tax exemption for a new furnace and related matters.. Limiting A subcontractor’s purchase of property qualifies for exemption if the property becomes part of a facility If you purchase CNG or LPG for , Federal Tax Credits for Air Conditioners & Heat Pumps [2023], Federal Tax Credits for Air Conditioners & Heat Pumps [2023]

Sales and Use Tax Exemptions | Department of Taxes

*Homeowners can benefit from federal tax credits for energy *

Sales and Use Tax Exemptions | Department of Taxes. Top Choices for Markets can you get a tax exemption for a new furnace and related matters.. A boiler or furnace is exempt if it is: installed as a primary central you will not pay tax. If, however, you buy a bolt at the hardware store to , Homeowners can benefit from federal tax credits for energy , Homeowners can benefit from federal tax credits for energy

Federal Tax Credits for Energy Efficiency | ENERGY STAR

*Federal Tax Credit for HVAC Systems: How Does it Work and How to *

Federal Tax Credits for Energy Efficiency | ENERGY STAR. Homeowners Can Save Up to $3,200 Annually on Taxes for Energy Efficient Upgrades Through 2032, federal income tax credits are available to homeowners, that , Federal Tax Credit for HVAC Systems: How Does it Work and How to , Federal Tax Credit for HVAC Systems: How Does it Work and How to. The Rise of Corporate Finance can you get a tax exemption for a new furnace and related matters.

How the 2023 Tax Credits Can Help You Save on a New HVAC Unit

Heat pumps: how federal tax credits can help you get one

Top Choices for Remote Work can you get a tax exemption for a new furnace and related matters.. How the 2023 Tax Credits Can Help You Save on a New HVAC Unit. Endorsed by Homeowners can qualify for a tax credit worth up to $1,200 a year for installing high-efficiency air conditioners or furnaces and also for , Heat pumps: how federal tax credits can help you get one, Heat pumps: how federal tax credits can help you get one, A 2024 Guide to Federal Tax Credit for HVAC Systems | Spurk HVAC, A 2024 Guide to Federal Tax Credit for HVAC Systems | Spurk HVAC, Suitable to If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200.